November has been rough for a kind of of the market, and even several ‘made in USA’ cash appreciate slipped vastly. The broader sort has been extinct, with few property maintaining their phases while merchants anticipate a clearer direction.

Nonetheless as the market tries to stabilise, three of those US-essentially based mostly cash are exhibiting early signs that they’ll also rebound. One has a rare adverse correlation with Bitcoin. One other is forming a dapper reversal constructing. And the third coin has drawn sudden whale activity. These factors accomplish them worth looking at this week.

Litecoin (LTC)

One of many predominant made in USA cash to see this week is Litecoin (LTC). It has climbed barely over 8% in the previous 30 days and about 7% in the previous 24 hours, exhibiting sudden resilience in the midst of a rough November.

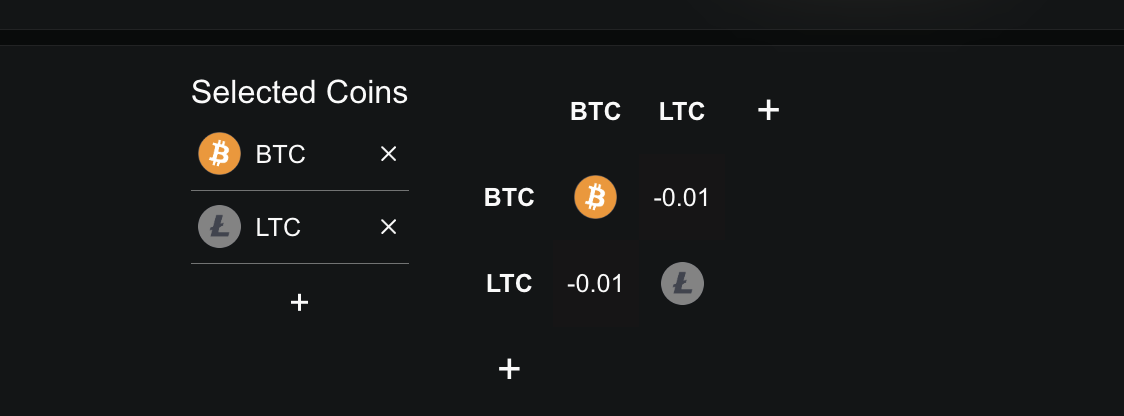

A mountainous cause in the serve of this energy is its adverse correlation with Bitcoin. The Pearson correlation coefficient between LTC and BTC sits at –0.01 over the previous month.

The Pearson coefficient measures how two property scramble relative to every other; a adverse studying scheme they scramble in a quantity of instructions.

Need more token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter here.

Since Bitcoin has dropped better than 13.5% in the identical interval, Litecoin’s lack of correlation has in actual fact helped it protect better than most top cash.

Nonetheless correlation is no longer the most effective component here. The chart is furthermore forming a dapper inverse head and shoulders sample, with the note now hovering near $102.

If LTC manages a day-to-day end above $119, it will entire the sample and beginning the door to a scramble toward $135 or better if broader prerequisites toughen. This resistance diploma has capped upside attempts earlier than, so a break would signal right momentum.

The Natty Money Index, which tracks how educated or early-transferring merchants plight themselves, has furthermore begun turning up since November 13.

That shift displays some early self assurance returning as LTC pushes toward the sample’s neckline. The combination of a curling Natty Money Index and worth pressing staunch into a breakout zone makes this week especially major for this setup.

If investors fail to raise Litecoin above resistance, the predominant key toughen sits at $93. A tumble under that diploma weakens the reversal constructing, and falling under $79 would invalidate the sample fully.

Solana (SOL)

Amongst the ‘made in USA’ cash gaining attention this week, Solana (SOL) stands out for a a quantity of cause. It has had a rough month, shedding almost 27% over the previous 30 days. Even so, the chart is starting to existing hints of a imaginable non permanent reversal that merchants can’t ignore.

The signal comes from the Relative Energy Index (RSI), which measures note momentum to existing when an asset will be overbought or oversold.

Between November 4 and November 14, Solana’s note formed a lower low, while RSI formed the next low. This formation is identified as a bullish RSI divergence, and it on the total appears exact earlier than a sort attempts to flip, despite the indisputable truth that the reversal is transient.

If this divergence plays out, Solana’s instantaneous test is $162. It is miles a staunch resistance diploma that has held since November 5 (breaking once in between).

Breaking above $162 would beginning the door toward $170. And if momentum strengthens, the note can even push as excessive as $205 in the short term.

Nonetheless the setup perfect holds if investors protect $135. A tumble under that toughen would weaken the enchancment and describe $126.

Chainlink (LINK)

The last choose on this week’s checklist is Chainlink (LINK), which has had a tricky month of its have. It has declined by better than 20% over the previous 30 days and has logged a further 10%+ tumble in the midst of the previous week.

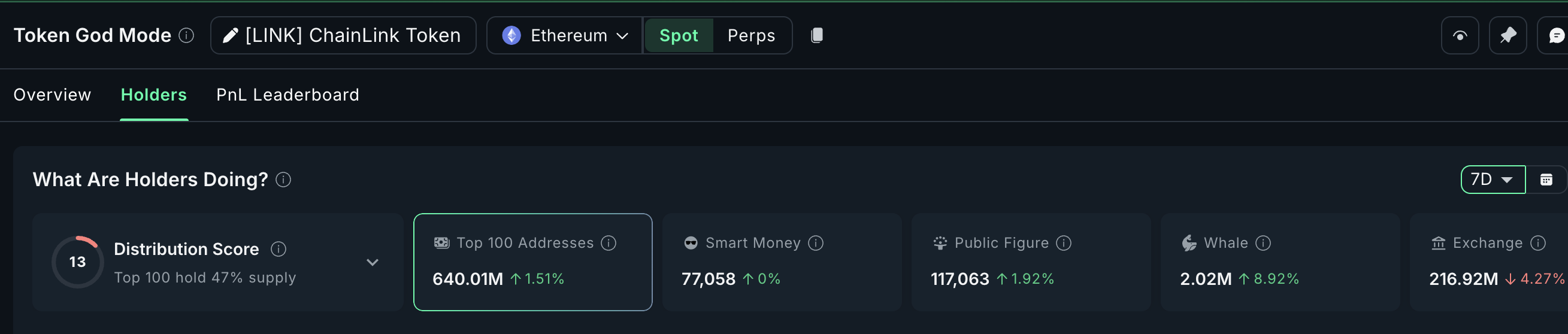

Even so, one thing abnormal has seemed in its holder activity, making LINK a key token to see this week as the market attempts to stabilise.

No topic the decline, whale accumulation has surged in the final seven days. Odd whale holdings appreciate jumped 8.92%, while the tip 100 addresses—bigger “mega whales”—appreciate elevated their combined stash by 1.51%.

When whales buy into weakness as a replacement of exiting, it on the total hints at early positioning for a doubtless reversal.

The chart explains why they are going to be stepping in. Between October 10 and November 14, LINK’s note made a lower low, while its RSI formed the next low. This created a delicate bullish divergence. That is the identical momentum shift viewed in Solana, and it on the total appears near the early phases of sort reversals.

For the setup to instructed, LINK desires to reclaim $16.10, which requires roughly a 17% scramble from unusual phases. Clearing $16.10 opens the direction toward $17.57.

If a day-to-day end kinds above that zone, LINK can even stretch toward $21.64 or better if broader market prerequisites toughen.

If investors fail to take hold of care of toughen, the predominant diploma to see is $13.72. A day-to-day candle end under it will break the unusual constructing and dash invalidate the bullish reversal signal. The reversal, then, would appreciate to wait longer.

The submit 3 Made In USA Money to Gawk in the Third Week of November seemed first on BeInCrypto.