On June 21, Chainlink (LINK) vesting contracts unlocked 21 million non-circulating tokens worth nearly $300 million. This amount represents significant provide inflation, with necessary economic effects that would also impact its assign as a promote-off happens.

Per a SpotOnChain file, the team sent 18.75 million of the unlocked amount to a Binance deposit take care of. Therefore, displaying intent to promote nearly 88% of the inflated provide straight, at a $265 million market worth by reporting.

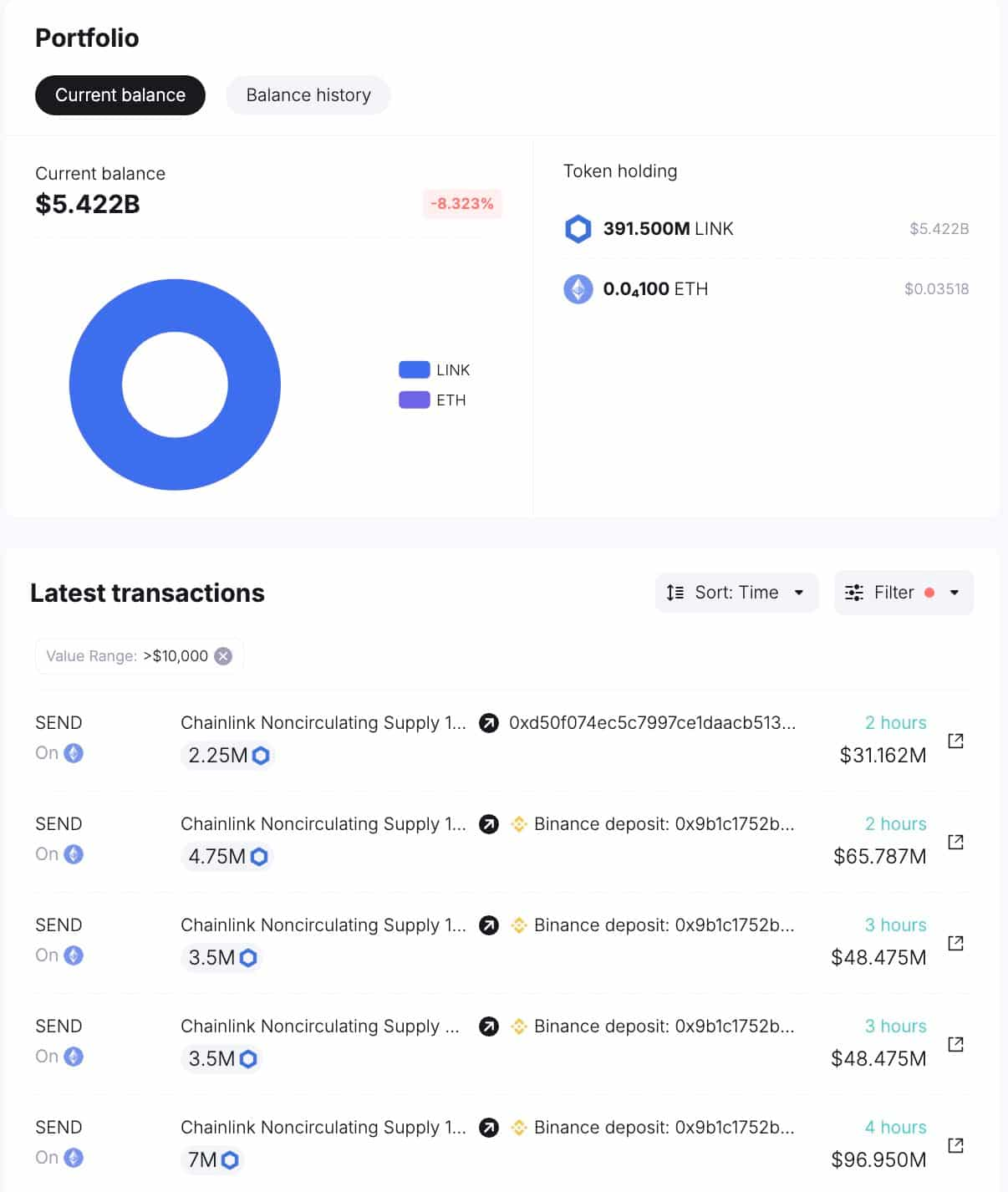

Furthermore, the contract sent 2.25 million LINK to the multisig pockets 0xD50f, for the time being retaining over 6 million LINK. This non-circulating provide take care of soundless has 391.5 million LINK for future unlocks, worth $5.4 billion, representing a threat.

Chainlink non-circulating provide unlocks over time

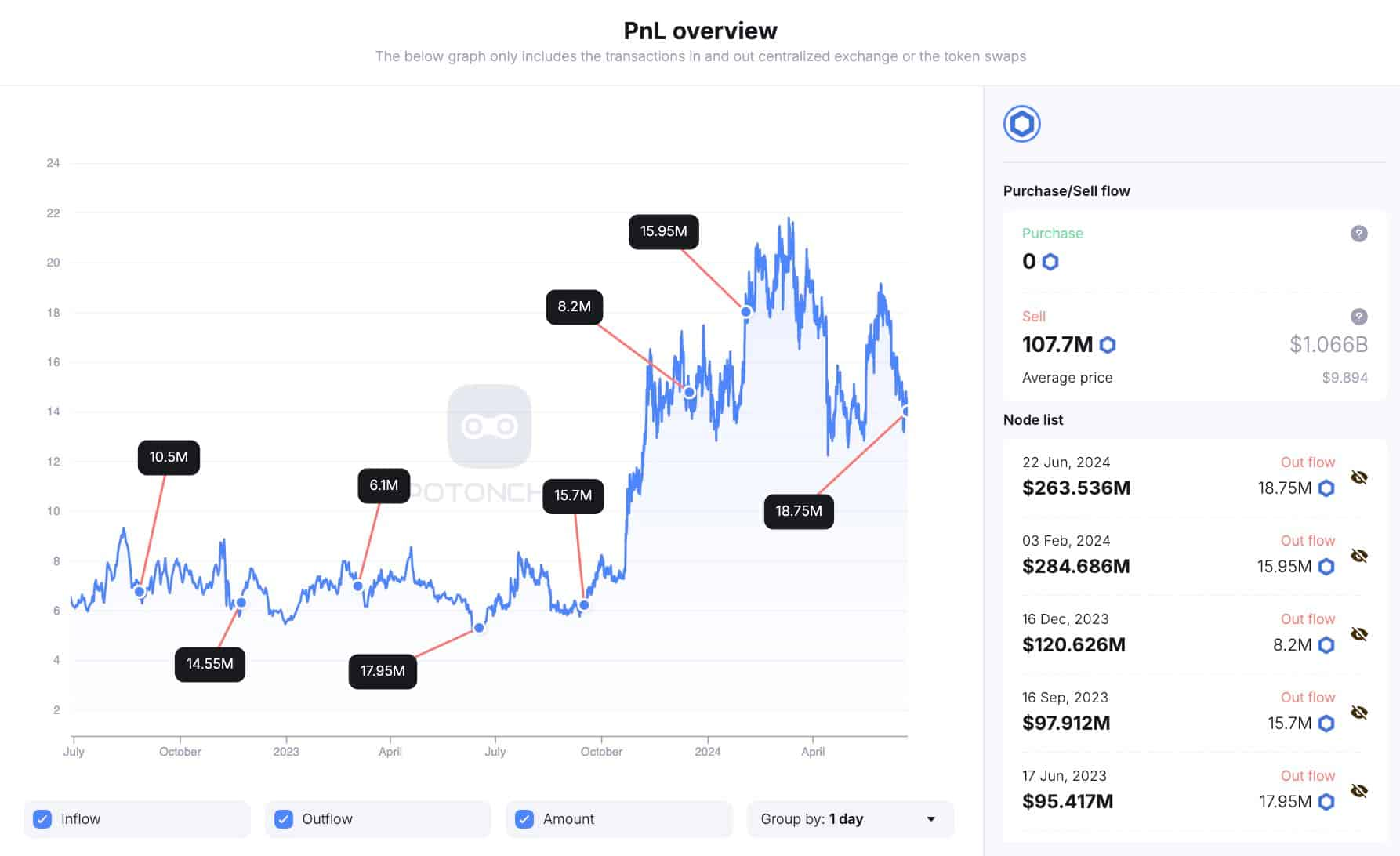

Seriously, Chainlink has been unlocking and promoting relevant quantities of its tokens since August 2022. In entire, it unlocked 127 million LINK and deposited 107.7 million LINK to Binance previously two years.

With a for the time being 608.10 million circulating provide, the unlocks fill resulted in a 26.4% two-Three hundred and sixty five days inflation.

Interestingly, the length had eight “unlock and deposit to Binance” events. These promote-offs involved quantities starting from 6.1 million to 18.75 million, with non-noticeable effects on assign.

Chainlink assign prognosis

As of this writing, Chainlink became once shopping and selling at $13.78 with a excellent 127.6% construct Three hundred and sixty five days-over-Three hundred and sixty five days. The Oracle protocol’s change rate in June 2023 became once $6 per token, displaying a factual performance and grunt skill no matter the provision inflation.

Therefore, this suggests LINK has been in a position to generate enough save a matter to at some point of these years. It is worth noting that Chainlink’s Oracle solution provides a helpful service for the surging accurate-world sources (RWA) account.

Mature finance giants esteem BlackRock (NYSE: BLK) and Franklin Templeton fill shown hobby in the tokenization of RWA. Thus, linked initiatives can acquire steam as these narratives dangle invent and institutional capital inflows into the cryptocurrency market.

Disclaimer: The verbalize on this set must soundless no longer be regarded as funding advice. Investing is speculative. When investing, your capital is in threat.