The below is an excerpt from a recent version of Bitcoin Magazine Pro, Bitcoin Magazine’s top charge markets e-newsletter. To be among the first to accept these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

Introduction:

The Bitcoin Volatility Top charge AMC, an modern funding product, has swiftly become the most attention-grabbing actively managed bitcoin-simplest monetary product in Europe and the 2d biggest globally. Despite this fulfillment, thus a ways this bitcoin-simplest AMC has flown below the radar and has obtained no media protection thus a ways till now. What makes this funding product providing specifically attention-grabbing is its dramatic upward thrust used to be attributable to the seed funding of $50 million to open from an enigmatic early Bitcoin miner from 2010. The product is designed to curb Bitcoin’s volatile pricing, fostering its adoption as a legitimate medium of replace.

What’s an AMC?

AMC stands for Actively Managed Certificate. It’s miles a vogue of structured safety that is neatly-liked in Europe. Jurisdictions such as Luxembourg and Jersey enable asset managers to manufacture these certificates in describe to rob capital from investors. Certificates present a “wrapper” for an funding technique, or remark underlying assets. The certificate is bought to investors and the capital is extinct to enforce the technique.

Who is the Mysterious Whale?

Based on inquiries in regards to the identity of the Bitcoin Whale within the wait on of the new Bitcoin Volatility Top charge AMC, Zeltner & Co. confirmed that the seed investor is certainly an early Bitcoin miner who has been concerned about Bitcoin since 2010. Alternatively, respecting the investor’s inquire of of to withhold privacy and steer determined of public scrutiny, Zeltner & Co. declined to whine any additional tiny print about their identity. The motives within the wait on of this form of vital glide by an particular person with massive Bitcoin holdings are specifically sharp. The introduction of this AMC, aimed at stabilizing Bitcoin’s save, showcases a strategic capacity to managing digital assets. By for my portion allocating their holdings to plan this funding product, the Bitcoin Whale no longer simplest addresses the topic of Bitcoin’s volatility but additionally enhances its viability as a accumulate medium of replace. This AMC stands out as a diversified market-making instrument that no longer simplest seeks to support watch over anxiousness but additionally differentiates itself thru its operational capacity, concentrating on a more accumulate and predictable marketplace for Bitcoin.

Why is that this AMC Related?

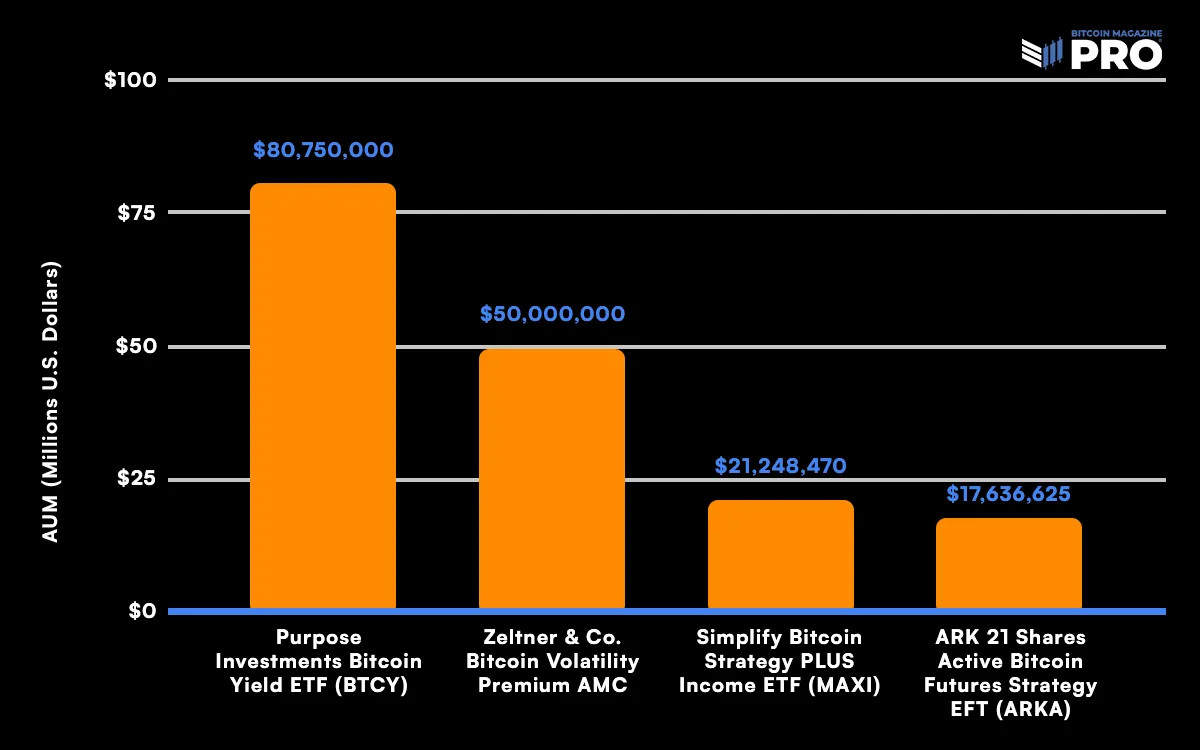

The Bitcoin Volatility Top charge AMC, has already become the most attention-grabbing actively managed bitcoin-simplest monetary product in Europe and the 2d biggest globally after the Reason Investments Bitcoin Yield ETF (BTCY), with over $109 million CAD ($80.750 U.S.). There are quite a lot of massive Bitcoin ETFs that actively manage futures positions, such as the ProShares Bitcoin Approach ETF (BITO), with over $2.82 billion in assets below management; on the opposite hand, these must no longer actively managed funds within the everyday sense. Rather then making an strive to outperform or optimize the anxiousness/return of an instantaneous funding in bitcoin, futures ETFs aim to tune the worth of bitcoin 1:1.

The incompatibility between an ETF and an AMC is that ETFs are passively managed. Meaning that they tune the underlying asset. Whereas AMCs are actively managed, which implies they’re attempting to outperform the underlying assets on either an absolute return or a anxiousness-adjusted return.

Resolve 1: Largest Active Bitcoin-Handiest Funds and Structured Merchandise

How is its Investment Approach Abnormal?

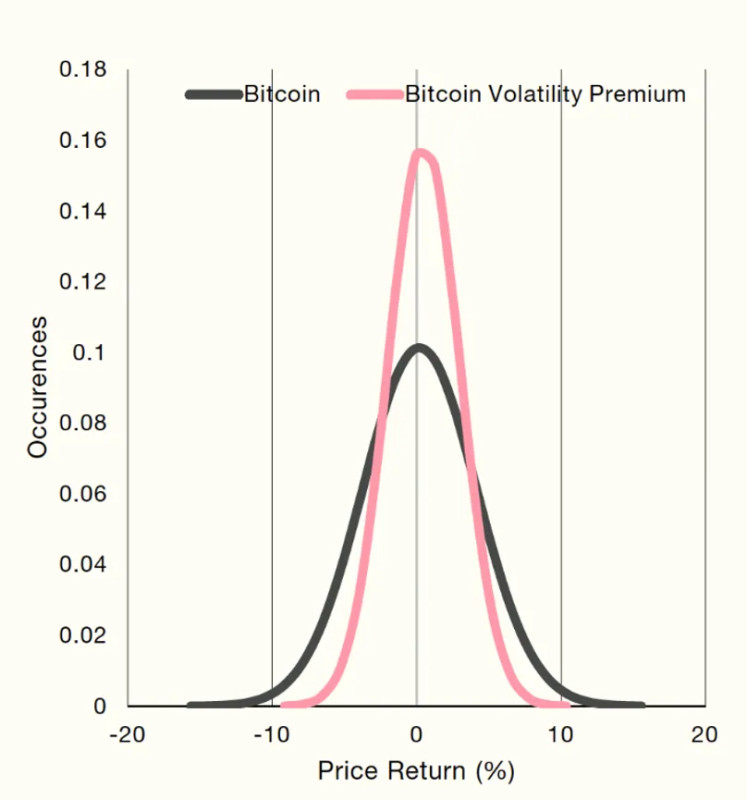

The certificate invests algorithmically in bitcoin and U.S. greenbacks, aiming to amass a volatility top charge while optimizing the anxiousness-return profile straight away by investing in bitcoin. The technique presents liquidity to the BTC/USD dispute market with market making on main exchanges such as Kraken. This ends in tiny gains, which would perhaps web between 2% and 6% per annum, reckoning on volatility. The volatility top charge is generated when the market strikes from filling the buy orders generated by the algorithm to filling the promote orders, and vice versa. The algorithm buys low and sells excessive at each dip or peak, respectively.

Resolve 2: Threat Profile of Bitcoin Versus Zeltner & Co. Bitcoin Volatility Top charge

Related to ETFs, as more investors invest in certificates of the Bitcoin Volatility Top charge AMC, the certificate must contain more bitcoin, therefore rising the inquire of of for bitcoin, which already outpaces the newly created each day offer by plenty of issues. The market making targets an allocation of 70% Bitcoin and 30% U.S. greenbacks, which implies that the technique for the time being owns over 540 Bitcoin.

Market Impact and Future Potentialities:

The purpose of the Bitcoin Volatility Top charge AMC is to mitigate the worth fluctuations of Bitcoin, making it more accumulate and purposeful as a medium of replace.

Dr. Demelza Hays, a portfolio supervisor at Zeltner & Co., shared insights with Bitcoin Magazine Pro:

“Bitcoin’s skill to become a world medium of replace and money hinges vastly on achieving accumulate procuring vitality. At the moment, the volatility inherent in Bitcoin’s save poses a barrier to its neatly-liked adoption for everyday transactions. Alternatively, if Bitcoin had been to stabilize in fee, it can well per chance also emerge as a viable various to typical fiat currencies, providing benefits such as decentralization, safety, and lower transaction expenses on Bitcoin scaling solutions such as Liquid, AQUA, and the Lightning Community.”

By turning into the most attention-grabbing actively managed bitcoin-simplest monetary product in Europe and a vital participant globally, the AMC leverages an algorithmic technique to invest in Bitcoin and U.S. greenbacks. This technique targets to study from market volatility, which in turn influences Bitcoin’s inquire of of and worth dynamics.

Swiss Family Keep of industrial Involvement:

The technique is managed by the noteworthy family place of job Zeltner & Co., primarily primarily based in Zurich, Switzerland. Founded by Thomas Zeltner, Zeltner & Co. is fixed the legacy of Thomas’s father, the leisurely typical president of UBS’ wealth management, Jürg Zeltner. Zeltner & Co., renowned for its discretion and expertise in wealth management, has lent credibility to this challenge, solidifying self assurance within the technique’s legitimacy and skill for fulfillment.

Regulatory and Geographic Advantage:

Picking Zurich, Switzerland for its headquarters, the AMC benefits from the gap’s favorable regulatory surroundings and its popularity as a world finance and innovation hub. This strategic dispute enhances the protection and appeal of the Bitcoin Volatility Top charge AMC to investors on the lookout for to diversify into digital assets.

Conclusion:

The open of the Bitcoin Volatility Top charge AMC comes at a time of heightened ardour, with bitcoin currently surpassing all-time highs and shooting the attention of institutional investors and mainstream media alike. As the market continues to former and appeal to bigger institutional participation, the emergence of modern funding autos such as this certificate highlights the evolving nature of digital asset management.