As crypto becomes ever extra mainstream and intersects with conventional finance and bureaucracies, cultural clashes are inevitable. No topic all the pieces, bitcoin promised to separate money from the speak, while crypto developed as a strategy of transacting worth-to-worth, uncensored, permissionless ways on various rails.

So, how can these worlds–the orthodox and the blockchain-constructed various–presumably align? That is still to be viewed, nonetheless recent knowledge of the formation of a new organization known as the MiCA Crypto Alliance is an example of differing approaches crossing and maybe clashing.

Upright to recap, MiCA (Markets in Crypto-Sources) regulation is a comprehensive framework of EU crypto principles that appears to existing an acceptance of the crypto alternate internal EU countries that can soon score harmonized regulation. It went into pressure in June 2023, nonetheless is being applied by means of a phased manner, with the expectation that all principles needs to be in enact by the cease of 2024.

The MiCA Crypto Alliance is a new organization established by the DLT Science Basis (DLT scheme disbursed ledger technology) in partnership with major crypto firms Hedera, Aptos Basis, and Ripple. The Alliance targets to lend a hand crypto firms (such as exchanges) in complying with MiCA and areas a actual emphasis on adherence to environmental and climate-linked regulations.

1/3 #Hedera is happy to affix @Ripple and @Aptos Basis as Founding Members of the MiCA Crypto Alliance, with technical toughen from DLT Science Basis. 🔗To be taught extra or develop into eager: https://t.co/UJVxCzmXGH pic.twitter.com/f4L1rvu5ur

— Hedera (@hedera) September 16, 2024

When assessing the MiCA Crypto Alliance and its targets, it’s worth pondering about regional idiosyncrasies relating to crypto and maybe alternate and technology extra broadly, notably the environmental attitude that looks famed round the MiCA Crypto Alliance.

Concerning crypto, the EU has adopted a regulation-first manner and moved rapidly to develop MiCA, which sets a framework nonetheless also can additionally be further tailored later as required. Within the intervening time, within the US, on the opposite hand, crypto is waging loads of appropriate battles against an SEC perceived–wisely or no longer–as hostile, that scheme that US crypto headlines are continually dominated by court docket battles and appropriate arguments.

Nonetheless, whether or no longer this fraught score 22 situation continues within the US could well well rely on the cease results of the upcoming presidential election, which appears to be like an increasing number of pivotal for crypto.

It’s to be expected that if Donald Trump wins–provided that he has introduced loads of strongly pro-crypto protection positions–the US blockchain alternate will receive a primary enhance and could well well no longer prefer to expend up resources on regulatory boundaries, while within the EU, it’s apparent that navigating MiCA items new demands for crypto firms.

Differing Directions on ESG

Thru the MiCA Crypto Alliance’s emphasis on climate-linked duties, one more actual distinction emerges, and it pertains to shifts which score taken residing at BlackRock and other US firms. Within the initiating, it’s vital that BlackRock CEO Larry Fink has develop accurate into a blockchain convert, publicly promoting the values of Bitcoin and tokenized resources on disbursed ledgers.

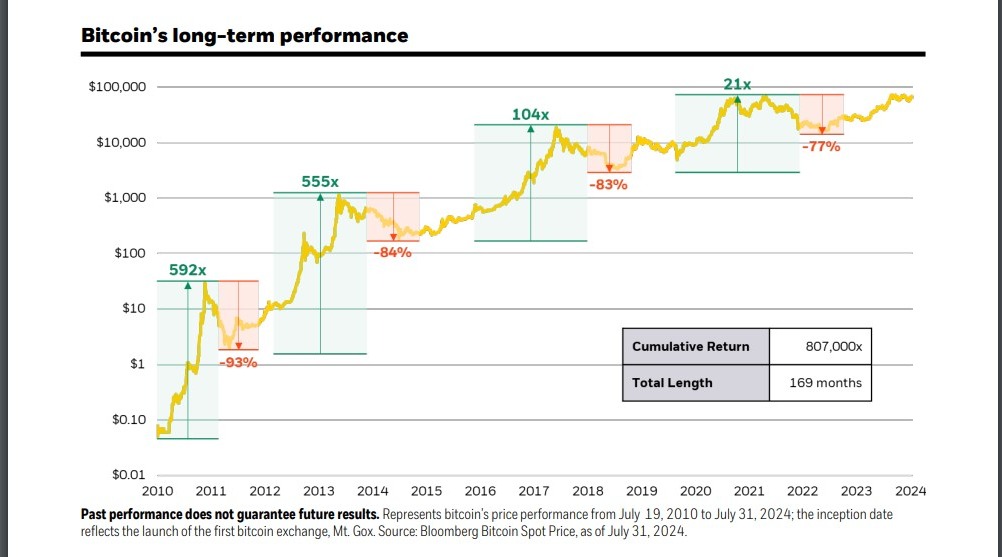

This month, BlackRock–which now operates the field’s main situation BTC ETF–revealed a file that undoubtedly outlined the case for BTC as an investment asset.

But this additionally comes after BlackRock has publicly moved away from the ESG model–whereby the E stands for environmental–with studies final month exhibiting that, for a duration of twelve months unless the cease of June 2024, the company had supported valid 4% of environmental/social shareholder proposals, down from a high figure of 47% in 2021.

BlackRock’s Senior Managing Director Joud Abdel Majeid mentioned that many such proposals had been “overly prescriptive, lacking financial advantage or asking firms to deal with field fabric risks they are already managing.”

Additionally, recent knowledge from ISS Company showed that median toughen internal firms for environmental shareholder proposals had dropped to valid 21% at Russell 3000 firms after this year’s annual meetings. For background context, this comes after Larry Fink explained in 2023 that he had stopped the utilization of the time duration ESG as it had turn into overly associated with radical politics.

Notably, the most in model BlackRock Bitcoin file does no longer mention climate or the atmosphere. By distinction, the MiCA Crypto Alliance net page formula a video titled ESG and DLT Workshop in Puerto Rico, along with loads of other climate and ESG-linked posts.

Prolonged-time followers of crypto discourse will undergo in mind that environmental concerns round Bitcoin score been addressed forward of and that this isn’t currently a famed home of debate. Which potential such considerations are being emphasised within the EU, nonetheless right here is rarely any longer especially the case in other areas.

This, in flip, implies that further regional divergence is doubtless, especially if the US elections usher in an openly pro-crypto administration in that nation. At that point, The US–already the international leader by manner of the tech sector–could well well present the crypto alternate with a hospitable atmosphere from which to operate.

In a roundabout scheme, though, for long-time crypto holders who score been following the blockchain world over loads of bitcoin halving cycles–going help over a decade for the earliest of adopters–this could well well all seem fun. No topic all the pieces, there’s a staunch understatement in seeing regional, extremely centralized bodies puzzle over the manner to tame a without boundaries technology constructed round one core theory: decentralization.