In 2025, there has been a pointy expand in companies the usage of Bitcoin as a reserve asset, which has resulted in the upward thrust of Bitcoin-linked stocks and bonds. Fund supervisor Lyn Alden pointed out two main reasons in the back of this pattern.

These reasons replicate institutional demand and highlight the strategic advantages companies score from leveraging Bitcoin.

Motive 1: A Substitute for Investment-Restricted Funds

One key motive Lyn Alden mentioned is the limitation many funding funds face. Several funds are fully allowed to make investments in stocks or bonds and are prohibited from straight searching for Bitcoin or cryptocurrency-linked ETFs.

Which capacity, this creates a foremost barrier for fund managers who favor exposure to Bitcoin—especially these that take into consideration in its exact development likely. To circumvent this restriction, stocks of Bitcoin-preserving companies cherish Technique (formerly MicroStrategy) (MSTR) absorb became a first charge replace.

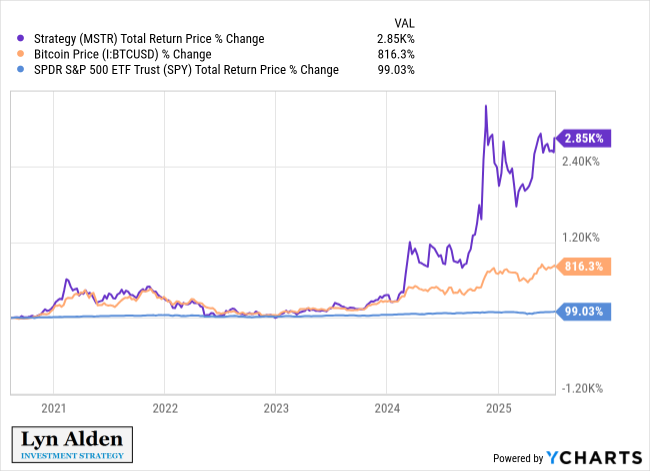

A chart equipped by Lyn Alden exhibits MSTR’s total ticket return from 2021 to mid-2025 at 2,850%. Bitcoin (BTC/USD) rose 816.3% all around the identical length, whereas SPY elevated by fully ninety nine.03%. This suggests that MSTR outperformed the broader fairness market and served as an oblique capacity for funds to construct Bitcoin exposure.

“In short, there are many funds, on account of mandates, that will likely well fully own stocks or bonds with bitcoin exposure; now not ETFs or the same securities. Bitcoin treasury companies give them score admission to,” Lyn Alden defined.

She also shared her inner most trip managing her mannequin portfolio. In 2020, she selected MSTR on legend of her exchange platform didn’t toughen explain Bitcoin or GBTC purchases. This adaptability enabled funds with approach restrictions to construct Bitcoin exposure with out violating rules.

Motive 2: The Advantage of Long-Length of time Bonds and Safer Leverage

Lyn Alden emphasized the 2d motive: companies’ capacity to express lengthy-term bonds. This helps them relieve away from the margin name likelihood that hedge funds in overall face.

Hedge funds veritably use margin borrowing, which will trigger forced asset sales when Bitcoin prices descend sharply.

In incompatibility, companies cherish Technique can express multi-365 days bonds. This allows them to relieve their Bitcoin positions even all over unstable market instances.

This suggests creates a safer score of leverage. It helps companies extra effectively capitalize on Bitcoin’s ticket swings than leveraged ETFs.

Lyn Alden pointed out that lengthy-term bonds offer elevated resilience against volatility than margin loans. Companies are now not forced to liquidate all over transient downturns.

“This score of longer-length corporate leverage is also in overall better in the future than leveraged ETFs. Since leveraged ETFs don’t use lengthy-term debt, their leverage resets each day, and so volatility is in overall pretty substandard for them,” she added.

Patrons Are More and additional Enthusiastic in DATs

Lyn Alden’s insights make clear the increasing investor hobby in the stocks of companies embracing strategic crypto reserves.

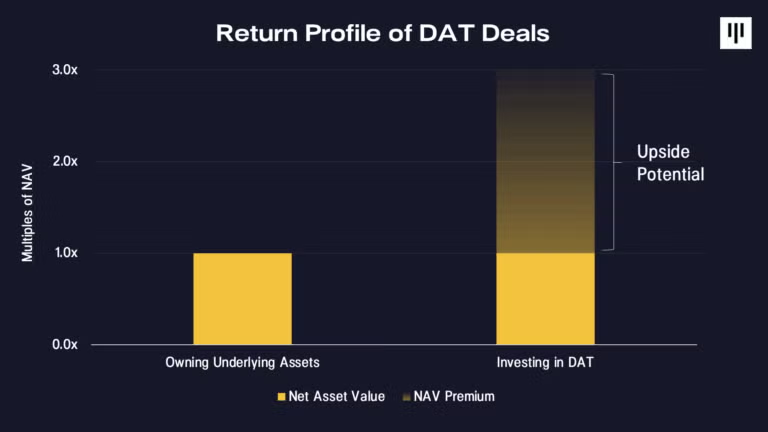

A present anecdote from Pantera Capital highlighted that Digital Asset Treasury stocks (DATs) bridge aged finance and digital sources. They allow merchants to construct exposure via familiar devices.

Pantera also believes investing in DATs may perhaps likely perhaps generate higher returns than the underlying digital sources.

“The sport has changed after Coinbase will get integrated in S&P500. Every tradfi PM is hungry and forced to add some digital sources. It’s DAT season, now not alts season… The pattern is tranquil in the early stage,” investor Nachi commented.

Additionally, a present BeInCrypto anecdote exhibits that all over this altcoin winter, the stocks of crypto-focused companies cherish Coinbase, Circle, and Robinhood are outperforming main tokens.

On the replace hand, this shift in investor level of curiosity in opposition to exterior profit alternatives may perhaps likely perhaps also trigger the crypto exchange to lose its development momentum.