The BRETT token is down 8.13% over the final 24 hours at $0.1594. This detrimental price action has resulted in a terminate to-associated tumble available in the market cap, which now stands at $1.58 billion. In the interim, the cryptocurrency’s 24-hour trading quantity paints a brighter image because it shows an uptick of over 30% toward the $68.49 million threshold. This locations the cryptocurrency’s quantity-to-market cap ratio at 4.32%, implying the token’s price fluctuations are stabilizing at press time.

In spite of the sustaining market volatility, the bearish price outlook has no longer slowed. In correct 24 hours, the cryptocurrency’s market price hit a ground price of $0.1598 from a gap price of $0.1733. Alternatively, on a broader scale, the token has been struggling to uncover better from its 31.89% decline since reaching its all-time high of $0.235 on December 1 this year.

Brett Faces Serious Abet at $0.1540

As of this article, the asset is poised to check a key succor zone at $0.1540 on Brett’s 4-hour chart. If this succor does indeed tackle, the cryptocurrency might perchance maybe also deliver a leap that pushes its price up the opposite side of this succor zone and toward the next resistance procedure at $0.1903.

A breakout above this resistance would, for essentially the most share, be destined for the $0.2341 opposition speak, which is a important degree for additional upward vogue. Alternatively, ought to the succor at $0.1540 be broken, the token’s price might perchance maybe also tumble to backdrops lower, concentrating on the $0.0790 zone severe succor.

Technically, the Relative Strength Index currently reads 40.35, putting the market into neutral territory. Alternatively, if the pricetag slides underneath 30, it ought to switch into an oversold situation. At the identical time, the Excellent Strength Index is bearish at -16.64 and -19.09. Besides, a narrowing of the fascinating averages in the Alligator indicator reveals a probable consolidation available in the market and a change in momentum.

Brett On-Chain Relate Shows Decline in Unusual Addresses but Stable User Engagement

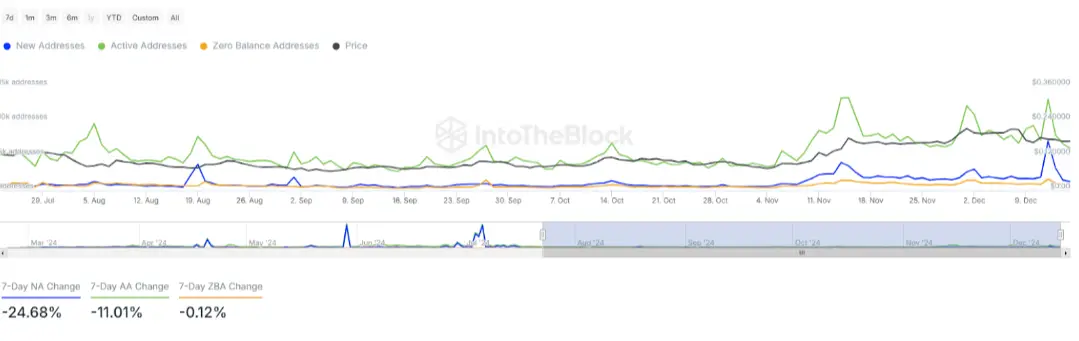

On-chain exercise for Brett is a blended image: current addresses are down 24.69% this past seven days. Alternatively, that hasn’t stopped the proper collection of active addresses, implying ongoing interplay from the present person substandard.

With most effective a 0.12% decline, the gathering of zero balance addresses demonstrates low volatility amongst customers who no longer exercise their wallets. These trends recount that whereas current person adoption wasn’t huge, of us that are persistently in the ecosystem are accumulated around.

Brett’s price volatility fits onchain exercise, with a in point of fact significant uncover greater in address exercise taking place in October 2024, on the time of an infinite price uncover greater. The price had retraced since then but became once accumulated increased than January 2024, exhibiting prolonged-timeframe doable. In spite of slowing down current person enhance, there is a power curiosity with active addresses steadily rising, primarily based mostly mainly on present customers of the quit chains such as BTC, ETH, and BCH.