Markets would possibly perhaps well just like moved previous the highest of U.S. tariff coverage uncertainty, however the jog forward remains volatile, in step with a fresh file from Nansen.

Nansen Highlights ‘Bessent Attach’ as U.S. Moderates Trade Stance

In a file shared with Bitcoin.com Information, Aurelie Barthere, Essential Analysis Analyst at Nansen, argues that most up-to-date U.S. tariff negotiations counsel a shift in opposition to pragmatism, easing some investor fears. The file highlights Treasury Secretary Bessent’s rising have an effect on over alternate coverage, contrasting with the diminished feature of hardline aides delight in Navarro and Commerce Secretary Lutnick.

This shift, coupled with non everlasting tariff exemptions for semiconductors and tech products, signals a doable de-escalation, Nansen’s learn analyst notes. On the opposite hand, Barthere says risks linger. Sectoral tariffs and unresolved negotiations with China would possibly well lengthen uncertainty, impacting user spending and enterprise funding.

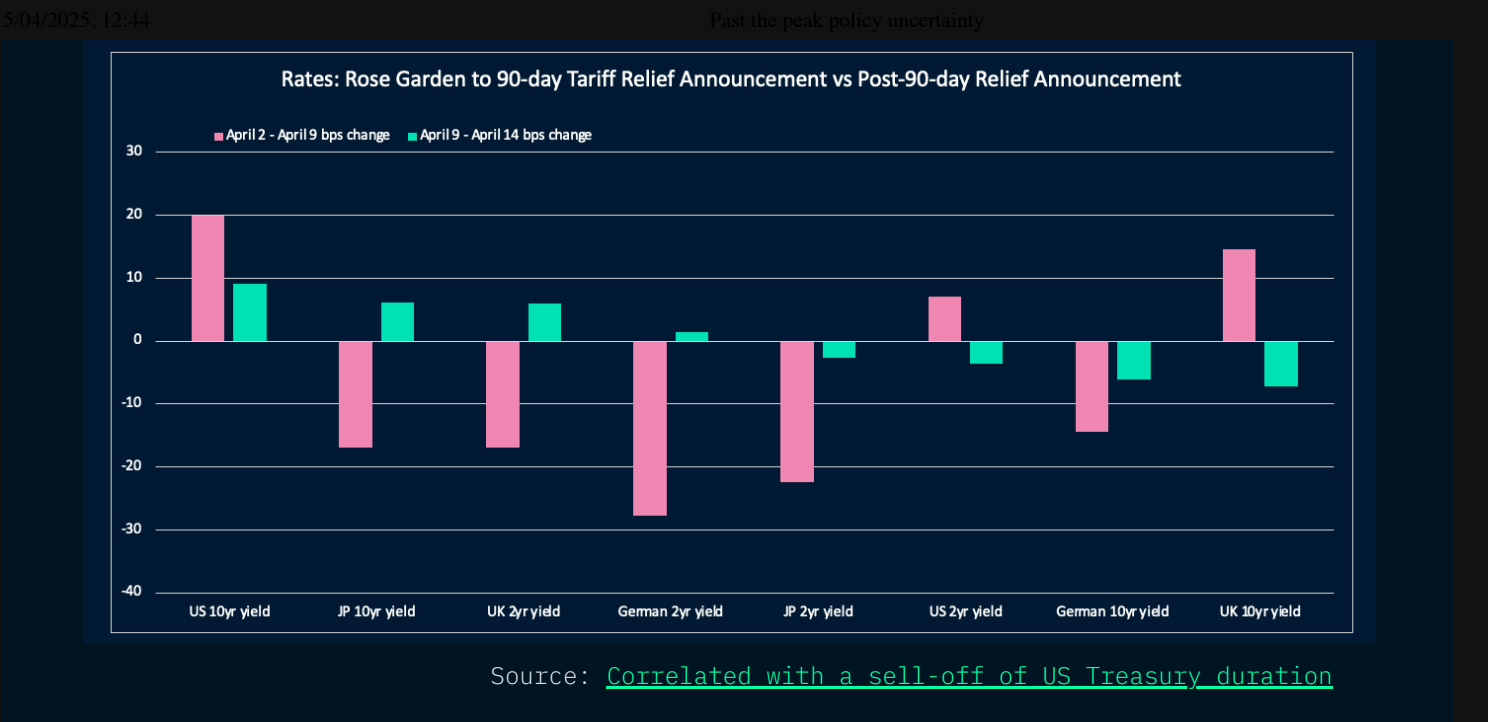

The file aspects to weakening U.S. Treasury inquire and a falling dollar as signs of international capital hedging in opposition to further volatility. Equities open air the U.S., in particular in Europe and China, underperformed all excessive of tariff tensions, Nansen recordsdata presentations. Yet, the firm cautions that the dearth of viable that that you might presumably judge of choices would possibly perhaps well just take care of global investors anchored to U.S. markets.

Barthere’s prognosis recommends a conservative plot, favoring resources delight in bitcoin ( BTC), discounted tech stocks equivalent to Nvidia, and excessive-margin European pharma companies. Gold is moreover cited as a geopolitical hedge. The firm’s Threat Barometer turned “chance-on” gradual closing week, reflecting cautious optimism. But Barthere warns the climb can be bumpy:

We like now likely passed the highest tariff uncertainty, with chance resources now rock climbing a bumpy wall of apprehension.