The MANTRA (OM) tag has currently seen a downtick and retested the $1 mark. It lowered over 26% from its all-time excessive (ATH) mark within the closing two weeks. Ensuing from the broader market selloff, the token confronted earnings booking on the highs.

Undoubtedly, OM token has been one of basically the most intriguing-performing crypto resources in 2024, having risen over 5800% within the closing ten months. This crypto asset recorded its ATH mark of $1.41 On July 22, 2024.

Despite the predominant rebound within the crypto market, Mantra (OM) tag peaceable suffered decrease volume having a seek for for exercise at press time. It hovered all the intention in which by intention of the $1 mark. On the opposite hand, the token has tightly held the cluster and consolidated all the intention in which by intention of the week.

MANTRA (OM) Label Faces Profit Booking

MANTRA has demonstrated resilience within the face of contemporary market turbulence and held the $1 mark, the outdated resistance. Following a retracement of 30%, OM tag correct made the next low formation, and the bulls were eyeing to flip the beneficial properties forward.

When writing, the MANTRA tag traded at $1.03 with an intraday surge of 6.98%, depicting bullish sentiment on the chart. On the opposite hand, the trading volume dropped over 34% to $27.06 Million within the previous 24 hours, conveying decrease investors optimism.

@DaanCrypto, in his tweet, talked about that OM is one of many crypto resources that remained secure amid the appealing volatility available within the market and held the bullish sentiment.

$OM One in all the few coins that changed into ready to maintain on to its bullish market constructing all the intention in which by intention of the recent distress available within the market.

One in all the RWA leaders and one I mediate will continue to enact properly when the market picks assist up.

$0.95 level has been critical as could even be seen. Would be… pic.twitter.com/ptwbANUqrI

— Daan Crypto Trades (@DaanCrypto) August 9, 2024

The Relative Strength Index (RSI) curve dropped to the oversold space and directed a negative divergence. That conveyed a additional tag decline could even be seen forward. Likewise, the CMF indicator represents a negative value of -0.08, reflecting a indispensable promoting stress.

Total Value Locked (TVL) Infamous a Upward push

Amidst the uptrend continuation, its Total Value locked (TVL) showed a indispensable upward push from the initiate of 2024. This crucial spike in TVL highlighted that increased capital locked into DeFi protocols.

That also highlighted an increment in liquidity and better recognition, which could well affect the rate upward push. The OM token had a TVL of $1.86 million with a liquidity of $3.75 Million on the time of writing.

Weighted Sentiment Knowledge Stayed on a Sure Imprint

The Weighted Sentiment info projects the definite sentiment amongst the investors, as the rate spiked above the zero line to the definite space. It implies that investors and traders absorb seemed assured and will likely rating the token tag forward.

Equally, the social dominance info shot up over 22% to 0.234%, revealing that investors absorb started chattering for OM and staring at for the upcoming pullback. OM gained media buzz and properly-known increased exercise and discussions on the media platforms.

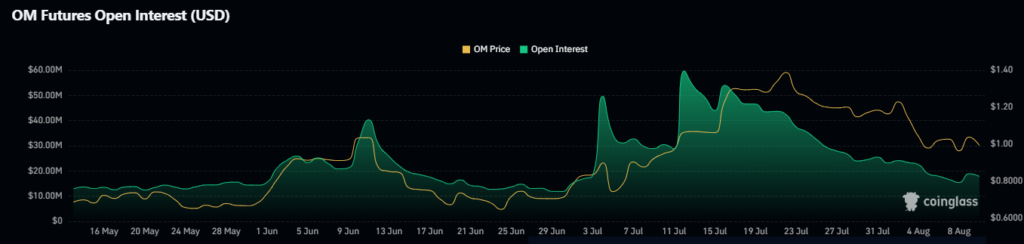

Futures Delivery Hobby (OI) Overview

The Futures Delivery Hobby (OI) info showed a decline of over 3.87% to $16.94 Million within the previous 24 hours. In total, when the rate rises and OI decreases, sellers absorb begun to duvet their positions. Thus, it triggers the rapid overlaying circulate.

If the OM tag accumulates extra beneficial properties, it’ll also merely attain the resistance mark of $1.20, adopted by the $1.40 mark forward.

On the different hand, if the token tag sees any retracement forward, it’ll also merely retest the on the spot make stronger zone of $1, adopted by the $0.87 mark within the rapid time duration.