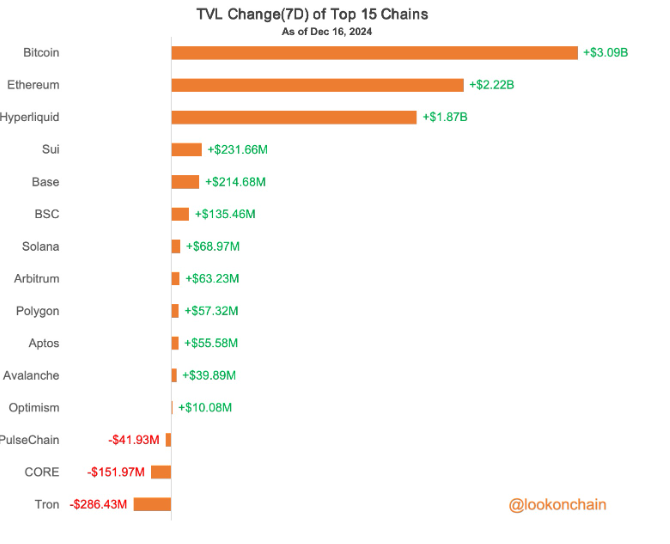

As the 2024 bull market extends, fund inflows are reaching new recordsdata. Salvage Ethereum (ETH) prices and new Bitcoin (BTC) mark recordsdata are already reflected in DeFi.

Extra mark is getting locked thru Bitcoin and Ethereum, as their mark grows at the close of the year. The attain of the bull market led to an overall recovery of DeFi within the previous month. Funds are flowing into BTC staking protocols and ETH-based entirely DeFi.

Inflows have been even more noticeable in liquid restaking, indubitably one of the crucial expansion sectors for the overall year. Furthermore, Hyperliquid’s upward push to prominence turned it into the finest hub for mark locked after BTC and ETH.

In step with the exchange of entire mark locked, Hyperliquid accelerated its inflows. The value locked in BTC and ETH is increasing as a result of value rally, while also increasing the value of collaterals.

Fund inflows into these top projects differ from particular person deposits to DeFi and ETF searching for. Fund inflows may per chance well also merely fluctuate for the many ecosystems, nevertheless the overall trend stays certain. The finest outflow of funds is from TRON, while smaller inflows proceed for essentially the most attractive L1 and L2 chains with developed DeFi and Web3 apps.

In the previous week, BTC staking expanded after the Cap-3 event by Babylon Labs. The event wraps up on December 16, after drawing new non-custodial staking for 1,000 blocks. The event drew in an further 59,983 BTC, valued at $5.38B. These inflows may per chance well be counted within the arriving weeks, reflecting the vertical expansion of TVL for Bitcoin’s community. The entire mark of locked BTC is now $6.92B, at prices above $104,000 per coin. Most of the value is locked with Babylon Labs, which carries $5.63B entire liquidity.

Hyperliquid grows TVL with new shopping and selling offers

Hyperliquid is within the system of increasing its decentralized futures shopping and selling platform. The DEX is adding new shopping and selling alternatives, starting out with low leverage.

Hyperliquid is also repeatedly expanding its launch passion, drawing in inflows of stablecoins. The exchange would no longer raise build markets, and handiest offers by-product pairs.

Hyperliquid reached a brand new all-time high in launch passion of >$4.3B. pic.twitter.com/8YUwBEEWEU

— Hyperliquid (@HyperliquidX) December 16, 2024

Per other metrics, Hyperliquid locks in $3.19B with vertical boom since its open in December. The upward push of the HYPE token and the prospective of high-velocity shopping and selling is boosting the positions of Hyperliquid as indubitably one of the crucial actively increasing protocols.

Because of the expansion, the native HYPE token has been on a ramification note. HYPE trades at $26.50, and not using a drawdowns since the token skills event. HYPE holders are also no longer promoting, no longer like early Magic Eden (ME) recipients.

Ethereum liquid staking and restaking boost DeFi

The opposite source of liquidity and locked ETH are DeFi apps with requisite collaterals. Liquid staking now carries a crammed with $70.69B, producing $7.68M in day-to-day bills. LidoDAO is level-headed the chief with greater than $39B in mark locked.

The opposite enormous source of inflows are liquid restaking protocols, which map one other layer of liquidity. Over the direction of 2024, liquid restaking expanded by greater than 6,000%, with entire mark locked increasing above $17B.

EtherFi is the chief, maintaining greater than $9.37B, followed by KelpDAO. The field began out with correct $284M in January. General, the DeFi sector now locks in greater than $140B, a stage no longer viewed since April 2022. DeFi mark crashed since 2022, while protocols had to rebuild and liquidity flowed to new apps.

With out a doubt one of the crucial expansion apps in 2022 change into Aave (AAVE), which now holds upward of $22B in varied assets. The creation of $196.8B value of stablecoins is also adding to the readily accessible liquidity for swimming pools, staking and lending.

A Step-By-Step Plan To Launching Your Web3 Career and Touchdown Excessive-Paying Crypto Jobs in 90 Days.