Strategy’s govt chairman, Michael Saylor, sparked debate with a poll suggesting Gamestop must purchase over $3 billion in bitcoin to develop BTC legitimacy.

Michael Saylor Turns up the Warmth With Ballot—Can Gamestop Meet BTC Expectations?

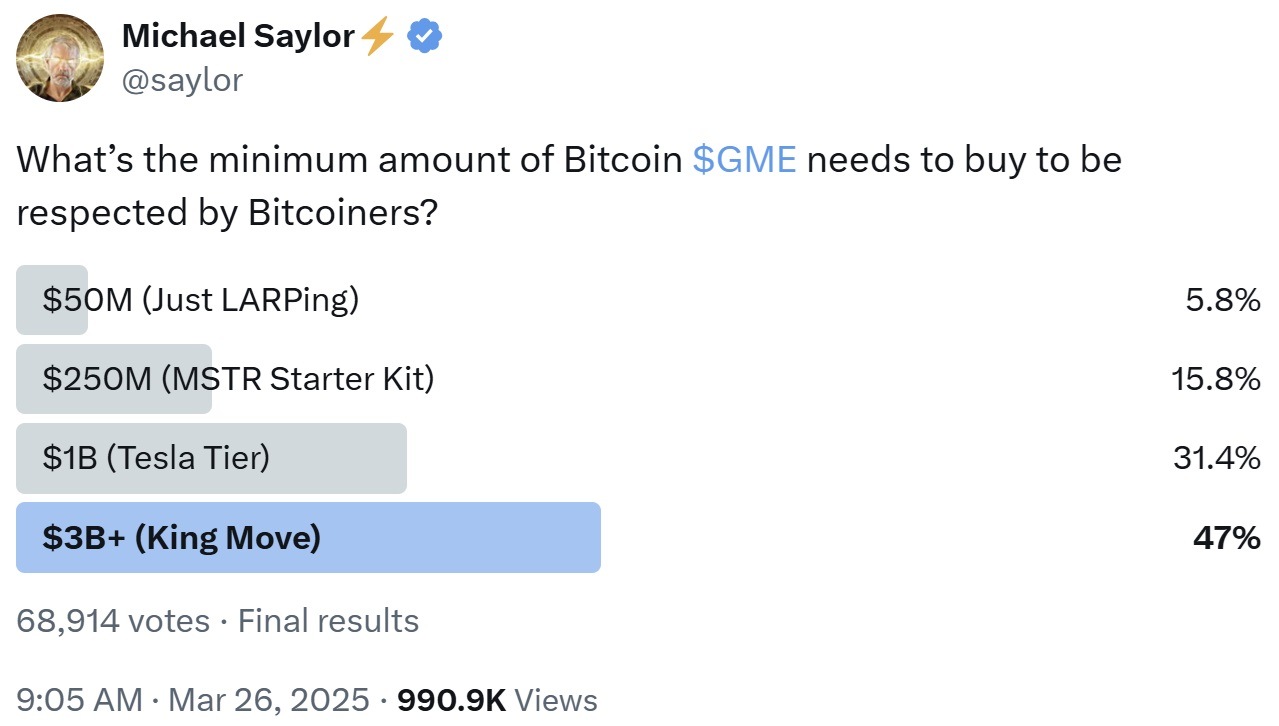

Michael Saylor, co-founder and govt chairman of tool intelligence firm Microstrategy (Nasdaq: MSTR), which now no longer too prolonged ago rebranded as Strategy, launched a poll on March 26 on social media platform X asking how noteworthy bitcoin Gamestop Corp. (NYSE: GME) would must construct in portray to set legitimacy among bitcoin followers.

Saylor asked his 4.2 million followers how noteworthy bitcoin Gamestop would must purchase to set credibility among bitcoin supporters. The 24-hour poll, which drew 68,914 votes, equipped four escalating possess tiers. The $3 billion-plus option, which Saylor referred to as the “King Switch,” led with 47% of the vote. The $1 billion “Tesla Tier” bought 31.4%, indicating many stare a thousand million-greenback investment as the threshold for corporate seriousness. The $250 million “MSTR Starter Equipment,” referencing Microstrategy’s 2020 entry, garnered 15.8%, while right 5.8% backed the $50 million “Appropriate LARPing” option. Saylor’s put up attracted practically 1 million views.

Gamestop announced its bitcoin formulation on March 25, revealing that its board of directors had “unanimously authorized an update to its investment protection to add bitcoin as a treasury reserve asset.” The company acknowledged that a bit of its fresh cash balance, alongside with proceeds from future capital raises, could per chance well be ancient to construct BTC. “The company’s investment protection permits investments in certain cryptocurrency sources, including bitcoin and U.S. greenback-denominated exact coins.”

The next day, Gamestop said it could well expand $1.3 billion through a non-public offering of convertible senior notes, with the likelihood to subject an additional $200 million. “Gamestop expects to articulate the catch proceeds from the offering for regular corporate capabilities, including the acquisition of bitcoin in a formulation in step with Gamestop’s Funding Coverage,” the company detailed. On March 27, Gamestop’s inventory experienced a basic decline of over 20% following the company’s announcement of a $1.3 billion convertible bond offering geared in opposition to financing bitcoin acquisitions.

In the intervening time, Strategy has persisted its aggressive bitcoin accumulation. On March 24, it disclosed the possess of 6,911 BTC for $584.1 million at a median imprint of $84,529 per coin. Saylor acknowledged that the company has carried out a year-to-date bitcoin yield of 7.7% in 2025. As of March 23, Strategy holds 506,137 BTC got for approximately $33.7 billion at a median imprint of $66,608 per coin.