Money market merchants are pricing in an ECB charge hike in the arriving months, ending the duration of relatively low rates. On the opposite hand, Polymarket predictions demonstrate unchanged rates for most of 2026.

The credit score panorama in 2026 might perchance consist of ECB charge hikes and an elevated financial outlook for the Euro situation, after a duration of unchanged hobby rates and low inflation.

On the one hand, cash market merchants are pointing to a capability hike in 2026, because the Euro situation financial system is exhibiting signs of a sooner recovery. On the opposite hand, merchants are pointing to more than a 50% probability that the European Central Bank will amplify hobby rates after a week of hawkish remarks.

The Euro situation inflation stays relatively low, however the duration of extraordinarily low rates in Europe would be ending.

In spite of the hobby charge cuts in 2025 and a dovish Fed, the expectations are that in 2026, quantitative easing might perchance quit, and a few central banks might perchance return to charge hikes.

In accordance to cash-market swaps, merchants query 13 basis aspects of ECB charge hikes by the dwell of 2026. The market shifted from an expectation for a charge slit last week. At the dwell of November, ECB Chief Christine Lagarde acknowledged that the fresh charge level of two% is supreme and displays the desired attain on Euro Space inflation.

The expectation for charge hikes affected Euro situation bond markets, with German 5-three hundred and sixty five days bond yields tranquil rising to 2.49%. The shift displays ongoing preparation for the dwell of the charge slit cycles for most critical central banks.

Prediction markets behold balance for ECB charge

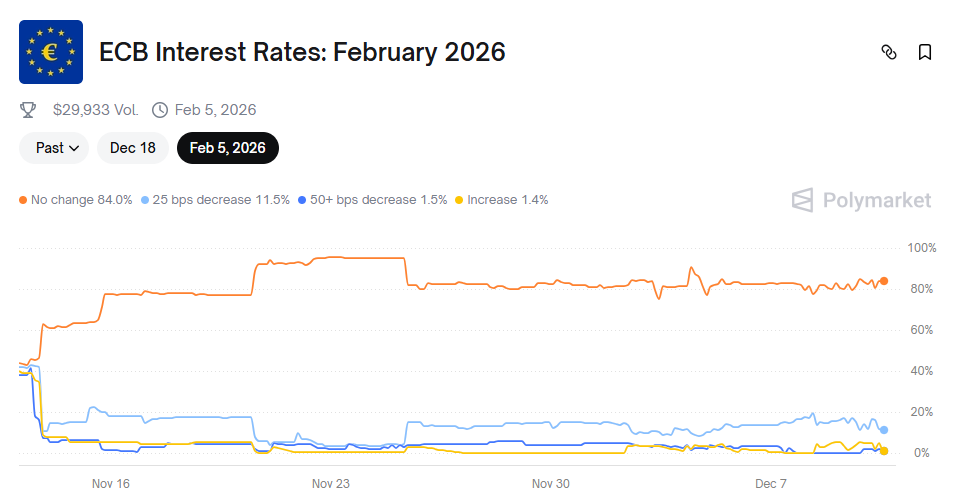

Polymarket merchants behold no surprises from the ECB, with ninety nine% of the bets on no charge hikes in December, looking forward to decision because the market’s time runs out.

For 2026, Polymarket merchants gift a clear notion, staring at for the ECB to preserve its recent rates.

Around 84% of market contributors query no hike from the ECB. The market has a restricted quantity below $20K, however might perchance turn into more vigorous because the date of choices approaches.

The ECB charge market is regarded as undervalued, however is intently watched for whales positioning and the functionality for fast gains in the case of early charge hikes from the ECB. Polymarket is now now not pricing in charge cuts, and a few merchants speak that is a likely subject, although it clashes with the signal from cash markets.

ECB charge decision hinges on sure outlook

The European Central Bank might perchance subject a more optimistic outlook for financial enhance in the subsequent few days. ECB Chief Lagarde pointed at upgraded predictions from the now now not too long previously carried out projections, and can recount an improved outlook by the dwell of the three hundred and sixty five days.

The Euro Space has proven more resilient to the US tariffs, acknowledged Lagarde all the draw throughout the Financial Times Global Boardroom match. The euro has now now not depreciated from these measures, leaving little stress for changing the rates to raise the financial system.

A undeniable outlook might perchance furthermore add one other argument for a charge hike sooner than the dwell of 2026.