MicroStrategy shareholders are put of abode to vote on plenty of key proposals for the period of a special meeting scheduled for 10 a.m. New York time on Tuesday, in conserving with a most smartly-liked represent from Bloomberg.

The main focal point of the vote will be to approve an amplify in licensed Class A frequent stock from 330 million shares to 10.3 billion shares. Shareholders can even imagine elevating the more than a couple of of licensed most smartly-favored shares from 5 million to 1 billion.

Bloomberg reported that MicroStrategy’s upcoming shareholder vote is vulnerable to with out issues approve the proposed measure, given co-founder and chairman Michael Saylor’s plentiful vote casting vitality—approximately 46% through his Class B shares.

The firm also plans to take as a lot as $2 billion through most smartly-favored stock offerings, which would immoral senior to Class A shares.

The amplify would attain MicroStrategy’s 21/21 draw, which targets elevating $42 billion over three years through part issuances and debt gross sales to toughen extensive Bitcoin acquisitions.

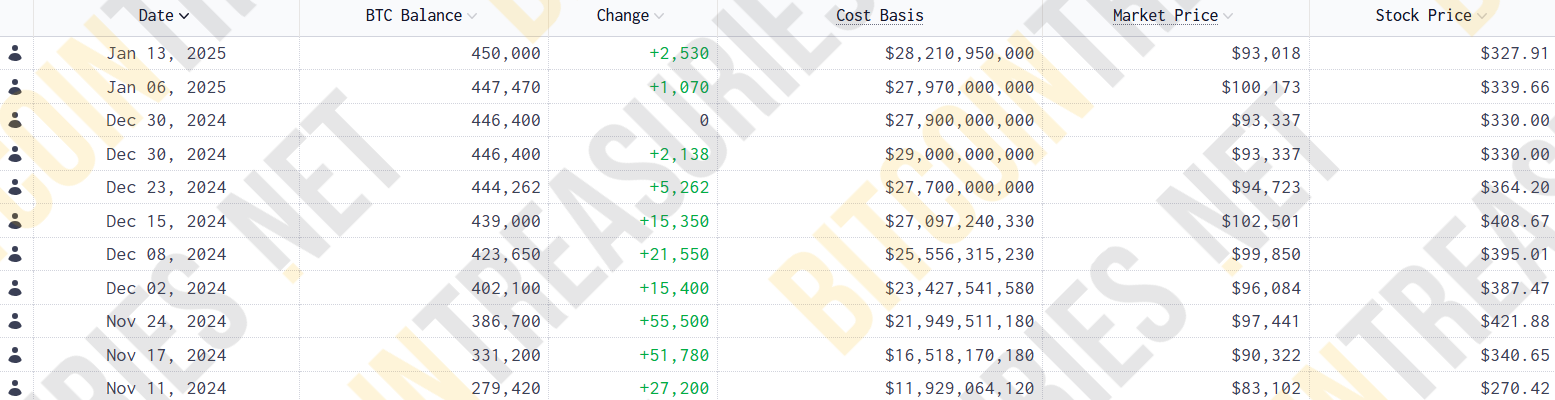

Since revealing the draw, MicroStrategy has collected 197,780 BTC through 10 consecutive weekly purchases, reaching nearly half of its purpose in over two months. Saylor beforehand informed Bloomberg that the firm would re-review its capital allocation strategy after reaching the target.

The upcoming meeting can even handle amendments to the firm’s equity incentive draw, including automatic equity grants for newly appointed board participants.

Following its most smartly-liked Bitcoin aquire, MicroStrategy maintains $6.5 billion of equity offerings closing below its $42 billion draw.

The Tysons, Virginia-basically basically based mostly firm currently holds roughly 450,000 BTC, valued at $Forty eight.5 billion at new market costs. It has invested approximately $28 billion in its Bitcoin holdings at an common impress of $62,691.