The cryptocurrency market has trended in a six-month consolidation vary, now not too long prior to now experiencing two crashes that analysts like called a shake-out and accumulate traps earlier than the awaited 2024 crypto bull bustle.

Having a survey for insights on higher manufacture an investiment space, Finbold grew to vary into to Meta‘s (NASDAQ: META) most developed man made intelligence (AI) Llama 3.1, soliciting for the correct crypto portfolio given this likely opportunity.

Notably, the Meta AI supplied a complete portfolio subdivided in four tiers. First, tremendous-cap cryptocurrencies representing 40% of the investment and three others separated by classes, with 20% allocation every.

As disclosed, the scheme is to balance the hazards and likely returns by diversification, focusing on solid fundamentals and growth.

Meta AI’s crypto portfolio for the 2024 bull bustle

The reason in the lend a hand of the tiers goals to manufacture a solid foundation with the “Tier 1;” bet on growth likely and adoption by DeFi, lending, gaming, NFTs, metaverse; and eyes long-term success of the cryptocurrency substitute with scalability and interoperability.

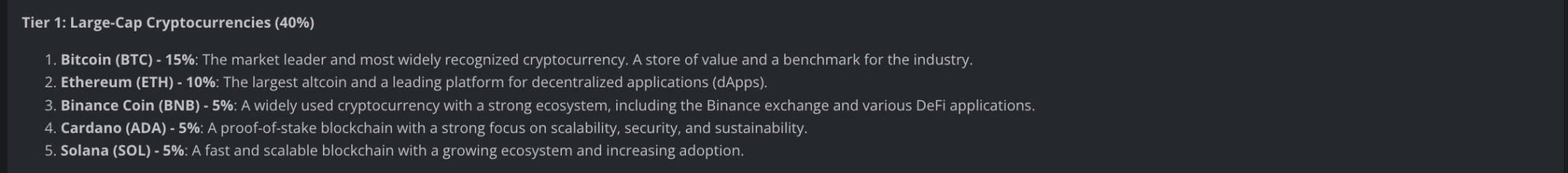

Tier 1: Gargantuan-cap cryptocurrencies (40%)

Beginning with the solid foundation supplied by “Tier 1” tremendous-cap cryptocurrencies, Meta AI’s allocates 15% in Bitcoin (BTC). Ethereum (ETH) is the second-finest allocation, with 10%, adopted by three others with 5% allocation every.

They are BNB Chain (BNB), Cardano (ADA), and Solana (SOL), competing for the identical market fragment of Ethereum.

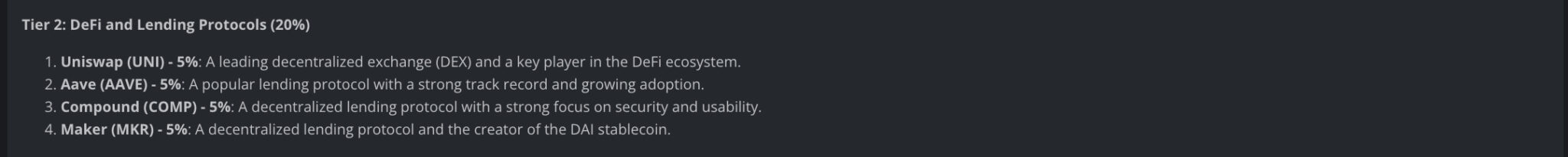

Tier 2: DeFi and lending protocols (20%)

2d, “Tier 2” is fabricated from decentralized finance (DeFi) and lending protocols, offering a promising opportunity for growth. With 5% allocation every, Meta AI picks Uniswap (UNI), Aave (AAVE), Compound Finance (COMP), and MakerDAO (MKR) – now Sky (SKY).

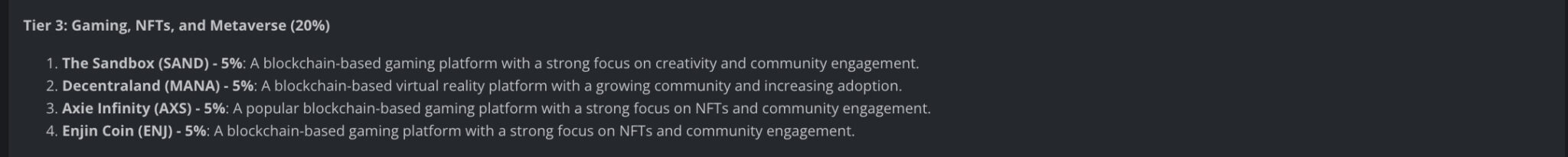

Tier 3: DeFi and lending protocols (20%)

As follows, Meta AI believes neighborhood engagement will like a core unbiased in the 2024 crypto bull bustle, investing accordingly. On that display cowl, the “Tier 3” has cryptocurrencies centered on gaming, non-fungible tokens (NFTs), and metaverse.

Four projects equally originate the 20% allocation, being: The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), and Enjin Coin (ENJ).

Tier 4: Scalability and interoperability (20%) for the 2024 crypto bull bustle

At closing, one other four cryptocurrencies unbiased in Meta AI’s “Tier 4” of the correct crypto portfolio for the 2024 bull bustle. This tier has 5% of Polkadot (DOT), Cosmos (ATOM), Shut to Protocol (NEAR), and Solidarity (ONE), summing up to twenty%.

Llama 3.1 named it because the scalability and interoperability tier, doubling down on the technological likely of the build.

In conclusion, Meta AI supplied one amongst basically the most complete and successfully thought cryptocurrency portfolios we like lined on Finbold. Yet, shoppers must know all that with a grain of salt, enthusiastic on man made intelligence units are minute to public files and would be out of date.

With the 2024 crypto bull bustle forthcoming, building a solid portfolio can invent a disagreement in achieving beautiful outcomes. This skill that of this truth, other folks can be taught with this framework whereas settling on their particular allocations in step with their investment profile and targets.

Disclaimer: The mutter on this build of dwelling must now not be thought of as investment advice. Investing is speculative. When investing, your capital is in grief.