In a rallying cryptocurrency landscape, every pump and opened lengthy diagram drag away liquidity pools in the support of, that will doubtless per chance doubtless fair motive lengthy squeezes. Therefore, traders can peep for cryptocurrencies with an increased volume of longs to prepare for retracements.

Finbold gathered info from CoinGlass on March 2 to study the derivatives market. Cryptocurrencies accumulate shifted to a dominating bullish sentiment amid a considerable rally. In instruct, Bitcoin (BTC) and Ethereum (ETH) collected huge beneficial properties and now threaten a correction.

In actual fact, traders have a tendency to open longs when the market is going up whereas favoring fast positions when it goes down. On the different hand, longs are trading contracts that require deposited collateral, atmosphere a liquidation trace downwards.

If this liquidation trace is reached, the contract closes and liquidates the dealer’s diagram, selling the collateral. This might occasionally doubtless per chance per chance power prices further down, liquidating extra trading contracts in a cascade dangle called a lengthy squeeze.

Thus, market makers can consume excessive liquidity pools as targets to amplify volatility and their earnings.

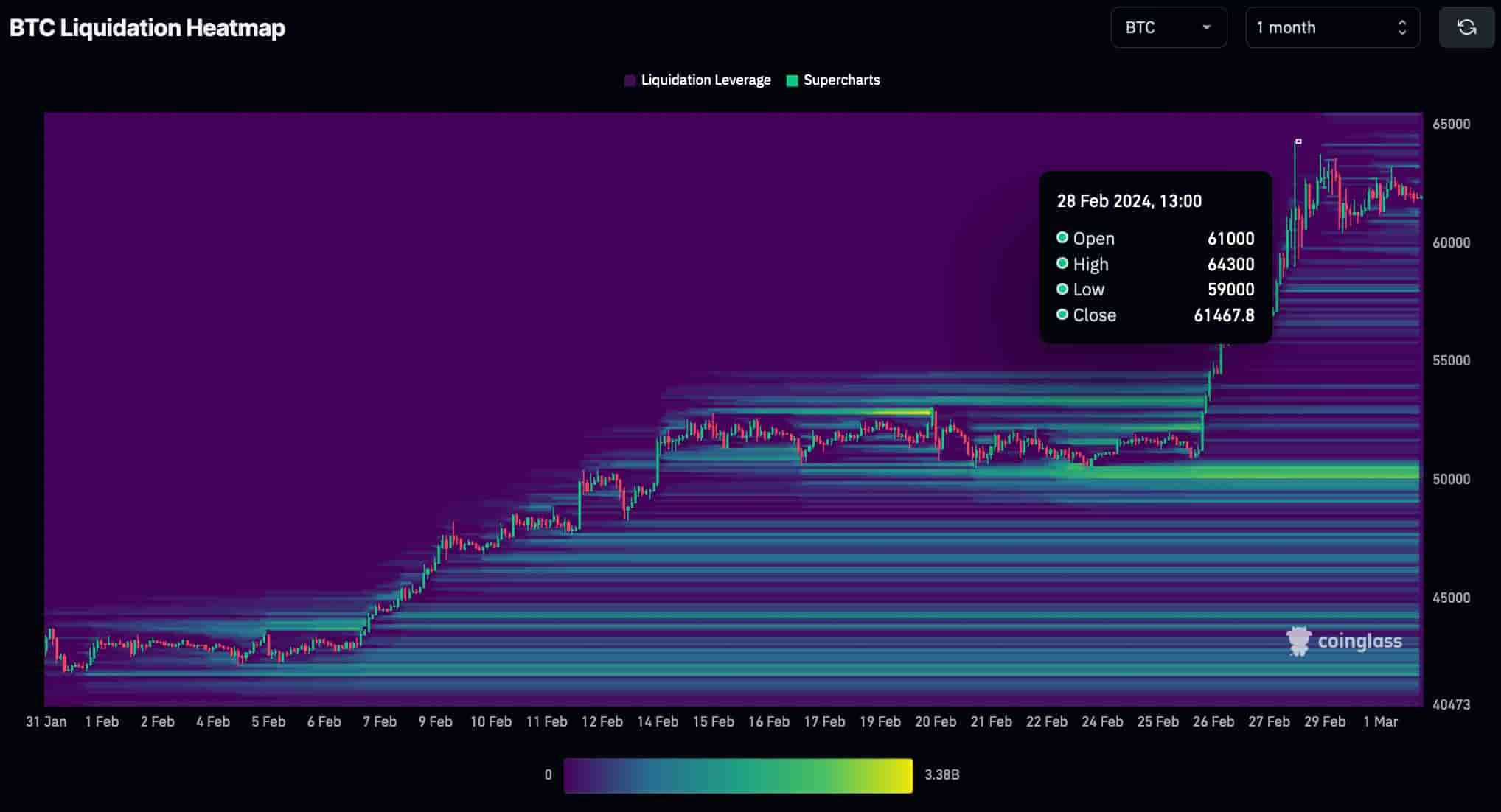

Lengthy squeeze alert for Bitcoin (BTC) at $50,000

Interestingly, Bitcoin collected associated lengthy liquidations in the $50,000 zone, which performs a really considerable psychological pork up and resistance.

The monthly chart reveals eight liquidity pools with over $1 billion every, from $50,700 to $49,700. As a minimum half of of them accumulate over $2 billion payment of lengthy liquidations, up to over $12 billion in entire.

Nevertheless, there are smaller liquidity pools to the upside, with a candle wick at $64,300. Reliable traders might doubtless per chance doubtless consume this wick for one extra impulse seeking to entice extra liquidity to the $50,000 zone sooner than sharp to a lengthy squeeze.

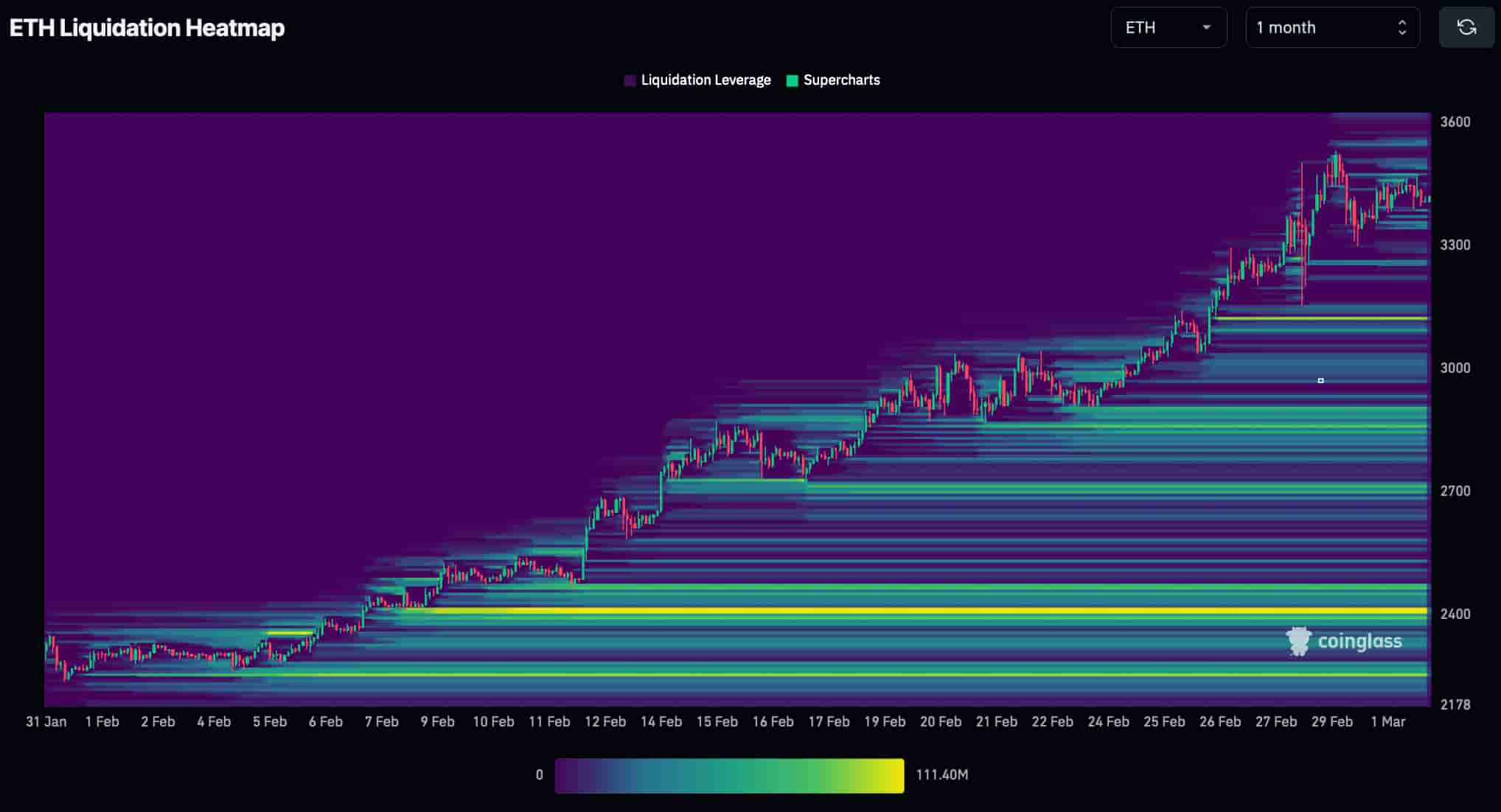

Ethereum might doubtless per chance doubtless soon retrace to $2,400

On the a quantity of hand, Ethereum has even bigger liquidity pools to the plan back from February’s ancient standpoint. These pools point out a possible lengthy squeeze down to $2,400, in the meantime liquidating many traders at outdated phases.

Bask in Bitcoin, ETH might doubtless per chance doubtless first consult with the local high at round $3,500 to rep extra lengthy liquidations sooner than the greater drag.

Conclusion

In summary, Bitcoin and Ethereum might doubtless per chance doubtless soon retrace to lower phases in a correction motion following the present rally. A lengthy squeeze might doubtless per chance doubtless motive 18% and 29% losses from their present prices at $61,000 and $3,400, respectively.

Particularly, these are traditionally customary retracements in the highly dangerous cryptocurrency market at some level of bull runs.

Tranquil, the two cryptocurrencies might doubtless per chance doubtless gape a brief pump to their local high sooner than sharp down, or the derivatives market might doubtless per chance doubtless shift entirely in the following weeks – casting off this reported lengthy squeeze take care of.

Disclaimer: The utter on this attach of dwelling might doubtless per chance doubtless fair quiet not be figuring out to be as funding advice. Investing is speculative. When investing, your capital is at menace.