Maker (MKR) is the 47th most standard crypto, with a dominance of 0.08% in the crypto world. Only in the near previous, Maker value witnessed a dip. Its market cap by 6.75% in the final 24 hours, is now valued at $1.77 Billion.

The put of dwelling volume influx had these days improved by more than 220%, amounting to $172.711 Million. It signified the rising request for Maker, its liquidity has improved to 9.94% in the previous 24 hours, showcasing an correct liquid contemporary.

Maker (MKR) Designate: On-chain Recordsdata Overview

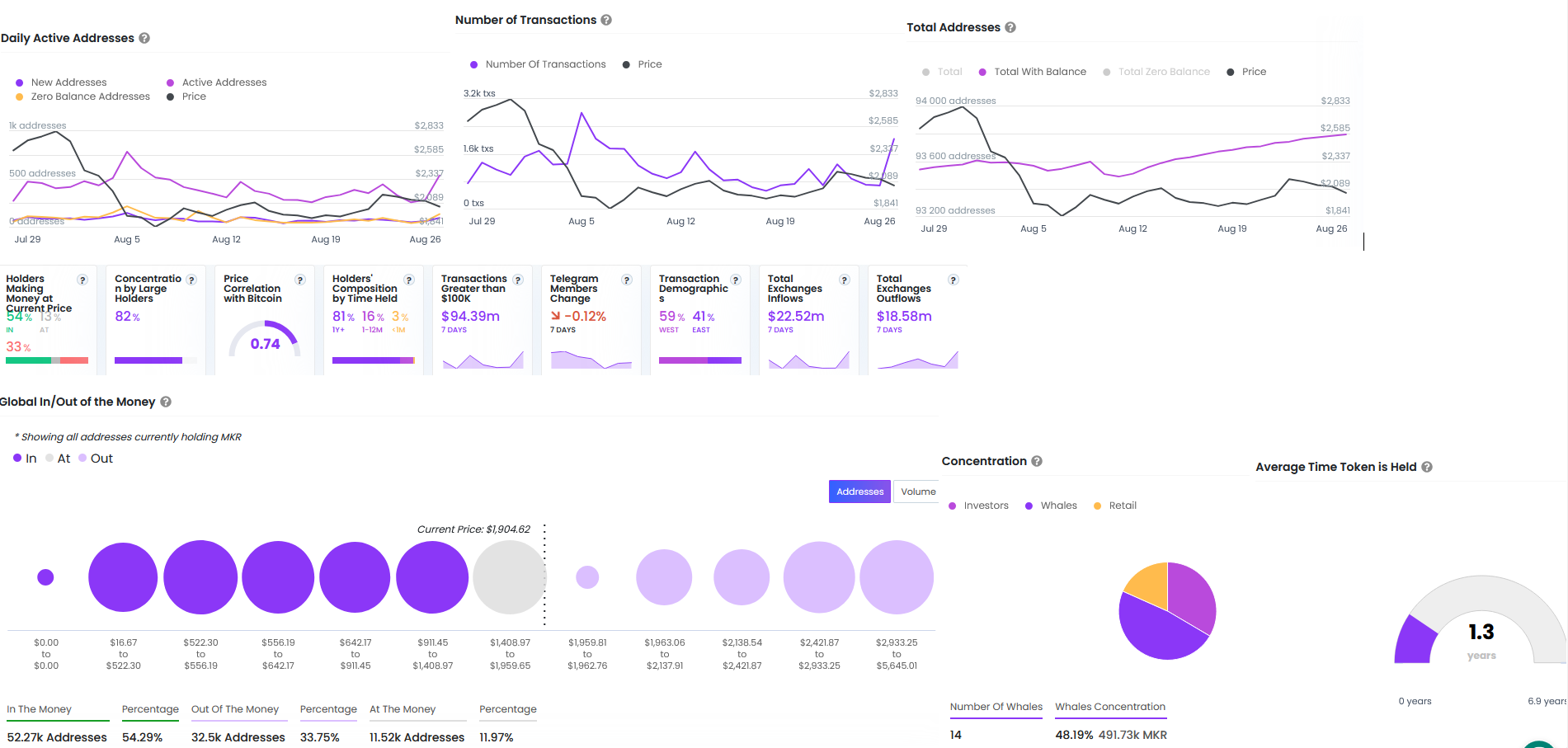

The day by day crammed with life addresses had been 536, which has witnessed enhance from 283 addresses in just a few days. On-chain info exhibits that 54.41% of the crypto holders are in income, which is 52.39K addresses. 34.85% or 33.56K addresses incurred losses, while 10.34K addresses are sitting on the cash, which manner no loss or income snort.

Equally, the need of transactions has increased and reached 2.03K transactions, which used to be 675 just a few days previously. Also, the practical time for which MKR used to be held sooner than switch used to be 1.3 years sooner than it moved out of the wallets of addresses.

At press time, the concentration by colossal holders stands at 82%, whereby Whales retain forty eight.19% of the floating provide, and investors retain 33.forty eight%.

Meanwhile, total outflows in exchanges surged to $18.58 Million final week, but inflows had been increased at $22.52 Million. This overpowered Maker value on account of a valuable distinction in the need of sell-offs and accusations, ensuing in a value dip in the previous couple of days.

What Does Derivatives Recordsdata Prognosis Spotlight for Maker?

The derivatives info at a gaze exhibited explosive enhance of 91.29% in the derivatives volume, which amounted to $239.66 Million. This resulted in a surge of request for property in the derivatives market. Meanwhile, contemporary behavior this week in value has led MKR to heavy prolonged liquidations at 621.87K, while shorts had been $11.90K. This confirmed have dominance in the MKR asset.

The property OI increased by a modest 1.3% in the final 24 hours of activity on the time of writing. This used to be valued at $100.forty five Million.

Maker (MKR) Technical Chart Recordsdata?

On a day by day timeframe, it witnessed that the height of $4075 used to be constructed after the bull speed in the first quarter of 2024. Thereon, the value had fallen true into a wedge and has followed this downward channel for when it comes to the subsequent two quarters of 2024.

If the downtrend persists, the channel might perchance prolong more by the tip of the third quarter of 2024. Nonetheless, to accelerate up the autumn, the bears enjoy to overpower the $1850 stage, which has proved sturdies in the prolonged speed.

Overall, the indicators depict bearishness: 20-day, 50-day, and 200-day EMA are bearish; MACD used to be also in the bearish territory, and RSI used to be flashed at 39.02.

Therefore, the resistance phases are at $2091, and $2493, respectively. Nonetheless, in case of additional tumble, the supports might perchance be contemporary at $1775, and $1567, respectively.