From the starting of July, crypto exchanges and stablecoin issuers will characteristic in the EU consistent with the foundations equipped for by the MiCA law.

The entry into force of the Markets in Crypto-Resources (MiCA) law on June 30 formula essential adjustments for the cryptocurrency industry in the EU. Practical one of MiCA’s key provisions is regulating stablecoins, to boot to guidelines for a immense series of crypto assets and alternate platforms.

Table of Contents

What MiCA says

MiCA is a regulatory framework that clarifies and uniformly regulates the cryptocurrency market. It defines digital asset classification and specifies laws and areas of responsibility for their implementation.

Closing April, participants of the European Parliament voted in desire of the cryptocurrency regulation bill MiCA. The EU has develop into one in every of the first jurisdictions on this planet to introduce comprehensive guidelines on crypto assets.

Firms will decide to produce chunky disclosure to customers, most contemporary a public industry mannequin, attach an efficient governance blueprint, at the side of trouble management, register with the European Banking Authority (EBA), attach a buyback mechanism, and bear ample reserves.

Moreover, issuers of asset-connected tokens (ART) and digital money tokens (EMT) should always expose sustainability files from June 30, and crypto carrier providers should always open inquiring for disclosure requirements by the discontinue of the year.

ART issuers (numerous than credit institutions) may maybe continue to characteristic if tokens were issued sooner than June 30, unless they are granted or denied authorization below the MiCA, equipped they apply for permission unless July 30.

Entities no longer complying with MiCA will be fined and barred from operating in the European Union.

What restrictions bear crypto corporations supplied?

As a result of introduction of MiCA legislation in the EU, some crypto corporations bear begun limiting the exhaust of stablecoins.

In March, OKX suspended shopping and selling of presumably the most indispensable stablecoin, Tether (USDT), for customers positioned in the European Union.

In early June, the Binance alternate supplied that it may maybe perhaps perhaps limit entry to unregulated stablecoins for patrons from the European Union. Binance may maybe even limit the decision of providers and products that can comprise unregulated stablecoins. The copytrading carrier and participation in the Launchpad and Launchpool programs will be fully unavailable for European alternate clients.

Crypto alternate Bitstamp acknowledged this may maybe perhaps delist the EURT, the euro-pegged Tether’s stablecoin, and numerous stablecoins that attain no longer agree to new EU crypto asset laws by June 30.

Also, the European company Lugh supplied that it may maybe perhaps perhaps pause issuing its EURL stablecoin sooner than the MiCA regulation entered into force.

📢 Annonce :

MiCA : Lugh slump son activité d’émission de stablecoin pic.twitter.com/RdXzJHBzY5

— Lugh (@LughStablecoin) June 4, 2024

Order of the Stablecoin Market

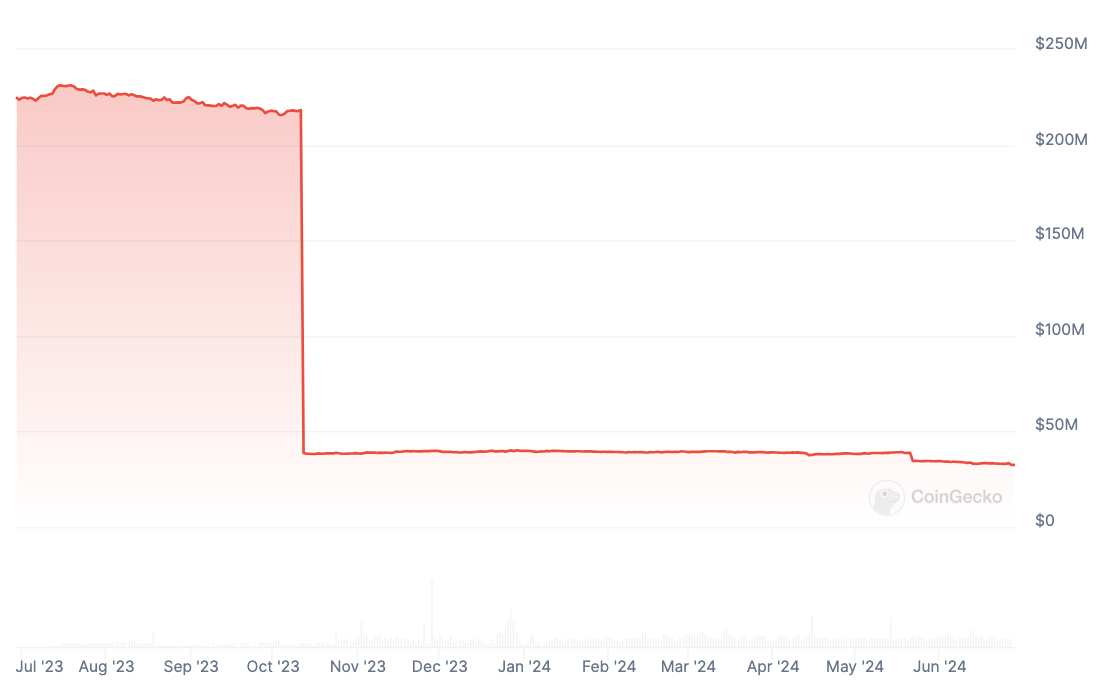

Per CoinGecko, for the interval of 2023, the stablecoin EURT with out be conscious misplaced its repute in the European crypto community. By October final year, the crypto asset’s capitalization fell nearly tenfold when put next to its peak in 2022—from $231 million to $32 million.

EURT is the second-largest stablecoin pegged to the euro by capitalization. When put next with USDT from the the same Tether, EURT’s quantity in circulation is tiny—most attention-grabbing 32.1 million cash as of June 26.

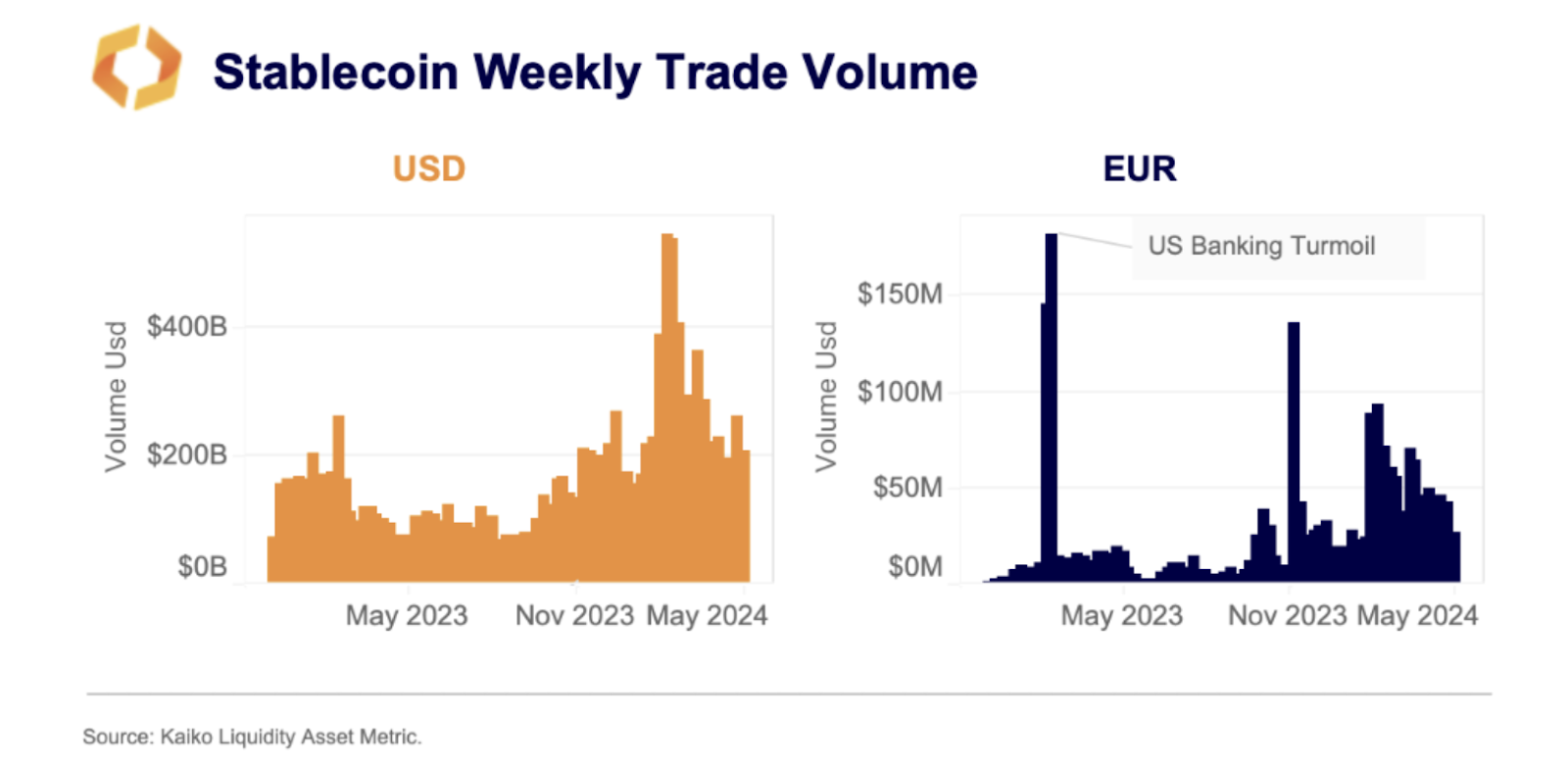

Per a myth from analytics agency Kaiko, stablecoins backed by euro reserves myth for most attention-grabbing 1.1% of the total shopping and selling quantity of stablecoins backed by fiat currencies.

The look also exhibits that nearly all (90%) of stablecoin transactions are in U.S. dollar-backed assets. Simplest 10% of stablecoins are backed by reserves in numerous currencies and right assets, at the side of gold.

The weekly shopping and selling quantity of greenback stablecoins equivalent to USDT exceeds $270 billion. Meanwhile, the total turnover of euro stablecoins EURT, EURS, EURCV, AEUR, and the worship is better about $40 million per week. On the opposite hand, analysts search files from of growth in this section as European regulators force exchanges to withdraw dollar assets from circulation.

What the specialists negate

Analyst MartyParty on the entire expects an explosion of stablecoins after the implementation of MiCA. He believes European Union banks, institutions, and stablecoin issuers will open minting trillions of euro-backed stablecoins in July.

Trusty Coin Explosion about to initiating

The MiCA provisions on stablecoins will reach into force on 30 June 2024 and the entire regulation will reach into force on 31 December 2024.

EU banks, institutions, and most contemporary valid coin issuers will initiating to mint trillions of Euro backed… pic.twitter.com/jaxcFP7dFa

— MartyParty (@martypartymusic) June 22, 2024

Alexander Ray, CEO and co-founding father of Albus Protocol, notes that new guidelines would require all organizations serious about industry transactions the utilization of asset-linked tokens to implement many regulatory measures, equivalent to KYC and AML protocols.

He acknowledged that implementing KYC and AML protocols will certainly amplify crypto corporations’ operating costs, and customers will indirectly pay for it.

Sven Mohle, managing director of BitGo Europe GmbH, added that with the adoption of MiCA, Europe is helping to space the bar for promoting global standards concerning guidelines and guidelines connected to combating money laundering and the financing of terrorism. On the opposite hand, it’s miles rarely seemingly that customers will survey fully standardized global guidelines at some level of the board.