Monero (XMR) Price experienced main development in November, aligning with a internet month for privacy coins following the nullification of Tornado Cash sanctions.

The renewed passion within the sector drove gains across the highest five privacy coins, with Monero rising 21% and affirming its dominance as the largest privacy coin by market cap.

November Turned into a Mammoth Month For Privacy Cash

November proved to be a standout month for privacy coins, pushed by the nullification of Tornado Cash sanctions, which reignited passion within the sector.

The overall top five privacy coins recorded main gains, with DASH taking the lead, surging an impressive 167%. This surge reveals the renewed market self belief in privacy-focused sources following the regulatory shift.

Monero is the largest privacy coin by a in point of truth extensive margin and its tag elevated 21% right thru the month. With a market cap bigger than the mixed tag of the following four biggest privacy coins, XMR continues to dominate the rental.

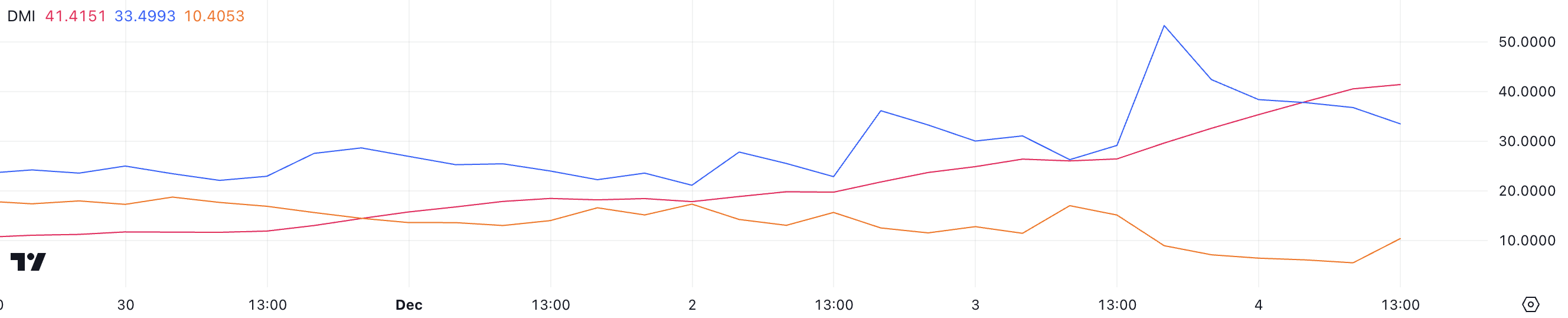

Monero DMI Reveals The Fresh Uptrend Is Tough

Monero DMI chart reveals a internet trend as its ADX has climbed to 41.4, up from below 30 upright a day within the past, making it indubitably seemingly the most necessary main gainers amongst altcoins.

This spicy amplify indicators that the strength of XMR newest trend has intensified vastly, reflecting heightened market momentum.

The ADX (Realistic Directional Index) measures trend strength, with values above 25 indicating a internet trend and below 25 suggesting a dilapidated or consolidating market. In XMR case, the DMI chart reveals D+ at 33.4 and D- at 10, indicating that patrons restful indulge in a major advantage over sellers.

On the opposite hand, the decrease in D+ and the upward push in D- counsel that promoting stress is beginning to grow, doubtlessly slowing XMR’s bullish momentum if the trend continues.

XMR Price Prediction: Can Monero Price Aid The Bullish Momentum?

XMR’s EMA traces remain bullish, with temporary averages positioned above lengthy-time interval ones and the associated payment staying above the temporary traces. This setup signifies sustained upward momentum, suggesting that the most fresh uptrend might presumably well furthermore proceed.

If this bullish trajectory holds, Monero tag might presumably well furthermore venture the $217 resistance and doubtlessly attain $220 and $225, stages no longer seen since May per chance per chance 2022.

On the opposite hand, the DMI chart indicators that a trend reversal is doubtless, which might presumably well furthermore bring XMR tag all of the kind down to examine its nearest internet make stronger at $166.