- A long Solana, immediate Litecoin purchasing and selling strategy also will most certainly be heavenly if altcoin ETFs develop SEC approval.

- Grayscale’s SOL belief represents 0.1% of Solana’s circulating present and has in no plot traded below its discover asset rate.

- The agency’s LTC belief contains 2.65% of Litecoin’s circulating present and has in general traded at steep reductions to its underlying resources.

Solana (SOL) has decrease possibilities of being plagued by the doable present stress from Grayscale’s impact in contrast to Litecoin (LTC) if the Securities and Commerce Rate (SEC) approves altcoin alternate-traded funds (ETFs).

Solana and Litecoin ETFs gasoline deliberation forward of SEC resolution

Solana and Litecoin could scrutinize diverging investor sentiment if the SEC approves altcoin ETFs, eminent Vetle Lunde, Head of Be taught at K33, in a Tuesday list.

Lunde eminent that a “long SOL, immediate LTC” change also will most certainly be heavenly if altcoin ETFs are launched, citing the variations in the purchasing and selling histories of Grayscale’s Solana and Litecoin trusts.

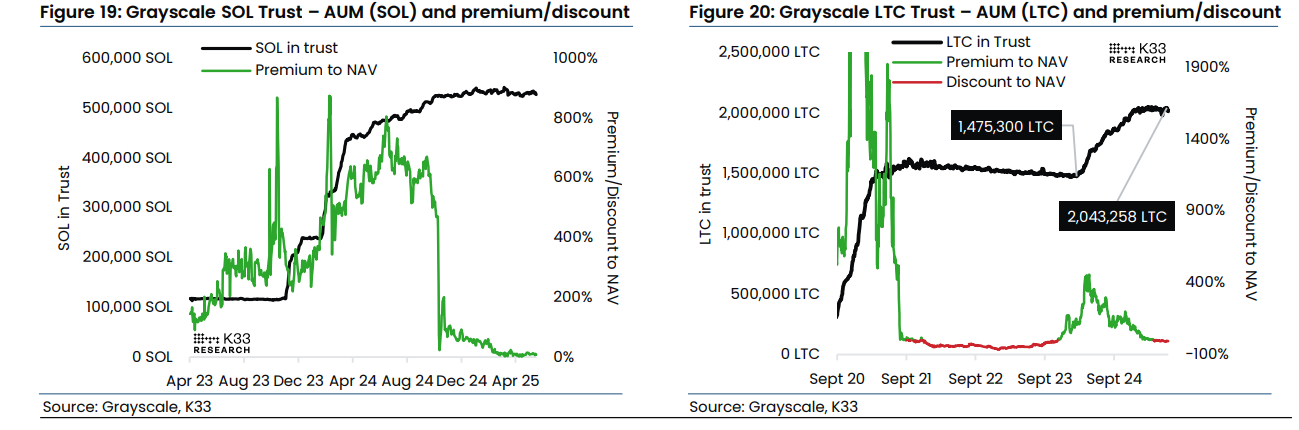

The agency’s Solana belief, which began purchasing and selling in 2023, represents fully 0.1% of the circulating SOL present and has in no plot traded below its discover asset rate (NAV). K33 eminent that this eliminates the threat of excess present hitting the market if Grayscale’s SOL belief is converted into an ETF.

On the more than just a few hand, the Grayscale Litecoin belief, which went public earlier than its Solana counterpart, traded at steep reductions for the length of the 2022 undergo market and for many of 2025.

Lunde highlighted that Grayscale holds an wonderful part of LTC’s circulating present — 2.65%. Given its history of infrequently purchasing and selling at reductions, the agency’s Litecoin belief could ride valuable outflows upon conversion to an ETF.

“We scrutinize a long SOL, immediate LTC change as heavenly after ETF launches, assuming they happen round the same time. Given LTC’s history of appealing reactions to definite news, we are going to seemingly wait just a few days submit-start earlier than acting.”

Grayscale SOL & LTC Trusts. Source: K33 Be taught

Intense outflows from Grayscale Bitcoin and Ethereum trusts also forced BTC and ETH ETFs for the length of their respective launches final year. On the opposite hand, inflows into several assorted products delight in been ready to offset outflows from Grayscale to an wonderful extent.

No longer like Bitcoin and Ethereum ETFs, Grayscale is never any doubt one of many fully three issuers, alongside Canary Capital and CoinShares, that delight in filed for an LTC ETF, “which ability fewer issuers are fresh to offset the doable outflows,” the list states.

The prediction from K33 comes because the US Securities and Commerce Rate (SEC) accredited generic list requirements for crypto ETFs. The regulator also will most certainly be anticipated to develop a resolution on Litecoin and Solana ETF filings in early October, earlier than selecting assorted funds later in the month.

Solana and Litecoin change round $210 and $107, down 2% and up 0.1%, respectively, over the final 24 hours.

Connected news

- Solana Tag Forecast: SOL promote-off below $200 looms as DeFi TVL, funding rates tumble

- Crypto market steadies forward of Litecoin, Solana, XRP, Dogecoin, and Cardano set ETFs deadlines

- Ethereum Tag Forecast: ETH faces rejection reach key resistance despite $547 million ETF inflows