Zeta Community Neighborhood stated on Wednesday that it raised about $230.8 million via a non-public piece sale, with patrons paying in Bitcoin (BTC) or SolvBTC — a wrapped Bitcoin-backed token issued by Solv Protocol.

Below the deal, patrons will receive newly issued Class A trendy shares and warrants allowing them to salvage extra shares later at $2.55 every. Every bit and warrant pair modified into sold at a mixed price of $1.70.

Per Zeta, the map will toughen its balance sheet with Bitcoin-basically basically based sources as section of a broader treasury approach. “By integrating SolvBTC into our treasury, we’re improving financial resilience with an instrument that combines Bitcoin’s scarcity with sustainable yield,” stated Patrick Ngan, Zeta Community’s chief funding officer.

Zeta Community, a digital infrastructure and fintech firm creating an institutional Bitcoin platform, expects the deal to finalize on Thursday, pending closing requirements.

Solv Protocol is an onchain Bitcoin asset management platform that considerations SolvBTC, a 1:1 wrapped Bitcoin-backed token designed for institutional use in yield and liquidity suggestions.

Ryan Chow, the CEO of Solv Protocol, stated that “listed entities are redefining what it methodology to withhold Bitcoin productively.”

Bitcoin yield suggestions emerge

While Bitcoin remains the main asset for digital asset treasuries (DATs) — a formulation popularized by Michael Saylor in 2020 — some debate has emerged over whether proof-of-stake networks esteem Ethereum (ETH) or Solana (SOL), which generate yield for validators, may perhaps perhaps per chance well provide a more keen long-period of time return profile.

For the time being, companies are finding methods to position Bitcoin to work.

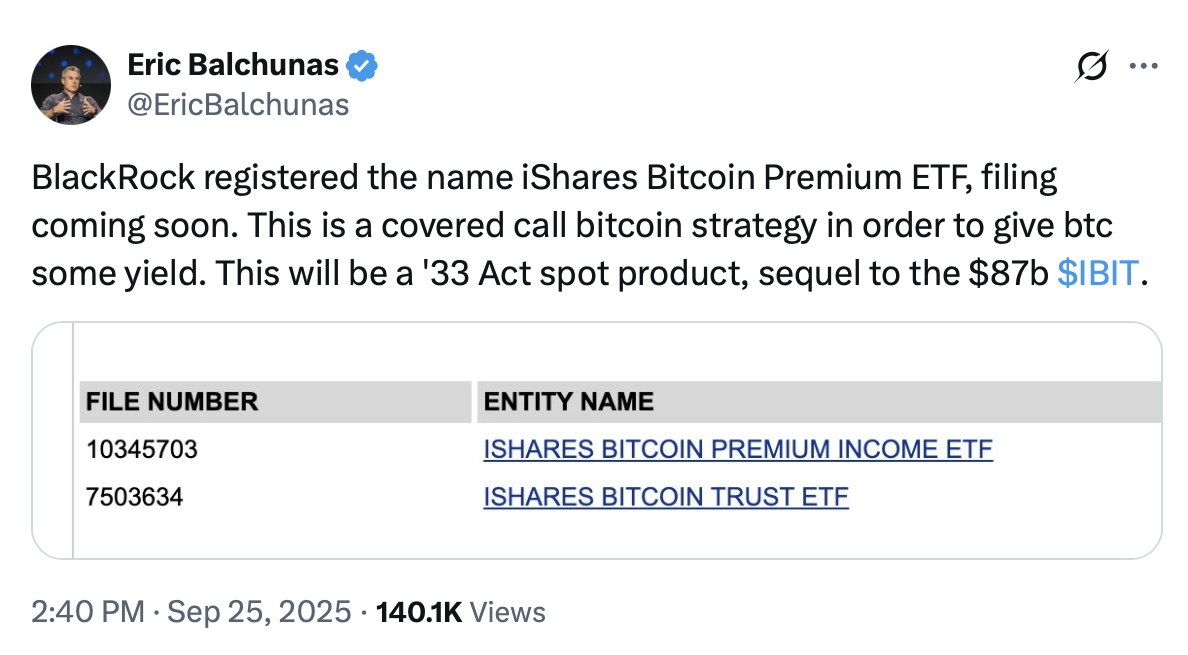

On Sept. 25, the sector’s greatest asset manager, BlackRock, filed to register a Delaware belief firm for a Bitcoin Top price Earnings ETF. Bloomberg ETF analyst Eric Balchunas stated the proposed fund would generate yield by writing covered call ideas on Bitcoin futures and collecting the option premiums.

Coinbase launched a Bitcoin Yield Fund in Would perhaps, giving institutional patrons birth air the US publicity to yield on BTC holdings. The fund objectives to generate an annual win return of 4% to 8% for holders.

Speaking on the Token2049 event this year, Chow stated Bitcoin may perhaps be staked to true networks. Within the discontinuance, he expects hundreds of Bitcoin to enter proof-of-stake ecosystems esteem Solana.