By Francisco Rodrigues (All instances ET except indicated otherwise)

The crypto market is struggling to uncover valid ground after Federal Reserve Chair Jerome Powell, talking after the central monetary institution lower the interest price by 25 basis ingredients, truly helpful one more discount in December isn’t any longer guaranteed.

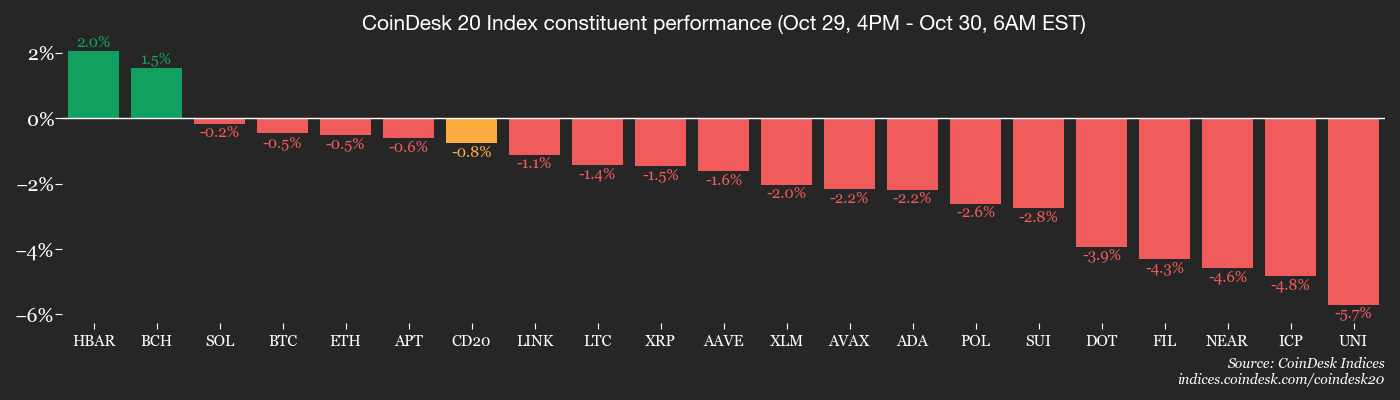

Bitcoin BTC$109,995.36 is down 2.5% over the closing 24 hours to $110,200, while the broader market as measured by the CoinDesk 20 (CD20) index misplaced 1.7%.

Whereas Wednesday’s discount turned into once expected, Powell’s hesitancy about extra easing sparked a pullback in threat assets. The circulation came whilst President Donald Trump signaled commerce tensions with China are easing.

The turbulence ended in larger than $820 million of crypto market liquidations over the closing 24 hours. Equities indexes saw diminutive drops and gold is struggling to dwell above the $4,000 mark.

Mute, the central monetary institution also announced it can end its steadiness sheet runoff by Dec. 1, a circulation that can furthermore add liquidity to monetary markets. To Spanish monetary institution Bankinter, what’s stopping extinct asset prices from rising is a case of “altitude illness.”

“The next Forty eight hours want to be spent digesting the expansive sail of recordsdata, particularly company earnings and central monetary institution news,” the monetary institution’s analysts wrote in a present. “The underlying tendency is to react quite positively, with the excellent constraint being the ‘altitude illness’ from recent highs.”

Lofty heights are no longer a dilemma for crypto given bitcoin is buying and selling some 13% underneath the all-time high it hit no longer as a lot as a month ago. To QCP Capital, it’s a outcomes of muted enthusiasm.

“The ten October flash break left both retail and institutional gamers cautious, and say book liquidity has yet to get better,” the company’s analysts wrote. “Meanwhile, digital asset treasuries (DATs) are adding to promote strain as many commerce underneath 1 mNAV.”

These reductions may well presumably furthermore be taught about extra DATs aquire help shares with funds that can reach through asset gross sales. Ether treasury company ETHZilla made headlines earlier this week for doing accurate that, promoting $40 million in ETH to repurchase shares at a lower effect to NAV.

Meanwhile, Friday’s $13 billion alternate choices expiry is adding extra strain to crypto prices. In step with Deribit recordsdata, market makers are uncovered to adverse gamma at strike prices between $100,000 and $111,000.

That setup methodology hedging divulge may well presumably furthermore lengthen effect swings into the tip of the week. Assign alert!

What to Watch

For a extra comprehensive listing of events this week, be taught about CoinDesk’s “Crypto Week Forward”.

- Crypto

- Oct. 30: Cronos (CRO) mainnet receives the “Smarturn” upgrade.

- Oct. 30, 10 a.m.: Core Scientific (CORZ) virtual particular meeting for stockholder vote on merger with CoreWeave (CRWV) and associated executive compensation.

- Oct. 30: HashKey Chain (HSK) pauses recent staking orders to interchange the staking contract, promising improved yields and a extra sustainable APY.

- Macro

- Oct. 30, 8 a.m.: Mexico Q3 GDP Tell Payment (Preliminary). YoY Est. -0.2%, QoQ Est. -0.3%.

- Oct. 30, 9:55 a.m.: Federal Reserve Vice Chair for Supervision Michelle W. Bowman is talking at the Financial Tell and Regulatory Paperwork Bargain Act Outreach Meeting. Watch are dwelling.

- Earnings (Estimates consistent with FactSet recordsdata)

- Oct. 30: Coinbase World (COIN), submit-market, $1.14.

- Oct. 30: Reddit (RDDT), submit-market, 52 cents

- Oct. 30: Rebel Platforms (RIOT), submit-market, -7 cents.

- Oct. 30: Approach (MSTR), submit-market, -10 cents.

Token Events

For a extra comprehensive listing of events this week, be taught about CoinDesk’s “Crypto Week Forward”.

- Governance votes & calls

- Arbitrum DAO is voting on a proposal to transfer 8,500 ETH from its treasury to the Arbitrum Treasury Management Council to spark off lazy funds and generate yield. Balloting ends Oct. 30.

- Unlocks

- Oct. 30: ZORA$0.07882 to free up 4.55% of its circulating provide worth $15.75 million.

- Oct. 30: KMNO$0.06668 to free up 5.Ninety nine% of its circulating provide worth $13.65 million.

- Token Launches

- Oct. 30: Plasma XPL$0.3142 turned into once listed on Bitstamp.

Conferences

For a extra comprehensive listing of events this week, be taught about CoinDesk’s “Crypto Week Forward”.

- Day 2 of two: Future of Money, Governance, and the Law 2025 (Washington)

- Day 1 of 3: CosmosVerse Balkans 2025 (Smash up, Croatia)

Token Talk

By Oliver Knight

- Higher than $80 billion turned into once wiped off the whole crypto market cap within the past 24 hours, as traders “sold the news” after the Fed’s interest-price lower and a commerce deal between the U.S. and China.

- Bitcoin BTC$109,995.36 and ether ETH$3,895.54, the 2 biggest cryptocurrencies, are both down 2.5% as they grapple with ranges of strengthen. XRP and XLM had been the worst performing tokens out of the 20 biggest, shedding 3.5% and 3.3% respectively.

- Plasma XPL$0.3142 continues to fabricate headlines for the depraved causes, tumbling 14% in 24 hours to compound an overall lack of 81% since Sept. 28.

- One glimmer of optimism sooner or later of the altcoin market turned into once TRUMP, the memecoin backed by the U.S. president, which rose by 6.8% after experiences emerged that Strive in opposition to Strive in opposition to Strive in opposition to, the firm managing the token, is planning to arrangement U.S. fundraising platform Republic.

- TRUMP has now risen by forty five% this week despite the proven truth that at $8.40 it remains effectively underneath its file high of $forty five.47.

- Bitcoin dominance ticked down a diminutive of from 59.3% to 59.0%, suggesting that some altcoins are outperforming bitcoin sooner or later of this newest interval of promote strain.

Derivatives Positioning

- Despite the day gone by’s submit-Fed news effect tumble in bitcoin, the BTC futures market reveals energy: Delivery interest (OI) has a diminutive of elevated to $27.2 billion, confirming minimal liquidations and snappy purchaser re-entry.

- Crucially, the highly polarized funding rates maintain normalized, now trending honest and shut-to-flat sooner or later of most venues. This indicators underlying market resilience and a much less volatile, extra measured sentiment compared with the outdated uncertainty.

- The BTC alternate choices market maintains a valid bullish lean, despite the proven truth that short-interval of time conviction has moderated.

- The implied volatility (IV) interval of time structure serene shows near-interval of time backwardation earlier than transitioning to long-interval of time contango. The one-week 25-delta skew has dropped to eight% from 10% the day gone by, but traders are serene paying a critical top price for short-interval of time name alternate choices.

- This diminished conviction is mirrored within the 24-hour effect-name volume ratio, which remains bullish at 55:44 in desire of calls.

- Coinglass recordsdata reveals $821 million in 24 hour liquidations, with a seventy nine-21 break up between longs and shorts.

- BTC ($368 million), ETH ($188 million) and others ($52 million) had been the leaders when it comes to notional liquidations. Binance liquidation heatmap signifies $109,700 as a core liquidation stage to computer screen, in case of a effect tumble.

Market Movements

- BTC is down 1.41% from 4 p.m. ET Wednesday at $109,991.72 (24hrs: -2.6%)

- ETH is down 1.3% at $3,894.22 (24hrs: -2.Forty eight%)

- CoinDesk 20 is down 1.56% at 3,670.84 (24hrs: -2.49%)

- Ether CESR Composite Staking Payment is down 1 bps at 2.84%

- BTC funding price is at 0.0024% (2.6488% annualized) on Binance

- DXY is unchanged at Ninety nine.18

- Gold futures are up 0.16% at $4,007.30

- Silver futures are unchanged at $47.92

- Nikkei 225 closed diminutive changed at 51,325.61

- Grasp Seng closed down 0.24% at 26,282.69

- FTSE is down 0.58% at 9,699.33

- Euro Stoxx 50 is down 0.Forty eight% at 5,678.22

- DJIA closed on Wednesday down 0.16% at 47,632.00

- S&P 500 closed unchanged at 6,890.59

- Nasdaq Composite closed up 0.55% at 23,958.47

- S&P/TSX Composite closed down 0.9% at 30,144.78

- S&P 40 Latin The United States closed up 1.11% at 3,012.82

- U.S. 10-Yr Treasury price is up 1 bps at 4.068%

- E-mini S&P 500 futures are down 0.22% at 6,907.75

- E-mini Nasdaq-100 futures are down 0.21% at 26,207.25

- E-mini Dow Jones Industrial Common Index are down 0.39% at 47,610.00

Bitcoin Stats

- BTC Dominance: 59.66% (+0.19%)

- Ether-bitcoin ratio: 0.03538 (-0.29%)

- Hashrate (seven-day transferring average): 1,108 EH/s

- Hashprice (area): $44.75

- Entire prices: 2.61 BTC / $292,842

- CME Futures Delivery Passion: 138,885 BTC

- BTC priced in gold: 26.2 oz.

- BTC vs gold market cap: 7.39%

Technical Analysis

- Bitcoin BTC$109,995.36 is for the time being maintaining above its predominant weekly strengthen stage at $107,000, having successfully bounced off this zone earlier on Thursday. Placing forward this strengthen is required.

- Could well presumably serene this core strengthen area break, the next critical stage to look may well presumably be a capability retest to $Ninety nine,000.

- Relating to momentum, the RSI is trending lower, signaling reducing momentum, but there are no longer any distinct bullish or bearish divergences for the time being boom to substantiate a shift within the significant pattern.

Crypto Equities

- Coinbase World (COIN): closed on Wednesday at $348.61 (-1.86%), +2.61% at $357.72 in pre-market

- Circle Internet (CRCL): closed at $131.74 (-3.21%), +3.56% at $136.43

- Galaxy Digital (GLXY): closed at $36.43 (-2.31%), +3.21% at $37.60

- Bullish (BLSH): closed at $52.57 (-2.67%), +2.66% at $fifty three.97

- MARA Holdings (MARA): closed at $18.88 (0%), +0.85% at $19.04

- Rebel Platforms (RIOT): closed at $22.17 (+2.85%), -0.81% at $21.Ninety nine

- Core Scientific (CORZ): closed at $20.77 (+3.38%), -1.25% at $20.51

- CleanSpark (CLSK): closed at $18.89 (-1.36%), +8.75% at $20.54

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $58.65 (-1.4%), +1.93% at $59.78

- Exodus Motion (EXOD): closed at $24.67 (-1.36%), +2.55% at $25.30

Crypto Treasury Corporations

- Approach (MSTR): closed at $275.36 (-3.26%), +3.31% at $284.47

- Semler Scientific (SMLR): closed at $25.Ninety nine (-4.52%), +4.23% at $27.09

- SharpLink Gaming (SBET): closed at $13.61 (-0.95%), -1.62% at $13.39

- Upexi (UPXI): closed at $4.54 (-1.94%), +4.41% at $4.74

- Lite Approach (LITS): closed at $2.08 (+7.77%), unchanged in pre-market

ETF Flows

Position BTC ETFs

- Each day earn flows: -$470.7 million

- Cumulative earn flows: $61.83 billion

- Entire BTC holdings ~1.36 million

Position ETH ETFs

- Each day earn flows: -$81.4 million

- Cumulative earn flows: $14.67 billion

- Entire ETH holdings ~6.81 million

Provide: Farside Investors

Whereas You Were Sleeping

- Crypto Merchants Steal On $800M Liquidations as Fed’s Caution Sparks ‘Promote-the-Details’ Reversal (CoinDesk): Jerome Powell’s cautious tone after a quarter-point lower precipitated pressured futures closures that hit long traders, knocking bitcoin in the direction of $108,000 earlier than a rebound near $110,000 as positions had been trimmed.

- U.S. and China Agree to One-Yr Trade Truce After Donald Trump-Xi Jinping Talks (Monetary Times): The framework pauses tech and rare-earth curbs, cuts a fentanyl-linked tariff, and freezes shipping levies, with leader visits deliberate as negotiators flip it into a broader agreement.

- Binance Boosted Trump Family’s Crypto Company Before Pardon for Its Billionaire Founder (The Wall Aspect road Journal): Binance allegedly despatched engineers to World Liberty Monetary and pushed for a $2 billion funding to be paid in USD1, boosting the stablecoin earlier than Zhao’s pardon — claims each facet thunder.

- This Bitcoin Market Dynamic Commands Attention as Prices Surge Past $110K Before $13B Choices Expiry (CoinDesk): With $13 billion in alternate choices expiring Friday, vendor hedging is vulnerable to power procuring for on upticks and promoting on dips near key ranges, increasing self-reinforcing swings that can overwhelm fundamentals.

- Central Banks Step Up Gold Purchases Despite Narrative-High Designate (Bloomberg): Purchases rose 28% to 220 tons closing quarter. Put apart a question to turned into once led by Kazakhstan, while Brazil sold for the significant time in over four years, on geopolitics, inflation and buck concerns.