Bitcoin’s weekly chart is at a pivotal level, with tag action hovering around key structural levels. Merchants are now questioning whether the brand new stir marks the birth of a deeper correction or perfect a healthy consolidation forward of the following leg up.

Elliott Wave Indicators Align With Constructing Correction

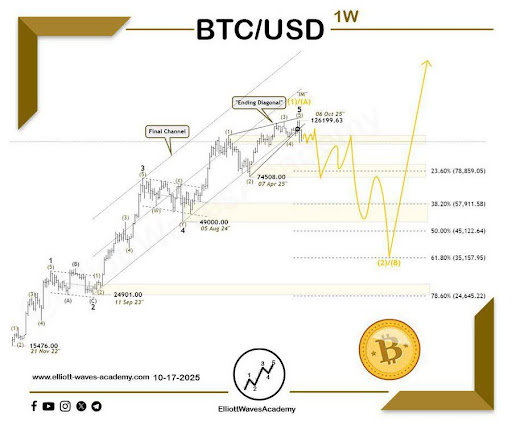

Elliott Waves Academy, in its most in style diagnosis tracking Bitcoin’s anticipated wave path on the weekly timeframe, has raised a key quiz: has the corrective wave begun? The brand new market development signifies that the bullish leg has possible finished, and the price might per chance presumably presumably also now be transitioning correct into a corrective section. A necessary reinforce stage of the prior upward wave has been broken, hinting at a ability wave reversal in development.

The proof for this transition grows stronger when staring on the spoil below the decrease boundary of the diagonal sample and the closing tag channel. Both of these constructions beforehand acted as stable helps all over Bitcoin’s impulsive climb, and their breakdown now suggests that market adjust is slowly nice looking from investors to sellers.

In the period in-between, Bitcoin is trading under the decrease boundary of the price channel, which has flipped correct into a key resistance zone. As prolonged as the price stays below this zone, bearish sentiment might per chance presumably presumably persist, maintaining the market in a cautious order.

No topic the weak point, there are indicators that the downward sub-wave might per chance presumably presumably also very neatly be nearing completion. The development suggests that a brief-term upward corrective wave might per chance presumably presumably emerge as the market makes an strive to stabilize and gather footing.

Expected Outlooks

Sharing his expectations, Elliott Waves Academy famed that Bitcoin might per chance presumably presumably also proceed to consolidate around its new levels as bulls are attempting and defend their positions. This kind of section of sideways movement on the complete reflects a duration of indecision within the market, the place each investors and sellers are ready for confirmation forward of committing to their next fundamental strikes.

However, the Academy cautioned that if indicators of weak point launch to emerge shut to the brand new resistance zone, the market might per chance presumably presumably face a ability reversal. This shift might per chance presumably presumably situation off renewed bearish stress, pushing Bitcoin correct into a deeper corrective leg.

In step with the diagnosis, the correction might per chance presumably presumably lengthen in the direction of the 50%–61.8% Fibonacci retracement levels of the old upward wave. These Fibonacci zones on the complete befriend as key areas of reinforce all over corrective actions, and a decline into these ranges might per chance presumably offer a more stable foundation for a future bullish reversal.

In the spoil, monitoring tag conduct around these a truly valuable levels within the following days might well be valuable. Whether the market holds firm in consolidation or slips correct into a deeper retracement, the upcoming actions in these zones might per chance presumably presumably situation the tone for the following section of Bitcoin’s prolonged-term wave cycle.