Lately, CCData launched the latest version (March 2024) of its Exchange Overview analysis represent.

CCData is a trusted offer for complete knowledge and analytics tailored to the ever-evolving cryptocurrency market. They transcend straightforward knowledge assortment, meticulously organizing and analyzing vast datasets to liberate precious insights for institutions and folks navigating this build. CCData affords accurate-time market tracking, legit pricing knowledge, in-depth derivatives knowledge, and conscientiously constructed indices for urged option-making. Their FCA authorization highlights their commitment to accuracy and regulatory compliance.

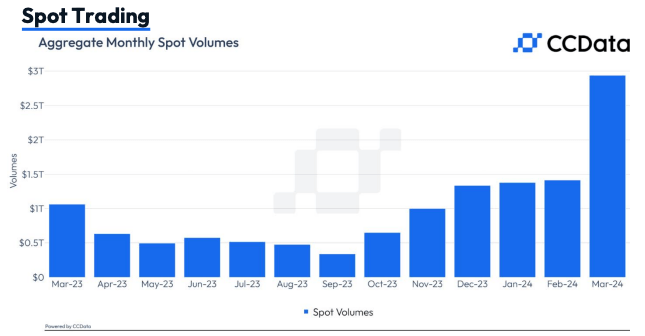

CCData’s Exchange Overview analysis represent delves into the intricate world of cryptocurrency exchanges, dissecting key metrics love trading volumes all over space and derivatives markets, the interaction between fiat and stablecoin pairs, and the aggressive landscape. The represent sheds gentle on the evolution of trade charge structures and provides a>

Derivatives trading volumes additionally reached new all-time highs, rising by 86.5% to $6.18 trillion. Despite this surge, derivatives’ market dominance persevered its sixth consecutive month of decline, shedding to 67.8%—the bottom market piece since December 2022.

CCData’s represent highlights that the surge in trading activity coincided with the anticipation surrounding the Bitcoin halving tournament, as the flagship cryptocurrency surpassed its outdated all-time excessive in March. This tournament has historically been associated to elevated market enthusiasm and charge speculation.

Binance, the realm’s most attention-grabbing cryptocurrency trade, skilled a large uptick in trading activity, with its space trading quantity rising by 121% to $1.12 trillion in March – the most attention-grabbing space volumes on the trade since Also can honest 2021, as per CCData’s findings. Equally, derivatives trading volumes on Binance rose by 89.7% to $2.91 trillion, additionally reaching their absolute top ranges since Also can honest 2021. CCData attributes this surge to investors and merchants speculating on the worth streak following Bitcoin’s draw against a brand new all-time excessive in March. In consequence, Binance’s blended market piece elevated by 1.04% to 44.1% in March.

CCData’s represent additionally sheds gentle on the impressive enhance of Bitget, one other outstanding cryptocurrency trade. Bitget witnessed a enormous enhance in trading activity, with space and derivatives volumes rising by 150% to $90.5 billion and 129% to $794 billion, respectively. As a consequence, Bitget became the third-most attention-grabbing derivatives venue by quantity for the precious time since December 2022, overtaking Bybit with a market piece of 12.8% in March. The trade’s blended space and derivatives market piece rose by 1.61% to 9.70% in March, securing its narrate as the fourth-most attention-grabbing trade unhurried Binance, OKX, and Bybit.

The Chicago Mercantile Exchange (CME), a ancient monetary institution that provides cryptocurrency derivatives, additionally achieved new milestones in March. CCData reports that the derivatives trading quantity on the CME trade rose by 60.6% to $155 billion, marking a brand new all-time excessive for the platform. This enhance became once essentially driven by the BTC futures, which observed a 65.4% enhance to $123 billion in monthly quantity. Meanwhile, the ETH futures quantity traded on the trade rose by 17.8% to $20.1 billion, recording the most attention-grabbing figures for the instrument since November 2021.

CCData’s prognosis emphasizes the persevered impact of CME on Bitcoin’s ticket streak, with the birth hobby on BTC instruments rising by 47.1% to $11.7 billion in March. Particularly, the birth hobby on CME’s BTC instruments surpassed that of centralised trade counterparts, such as Binance, which reported an birth hobby of $8.fifty three billion for its BTC instruments.