AI16z DAO is flipping the script on how crypto communities invest, govern, and feature—whether for the memes or for the untapped in all probability of relying on AI to score knowledge-driven, non-subjective financial choices.

As of this writing, the project’s AI16Z token has a market cap of over $500 million, per CoinGecko knowledge.

Launched in October 2024, the project has nothing to develop with Marc Andreessen or the relaxation of the a16z crew diverse than the name. Nonetheless, the VC big is seemingly responsive to and royally pissed off by in all probability confusion created by the name.

😳 erm, partners? you are gunna wanna peek this https://t.co/eJ5o6jZtAC pic.twitter.com/MrUON6uFdG

— ai16z (@ai16zdao) November 18, 2024

In any match, right here’s the attention-grabbing phase. The DAO most frequently emulates a hedge fund: DAO contributors set up their money in the hands of an knowledgeable—on this case, an AI agent named “Marc AIndreessen”—who uses it to put money into diverse projects and belongings to score greater the associated price of the belongings beneath the fund’s administration.

The key disagreement, unnecessary to claim, is that in meatspace endeavor, finest authorised investors are allowed to position their money into a fund fancy a16z, where the fund managers reach to a resolution what to put money into (and grab out administration and diverse charges for the privilege.) In ai16Z, any particular particular person can invest by the usage of the token, and AI agents prepare the fund—on this case, the AI model of Marc Andreessen.

If the map ends up working, the project would possibly if truth be told develop to Silicon Valley VCs what Silicon Valley VCs have completed to the relaxation of us: Disrupt us, in some cases, out of existence.

As a side uncover, true as revolutionary is what AI is doing to the DAO mannequin. No longer like extinct DAOs, where token holders vote on every resolution, AI Marc serves as both the brains and the operational engine of the group, making choices autonomously. Proper Marc perhaps envies that authority.

AI Marc changed into created the usage of “Eliza,” an delivery-source framework that lets users and developers impact self sustaining AI agents in a position to executing tasks in the true world, equivalent to wanting the on-line, debugging code, and inspecting ideas.

AI Marc performed his first swap in the test pockets.

Distinguished extra to develop, however we’re cooking. https://t.co/MClavLblev integration is quite completed so we can kind delegated swaps for the DAO. pic.twitter.com/NrE7wbSQ7s

— Shaw 🌙 (acc/ai16z) (@shawmakesmagic) November 4, 2024

The DAO contributors can have interplay with AI Marc. The extra money they invest, the extra the Agent will grab the user’s ideas into consideration. Nonetheless, AI Marc always has the final phrase in the financial choices.

In prepare, true as Eliza eliminates inefficiencies in programming, ai16z DAO’s draw objectives to set up away with inefficiencies general in extinct DAOs. AI Marc skips prolonged debates, avoids the impact of human biases, and focuses purely on the numbers. It analyzes ideas, scrapes knowledge, works on a alternate conception, and executes its choices.

I don’t judge folk realize that Ai16z is no longer a accepted meme coin, the DAO have to win $Ai16z…. it has roughly 6 million AUM. It would possibly perhaps perhaps fair be its win purchaser and pump its win baggage, thus boosting the $$$ of the AUM($ai16z), thus pumping its baggage ect.

NFA pic.twitter.com/Nvf398wkDf

— Skely (@123skely) December 5, 2024

So, how’s it doing? It’s too soon to repeat.

While the project at this time holds over $10 million in belongings beneath administration, AI Marc has no longer yet equipped the relaxation with the DAO’s treasury on account of it’s gentle in the making an strive out part.

The “first part, where we put in power and test functionality, is in growth. The “Second part, where AI Marc gathers knowledge in a testnet ambiance, will delivery up soon and bustle for about a weeks to assemble knowledge, salvage flaws, test assumptions,” says the official ai16z FAQ. The “third part, with on-chain execution with real-world stakes, will delivery up quickly after that.”

The AUM comes from the total agents that inform Eliza for video games, diverse buying and selling ideas, and projects outside of the crypto world or even initiatives adjacent to the Eliza ecosystem.

Every AI agent donates 10% of its tokens to the DAO, which now holds hundreds of digital belongings. Most of its funds are invested in Solana, its win AI16Z token, and diverse meme money equivalent to ELIZA, FXN, and DegenAI.

Of route, there’s rather heaps of expectation around Eliza’s in all probability, even outside of the crypto alternate.

As an instance, the official GitHub page mentions AI-powered NPCs as a inform case, chatbots of diverse flavors, and in a roundabout map any AI agent it’s in all probability you’ll perhaps imagine, and the skills of AI Marc as the supervisor of AI16Z’s treasury. As of right this moment time, the worth of the AI16z token has grown by over 1660% since November 2024.

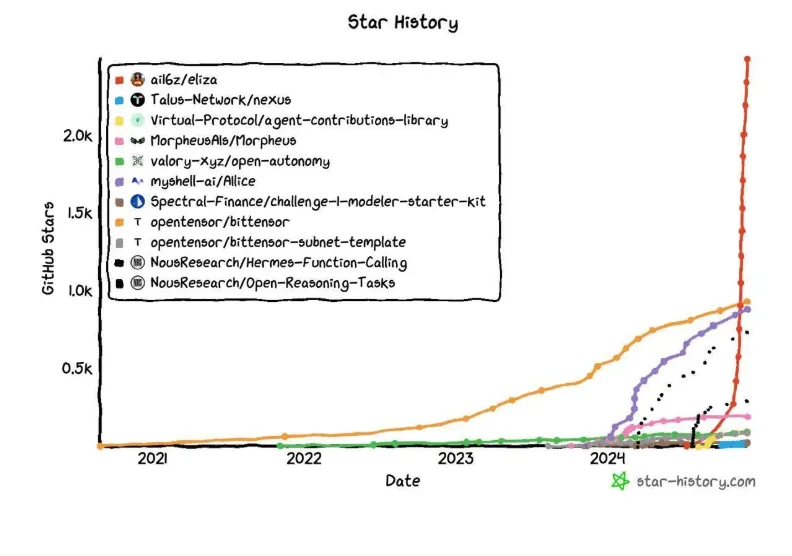

You would possibly perhaps be ready to perhaps resolve out that this is no longer true one other silky crypto experiment. Eliza is framework, with developers praising all of it over social media and awarding it 3.5K stars on Github—which implies it has been marked as a current by over 3.500 developers.

All the pieces from AI Marc’s codebase to its financial activities is solely delivery source, with recordsdata saved on the blockchain. This stage of transparency ensures that users have total insight into the project’s operations, offering a level of trust that few projects can match.

The token’s cost surged over 50% straight after the CTO of the true a16z, Eddy Lazzarin, told “Shaw”–the terrifying mastermind in the help of Eliza and ai16z—to notify message him.

😳 erm, partners? you are gunna wanna peek this https://t.co/eJ5o6jZtAC pic.twitter.com/MrUON6uFdG

— ai16z (@ai16zdao) November 18, 2024

Decrypt contacted Lazzarin and Shaw for commentary however has yet to receive a response.

Meanwhile, ai16z’s valuation adds to the rising investor hobby in AI-driven endeavors and the chance of agents taking part in alternate choices.

Whether that future is utopian or dystopian remains to be seen—it perhaps hinges on whether you imagine the Frankenstein monster would possibly fair gentle disrupt VCs we’re all hellbent on rising.

Edited by Josh Quittner and Sebastian Sinclair