Greed, FOMO, and an total bullish sentiment dominate the cryptocurrency market, following Bitcoin’s (BTC) flee to above $70,000. This landscape encourages traders to initiating lengthy positions, which can also lead to a lengthy squeeze.

On that convey, a lengthy squeeze is the replacement of a short squeeze, going down when lengthy positions are liquidated in collection. When traders initiating longs, they invent liquidity swimming pools to the scheme back that can turn out to be targets for whales and market makers.

If the price crashes, reaching these liquidity swimming pools, these positions are pressured to end through liquidation, promoting the underlying asset. For this cause, beautiful investors on the total argue that we can maintain to change in opposition to the current dominating sentiment.

On February 13, Finbold become to CoinGlass records, which presentations that most cryptocurrencies maintain a lengthy-squeeze skill in the short period of time.

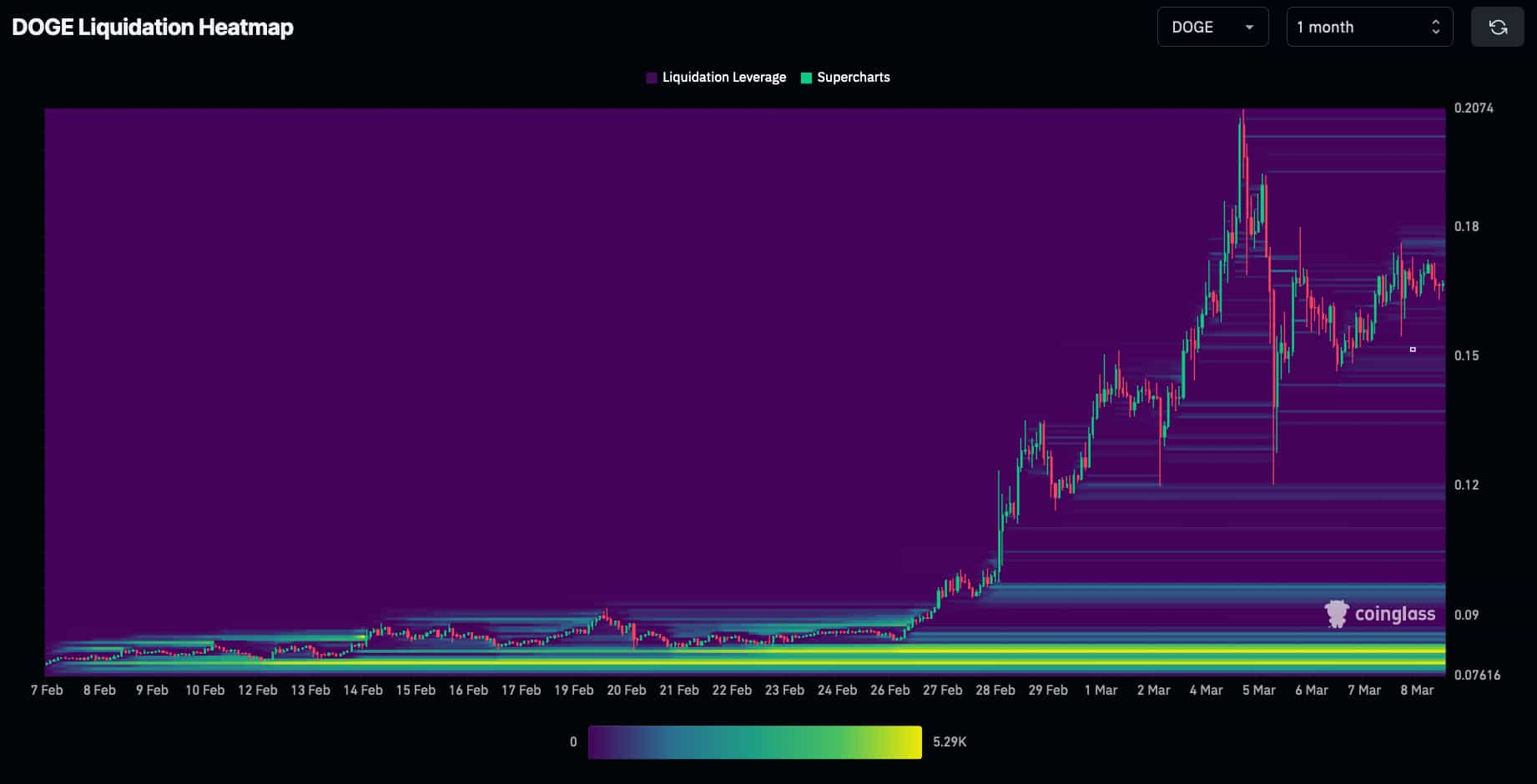

Dogecoin (DOGE)

First, Dogecoin (DOGE) just recently had the spotlights main a meme coin euphoria that dominated the market. DOGE surged 75% from March 1 to a local high of $0.206 on March 5.

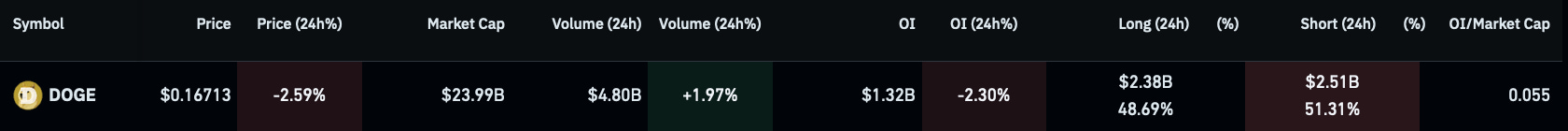

On the time of newsletter, Dogecoin was once shopping and selling at $0.167, shedding 2.6% in the final 24 hours. Despite a momentary elevate in brief positions, DOGE restful holds a majority of longs among its $1.32 billion of Start Ardour (OI).

This mentioned negate is seen on the month-to-month liquidation heatmap, with massive liquidity swimming pools to the scheme back. Due to the this truth, DOGE would possibly possibly well suffer a lengthy squeeze at any 2d if the price starts reaching the smaller liquidity swimming pools.

Such an tournament would procure its fracture top in the $0.08 to $0.076 set up differ for over 50% losses.

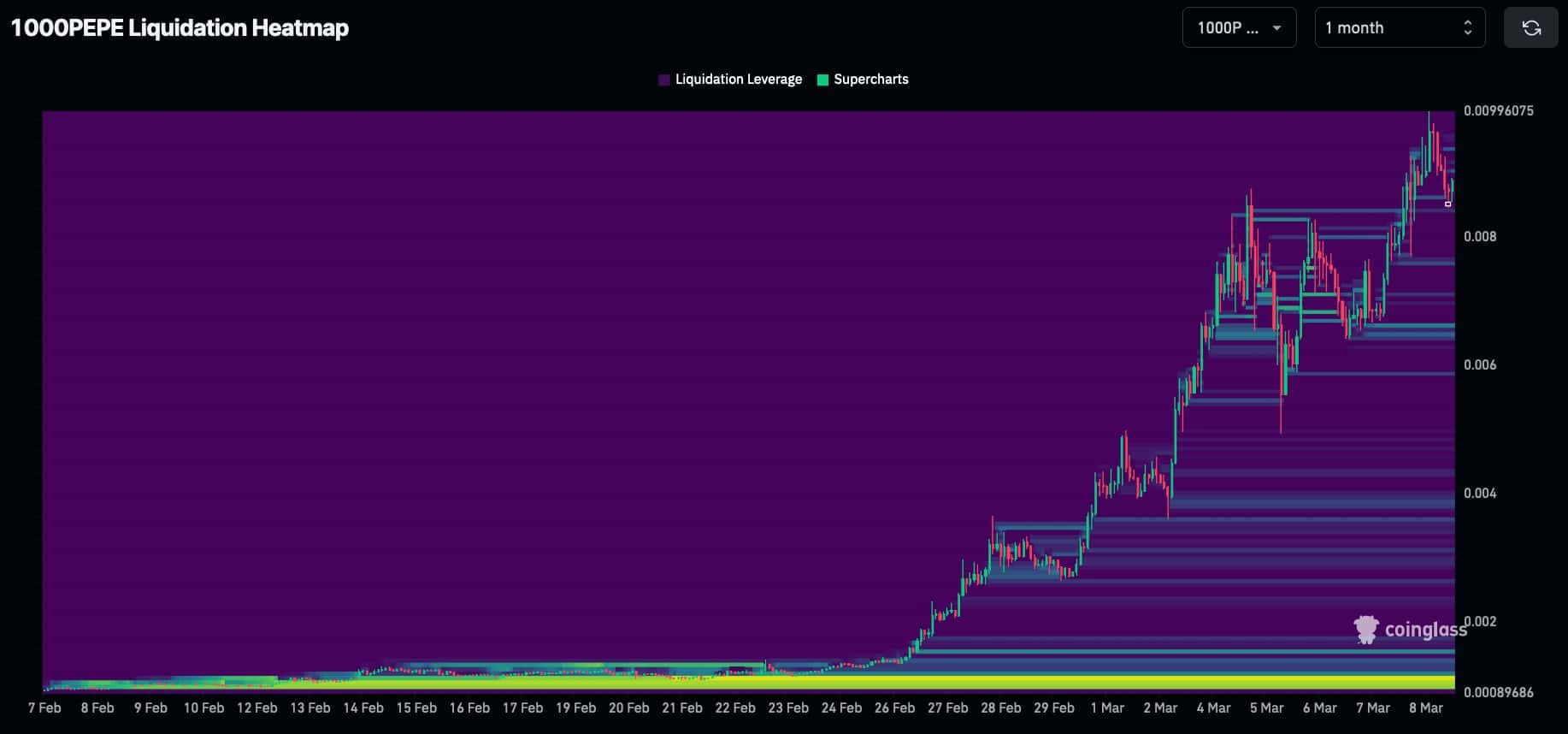

Pepe (PEPE)

2nd, Pepe (PEPE) would possibly possibly well suffer from a same nonetheless worse destiny as Dogecoin. As of late, PEPE shy the market with reach-inspire, performing as the week’s top gainer.

Equally to DOGE, this movement left mammoth liquidity swimming pools in the inspire of, which market makers can now exploit through a lengthy squeeze. Notably, the very finest liquidations would originate at $0.0000011, an 87.5% fracture from $0.0000088 by press time.

On the replacement hand, the crypto landscape is unpredictable and extremely volatile, this capacity that this scenario can change anytime. Sure news and trends would possibly possibly well maintain these projects stable subsequent week, fueling elevated costs rather than decrease ones. Merchants must change cautiously and keep away from over-exposure in any direction.

Disclaimer: The whisper on this set up can maintain to never be thought to be investment advice. Investing is speculative. When investing, your capital is at risk.