MSTR stock label persevered its most up-to-date downtrend on Monday as volatility within the crypto market remained.

- MSTR stock label persevered its extraordinary downward pattern this week.

- MicroStrategy persevered its Bitcoin accumulation approach.

- Technical evaluation suggests that MSTR would possibly per chance per chance shatter to $100 rapidly.

MicroStrategy dropped to $136, down by 75% from its all-time excessive. It then stabilized at $145 as Bitcoin ($BTC) pared relieve about a of its earlier losses and moved above $78,000.

Intention also stabilized after the corporate published that it obtained 8555 coins worth over $75 million closing week. It modified into its smallest aquire in three weeks.

Intention has obtained 855 $BTC for ~$75.3 million at ~$87,974 per bitcoin. As of two/1/2026, we hodl 713,502 $BTC obtained for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

The corporate now holds 713,502 coins, which it bought for the everyday label of $76,052. At its lowest stage on Monday, Intention’s unrealized losses jumped to over $900 milllion.

Intention has rating admission to to more cash to proceed it Bitcoin looking out for to search out spree. Its looking out for to search out account confirmed that it has rating admission to to over $8 billon worth of the MSTR stock to sell to raise capital. It also has $20 billion worth of STRK most favorite shares, $4 billion of STRD, $3.6 billion of STRC, and $1.6 billion of STRD stock.

As a result of this truth, there would possibly per chance be a probability that Saylor will use the lower Bitcoin label to proceed the accumulation. His scrutinize is that Bitcoin will within the waste leap relieve and transfer to a fresh account excessive.

Ancient past presentations that Bitcoin constantly rebounds whenever it crashes into a get market. Let’s take into accout, $BTC crashed by over 35% between its absolute best point in January closing year and its lowest point in April. It then rebounded to a account excessive in Can even.

Bitcoin also slipped by over 70% between its absolute best stage in 2021 and lowest stage in 2022. It then surged from under $16,000 in 2022 to $126,200 in 2025. As a result of this truth, the per chance scenario is the build Bitcoin rebounds later this year.

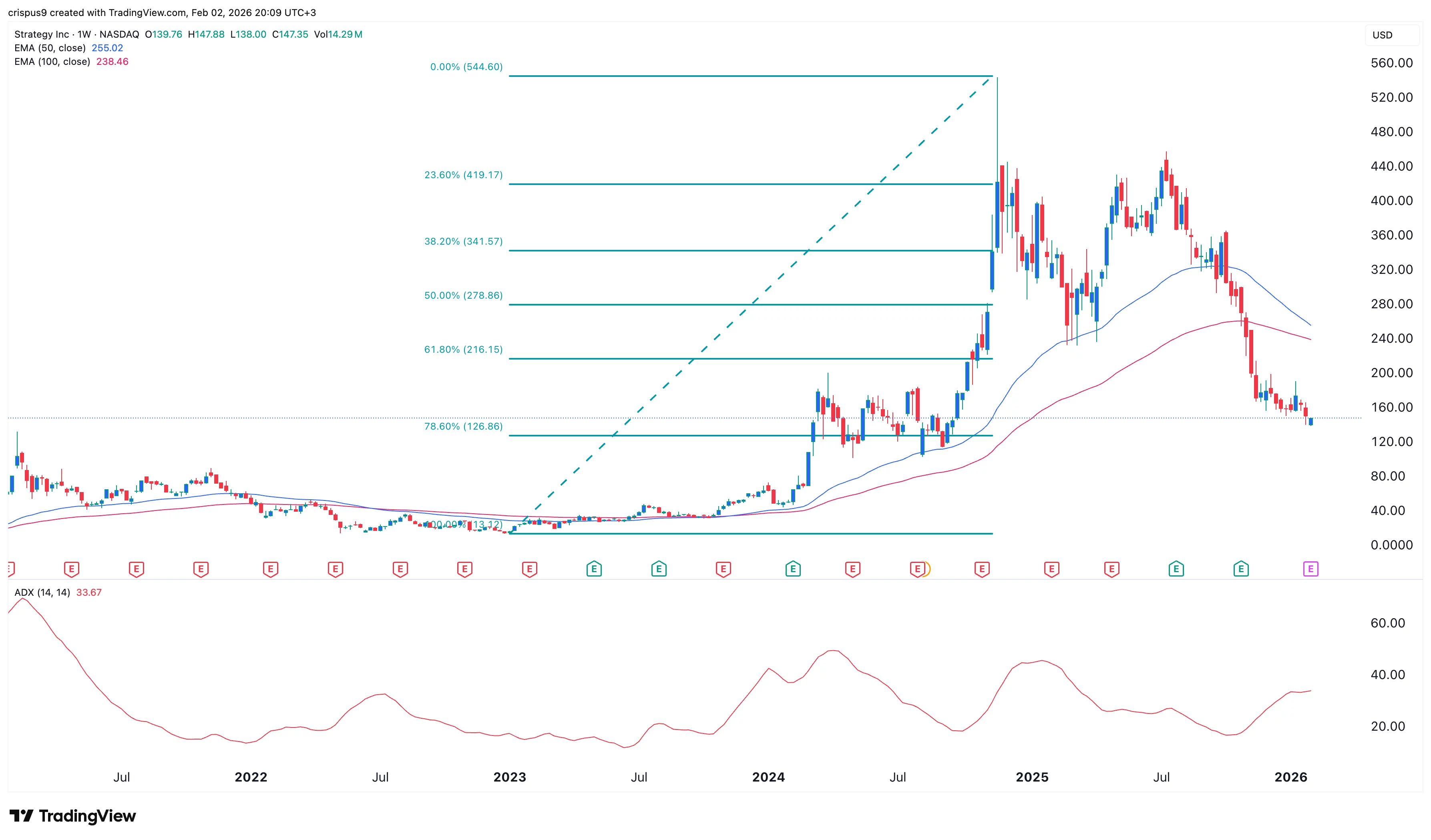

MSTR stock label technical evaluation

The weekly chart presentations that the MicroStrategy share label has been in a extraordinary downward pattern. It has now crashed under the 61.8% Fibonacci Retracement stage, confirming the downward pattern.

The Moderate Directional Index has jumped to 33, its absolute best stage since March closing year. A hovering ADX indicator is a stamp that the downward pattern is gaining momentum.

The stock moved under all appealing averages and the Supertrend indicator. As a result of this truth, the per chance scenario is the build it drops by 35% to $100 after which resumes the downward pattern.