The fresh week for Bitcoin (BTC) and altcoins began with US President Donald Trump threatening NATO worldwide locations with in depth tariffs over management of Greenland.

As this event shook world markets, Trump announced that the US would impose a 10% tariff on goods from the UK, Denmark, Norway, Sweden, France, Germany, the Netherlands, and Finland starting February 1st, and that this charge would elevate to 25% by June.

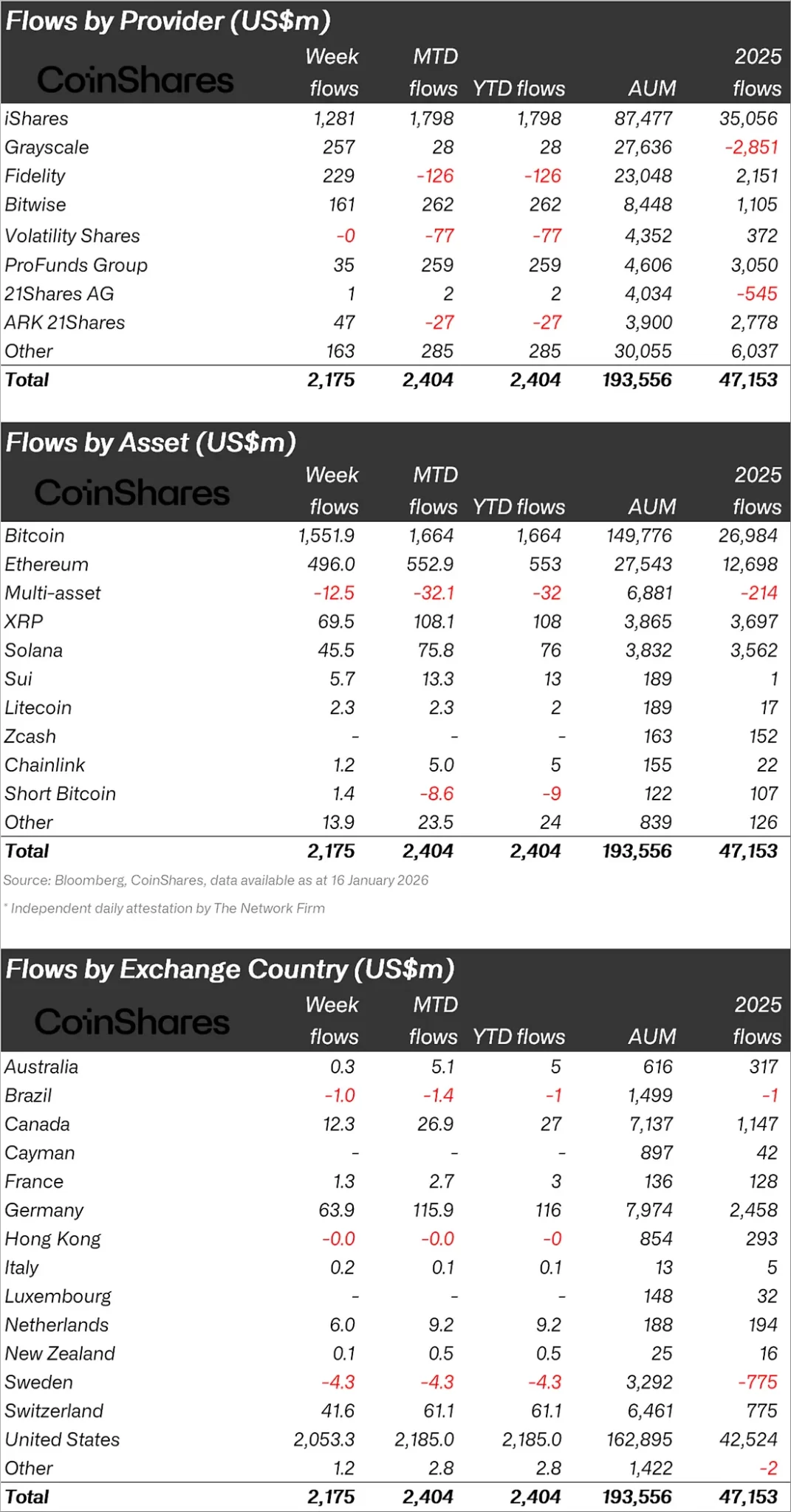

As markets practice the US-EU tariff tensions, Coinshares released its cryptocurrency file, stating that there used to be a $2.17 billion influx final week.

“Cryptocurrency funding products noticed their largest weekly inflows since October 2025, totaling $2.17 billion on Friday, despite market sentiment weakening due to geopolitical tensions, tariff threats, and policy uncertainties.”

Bitcoin Retains Its Management!

Having a peep at crypto funds in my concept, it used to be noticed that practically all of inflows were in Bitcoin.

Bitcoin noticed inflows worth $1.55 billion, whereas Ethereum (ETH) skilled inflows of $496 million.

Having a peep at other altcoins, inflows continued, with Solana (SOL) seeing $45.5 million, XRP $69.5 million, Sui (SUI) $5.7 million, and Litecoin (LTC) $2.3 million.

“Bitcoin led the inflows with $1.55 billion.”

Despite proposals from the US Senate Banking Committee below the CLARITY Act that would also prohibit stablecoins from offering returns, Ethereum and Solana recorded inflows of $496 million and $45.5 million, respectively.

There used to be influx precise into a wide diversity of altcoins. Potentially the most essential of these were XRP ($69.5 million), Sui ($5.7 million), LIDO ($3.7 million), and Hedera ($2.6 million).

Having a peep at regional fund inflows and outflows, the US ranked first with an influx of $2.05 million.

After the US, Germany noticed inflows of $63.9 million, and Switzerland received $41.6 million.

In accordance with these inflows, Sweden and Brazil skilled very dinky outflows.

*That is no longer funding advice.