The crypto market continues to show volatility as June approaches, with plenty of ‘made in USA cash’ posting fundamental features. One standout is Sei, which is currently rising due to the its choice as the blockchain candidate for WYST, a USD-backed stablecoin.

BeInCrypto has analyzed two other Made-in-USA crypto tokens that are making waves this week.

Sei (SEI)

SEI has emerged as one of the head-performing Made in USA cash, surging by 15% over the last 24 hours. Buying and selling at $0.208, the altcoin is currently above the fundamental pork up level of $0.197. The most up-to-date upward stream signals rising investor self assurance within the cryptocurrency.

The most up-to-date announcement of the Wyoming Stable Token Commission deciding on Sei as the blockchain for the WYST USD-backed stablecoin has driven the altcoin’s upward thrust.

The RSI has also climbed above the neutral designate, signaling a shift into the bullish zone. This technical indicator suggests persevered momentum for SEI within the terminate to term.

Given the present momentum, SEI is at risk of continue its enhance towards the resistance at $0.225 within the approaching days. Nevertheless, if the altcoin loses momentum and falls thru the $0.197 pork up, it can maybe well well furthermore tumble to $0.183. This kind of shuffle would invalidate the present bullish outlook for SEI.

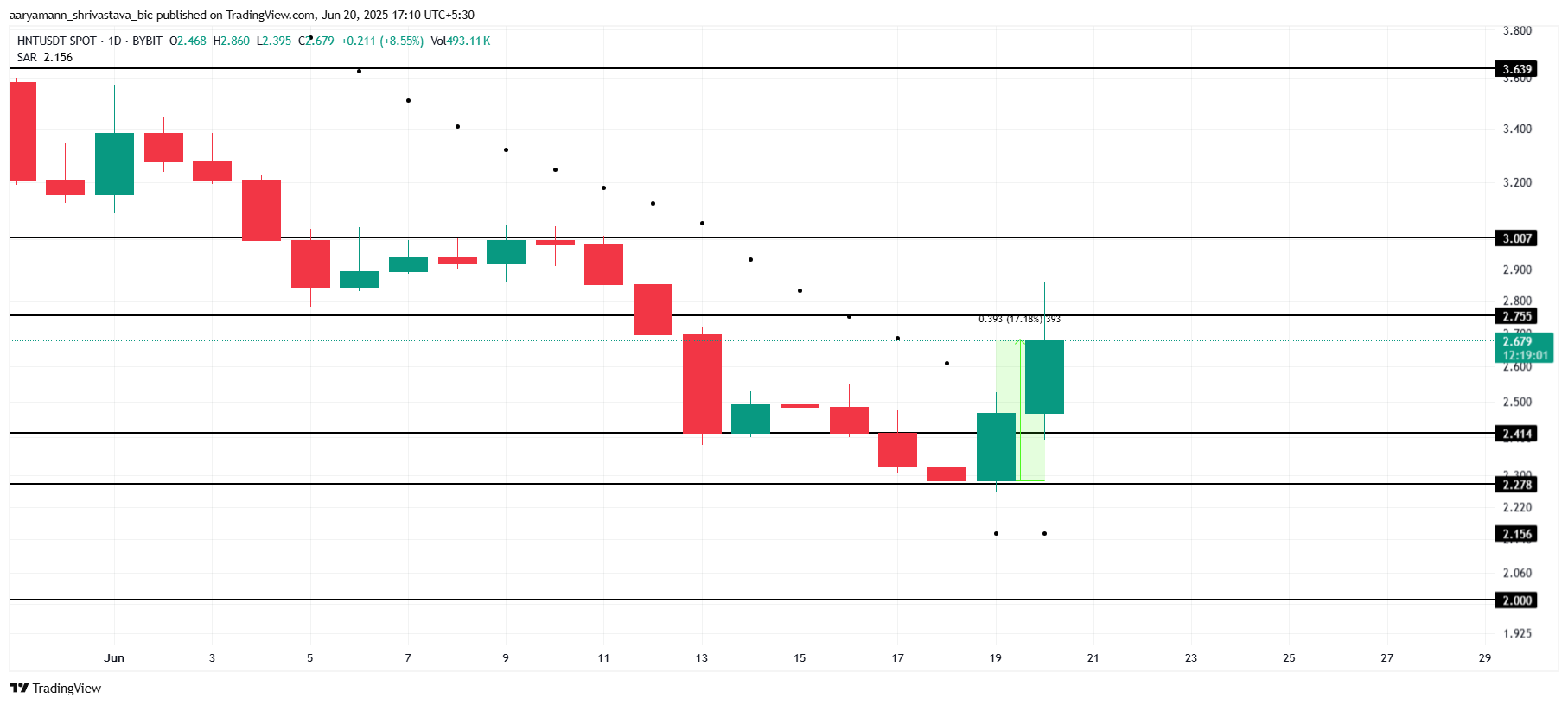

Helium (HNT)

HNT has shifted from bearish to bullish for the first time since the initiating of the month. The altcoin is up by 17%, currently trading at $2.67. This marks a fundamental alternate in momentum, with HNT taking a look to continue its sure label stream within the terminate to future.

The Parabolic SAR is now positioned below the candlesticks, signaling a solid uptrend for HNT. This shift ends a month-and-a-half of run of downtrend, suggesting that the altcoin would possibly maybe maybe well well furthermore rupture thru $2.75 and reach the $3.00 designate.

Nevertheless, if HNT fails to breach the $2.75 resistance, it can maybe well well furthermore abilities a decline. A fall to $2.41 would imply weakening momentum, and a rupture below $2.27 would invalidate the present bullish outlook. This scenario would possibly maybe maybe well well furthermore end result in further losses for HNT holders.

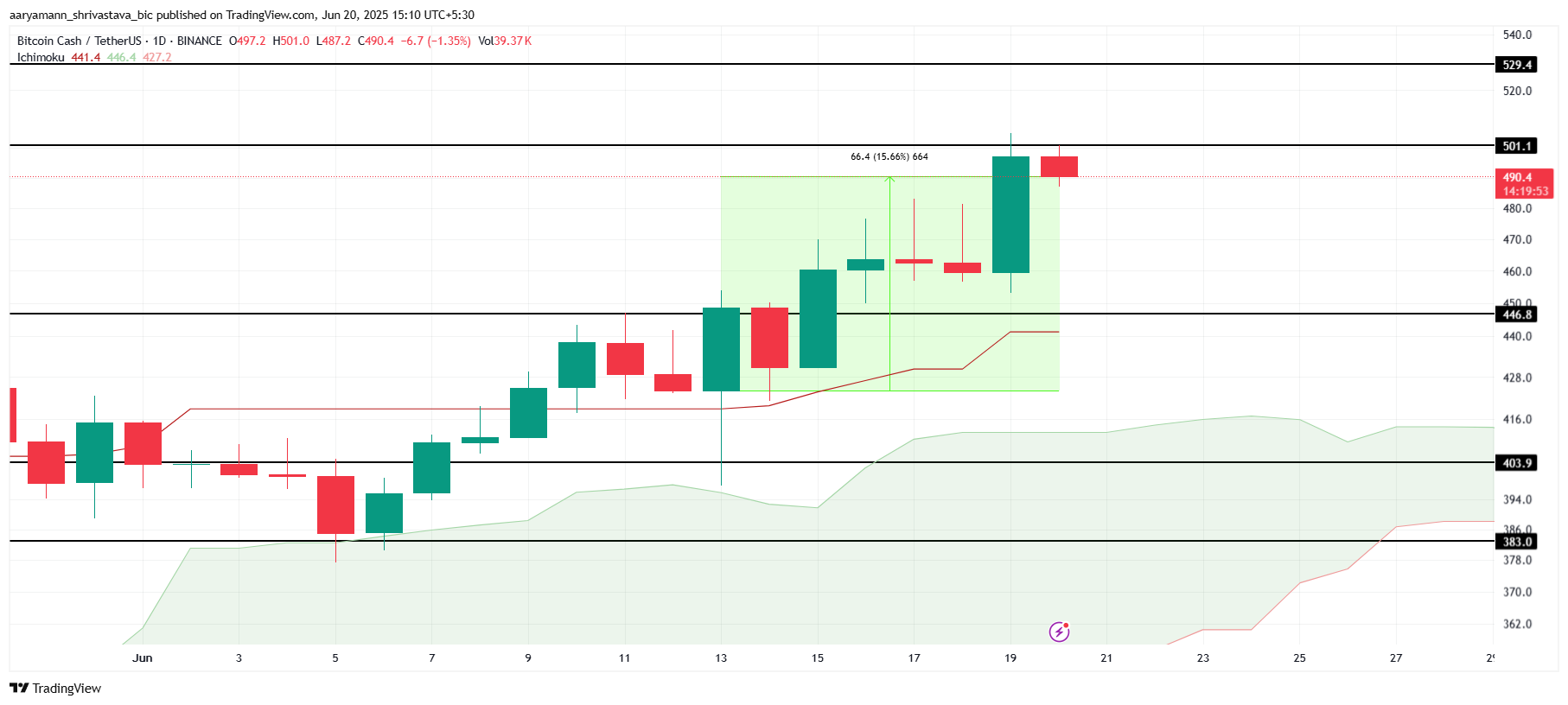

Bitcoin Cash (BCH)

BCH is currently priced at $490, having risen by 15.6% over the past week. The altcoin has benefited from Bitcoin’s rally, bringing it nearer to the $500 designate. Investors are closely staring at this level as BCH continues to show resilience following Bitcoin’s most up-to-date performance.

The principle resistance level for BCH is $501, a label it hasn’t surpassed since December 2024. The Ichimoku Cloud is indicating solid bullish momentum, suggesting BCH would possibly maybe maybe well well furthermore rupture this resistance.

If it does, the price would possibly maybe maybe well well furthermore upward thrust further, potentially reaching $529 and beyond, with extra upside seemingly.

Nevertheless, if market sentiment turns negative and promoting rigidity intensifies, BCH would possibly maybe maybe well well wrestle to surpass $501. In this case, the price would possibly maybe maybe well well furthermore retreat to $446, invalidating the present bullish outlook.

A loss of momentum would possibly maybe maybe well well furthermore lead to a label reversal within the short term.