Litecoin factual saw its strongest tag spike in months, and it’s now not tough to see why. A formidable mixture of speculative energy, company action, and ETF optimism has lit a fireplace below LTC, pushing it to a five-month high of $128.40. But is that this LTC tag momentum sustainable, or is the market getting sooner than itself?

Let’s rupture it down.

Litecoin Stamp Prediction: What’s Driving the Stamp Surge?

First, the numbers. Litecoin is up over 41 p.c this month and nearly 6 p.c in the previous 24 hours on my own. As of now, it’s retaining round $123, giving it a market cap shut to $9.4 billion. That wander isn’t random. It comes trusty after two important catalysts.

The mountainous one? MEI Pharma raised $100 million—now not for R&D, now not for enlargement, however to alter into a Litecoin treasury firm. That’s a extensive bet on LTC from a publicly listed pharmaceutical participant, and it’s sending a noteworthy message to the broader market: Litecoin isn’t factual for payments anymore, it’s an organization asset.

Then there’s the ETF hypothesis. While prediction platform Polymarket areas the chances of a Litecoin ETF approval this year at 83 p.c, competing platforms love Myriad present users assign a query to XRP to beat Litecoin to the discontinuance line. Regardless, multiple filings from Canary Capital, Grayscale, and CoinShares counsel the run is on. The truth that these institutions are even in the conversation is ample to inject serious momentum.

What the LTC Stamp Chart Says?

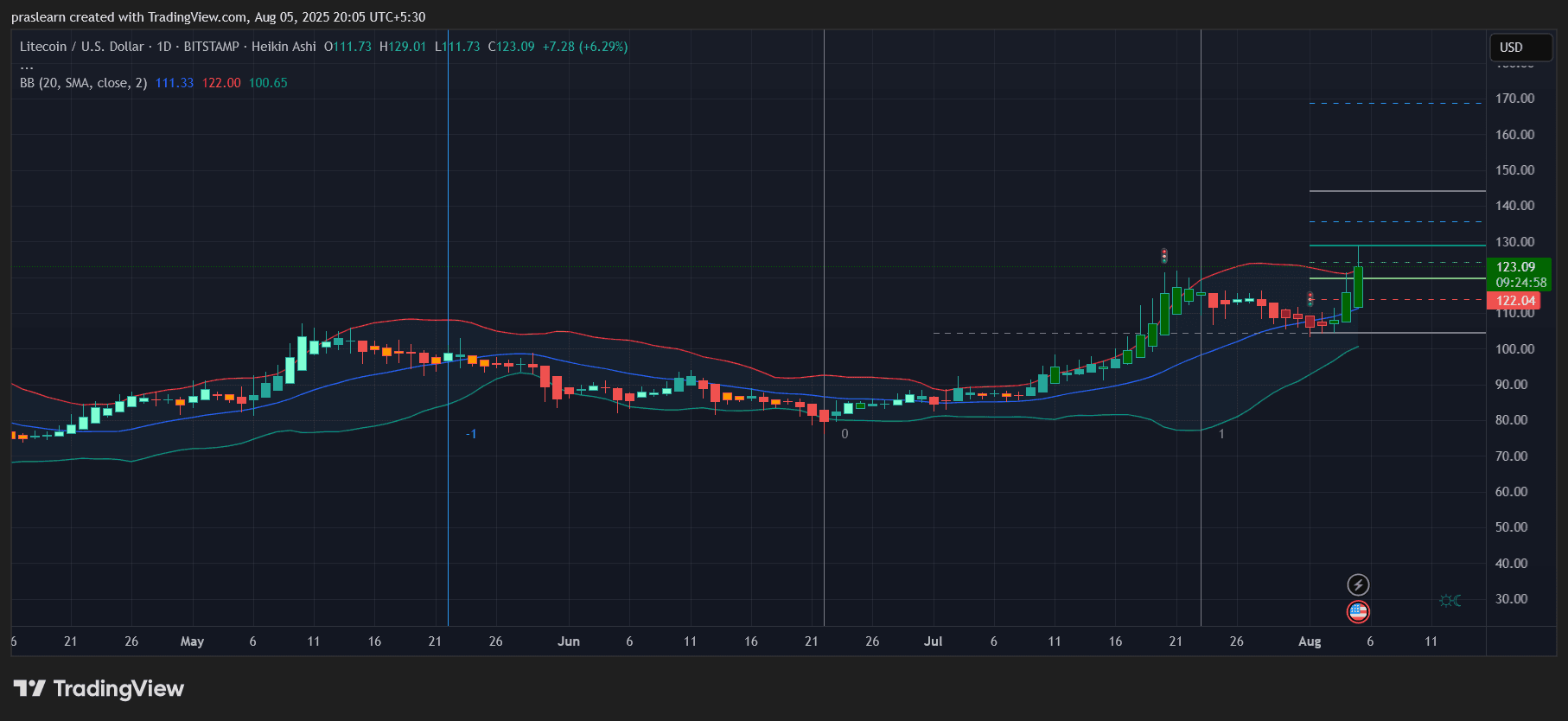

Taking a seek at the TradingView each day chart, LTC broke above every the midline and upper band of the Bollinger Bands, which generally indicators an overbought but sturdy bullish condition. It’s riding above the 20-day transferring common comfortably, and the Heikin Ashi candles present clear bullish continuity after a minor pullback.

That pullback after hitting $128.40 wasn’t a reversal—it appears to be like extra love a healthy consolidation. The latest candle has reclaimed the upper Bollinger Band, suggesting that bulls are peaceable up to the impress. Momentum is sturdy, and the price structure is mountain climbing with greater lows and greater highs.

If Litecoin can shut above $125 in the next couple of intervals, the door opens to a retest of $135 to $140. Above that, $150 turns into the psychological level to stare. On the plot back, $110 acts as sturdy support, and a drop below $105 would invalidate this bullish thesis.

Are ETF Rumors Already Priced In?

Litecoin ETF approval hypothesis has been round since February, when the SEC first acknowledged the filings. What we’re seeing now isn’t contemporary files—it’s a resurfacing of ragged optimism, coupled with contemporary capital from MEI Pharma. That matters.

In actuality, the MEI investment can also be the extra well-known lengthy-length of time catalyst. ETF approvals can wander costs swiftly, however if extra firms birth adding LTC to their balance sheets, that builds a deeper scandalous of ask. And never like ETF rumors, treasury allocations are liable to stay round.

Litecoin Stamp Prediction: What Comes Next for LTC Stamp?

Short length of time, assign a query to volatility. The market is jittery, and LTC will swing on every new ETF headline. But if treasury adoption continues and Litecoin maintains its position as a high price coin—it now not too lengthy ago captured 14.5 p.c of crypto payments on CoinGate—there’s an extended runway right here.

Defend an gaze on three issues: SEC choices round Litecoin ETFs, company announcements hinting at LTC treasury positions, and any important price platform adopting LTC.

The price is reacting to indicators of trusty-world utilization and institutional passion. If these indicators procure stronger, this could maybe maybe perchance also be the starting of a structural uptrend, now not factual a hype-pushed pump.