As summer season looms, CryptoQuant warns that Bitcoin miners may maybe well face vital challenges ahead, in particular if prices fail to recuperate substantially at some point soon of the hotter month.

No matter Bitcoin‘s tag dipping under the $58,000 effect and prompting weaker investors to sell at recent stages, valuable capitulation among Bitcoin miners has yet to launch. CryptoQuant head of analysis Julio Moreno mentioned in an interview with crypto.data that the community hashrate remains a dinky greater than pre-halving stages, noting that miners “can unruffled function a income” with “rather efficient tools.”

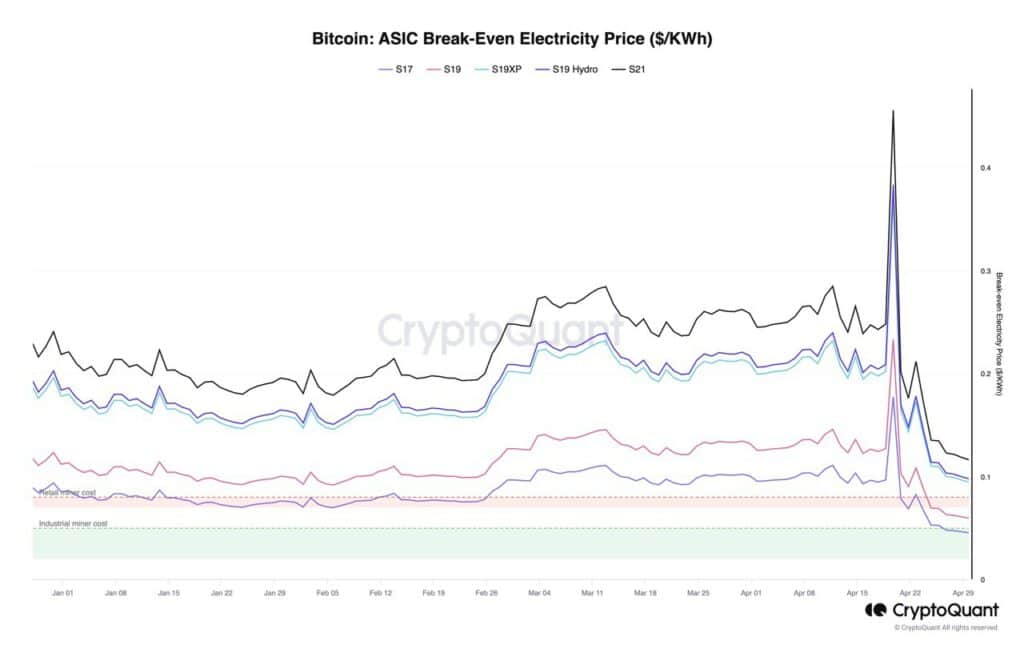

Moreno says the profitability is unruffled will also be seen within the ruin-even electricity tag for ASIC gadgets S19 and S21, which remain above the electricity tag of colossal industrial miners (inexperienced dwelling).

On the opposite hand, he additionally famed that some retail miners, in particular those the utilization of older ASICs like S17 and S19, may maybe well maybe be experiencing destructive earnings “because of greater electricity charges,” in conjunction with a capitulation event “will rely on how community hashrate and costs evolve within the subsequent few weeks.”

Addressing concerns about doubtless tag volatility at some point soon of the summer season buying and selling slowdown, Moreno emphasised that miners typically answer to tag actions in desire to the numerous formulation spherical. But, he didn’t rule out the likelihood that Bitcoin may maybe well take into fable more selling rigidity within the arriving months.

“[The market is] more liable to take into fable a miner capitulation if prices don’t recuperate considerably at some point soon of the summer season. Particularly with the hashprice (moderate miner income per hash) making unusual lows.”

Julio Moreno

As crypto.data reported earlier, Bitcoin miners are no longer selling their crypto holdings at recent prices regardless that their income has dropped to stages final seen in early 2023 because of basically the most authorized halving, which reduced mounted block rewards from 6.25 BTC to a pair.125 BTC. In line with CryptoQuant CEO Ki Younger Ju, miners now possess two alternate choices: capitulate or look ahead to an enhance in Bitcoin’s tag, which is at this time buying and selling under the $58,000 effect.