The cost of Litecoin (LTC) has dropped 7% in the final 24 hours, bringing its market cap to $9.33 billion. Despite this decline, technical indicators veil mixed alerts. The RSI sits in a neutral zone, while Ichimoku Cloud suggests uncertainty across the altcoin’s subsequent pass.

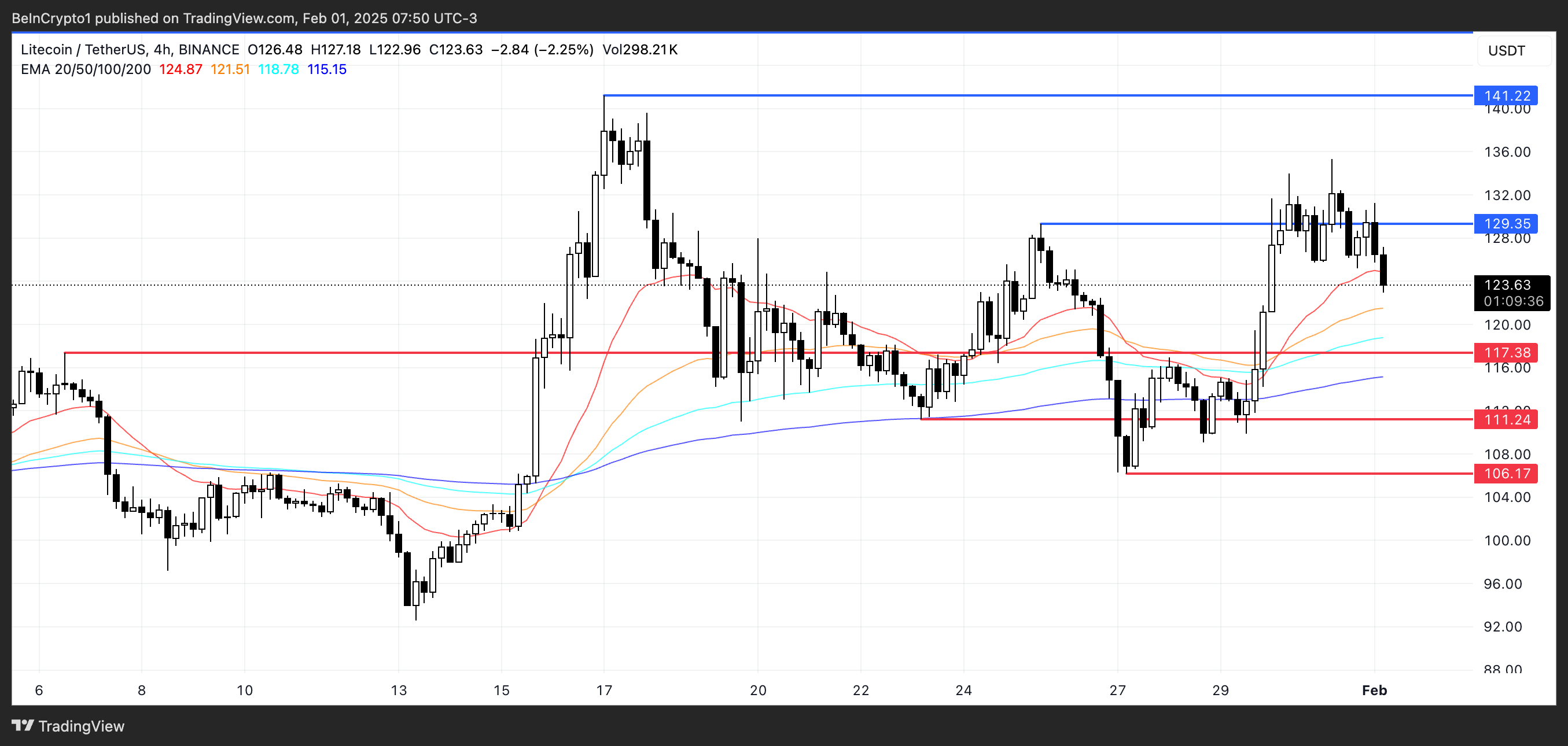

The EMA structure for Litecoin stays bullish overall, nonetheless the shortest-timeframe EMA is sloping downward. If the construction continues, this will likely maybe presumably lead to a loss of life imperfect. With LTC at a excessive level, a breakout could well presumably see it manufacture 14% to $141, while further weakness could well presumably push it down 14% to $106.

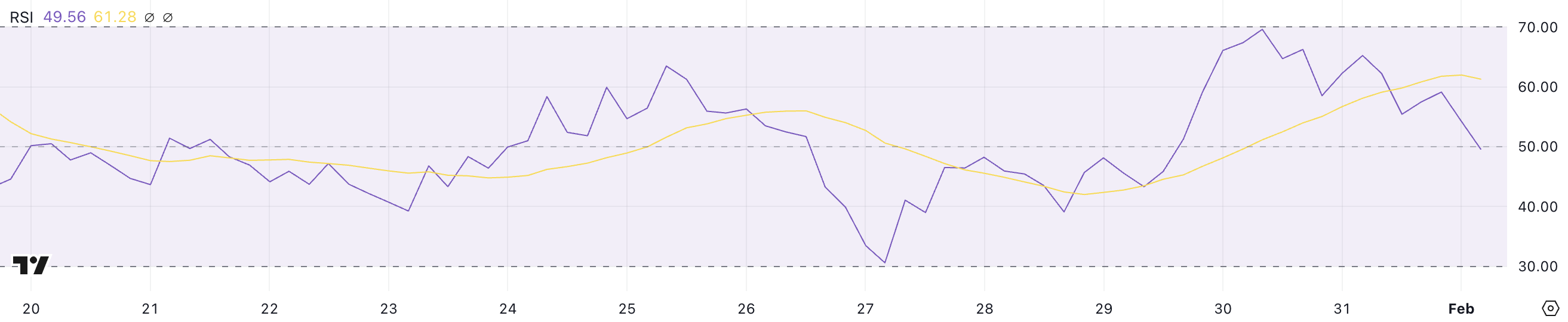

Litecoin RSI Is For the time being Neutral

Litecoin RSI is for the time being at 49.5, down from 69.6 dazzling two days previously. This indicates a shift in momentum because the stamp dropped 7% in the final 24 hours, even after recent decided traits in its ETF applications.

The Relative Strength Index (RSI) is a momentum indicator that measures stamp strength on a scale of 0 to 100. Ranges above 70 explain overbought stipulations, and below 30 suggest oversold stipulations.

A studying between 40 and 60 in overall alerts market consolidation, the build neither merchants nor sellers relish particular retain watch over.

With LTC now at 49.5 RSI, it sits in a neutral zone, suggesting neither solid bullish nor bearish momentum.

Alternatively, the absorbing drop from approach-overbought levels indicates weakening making an strive to search out stress. If the RSI traits lower towards 40, this will likely maybe presumably lead to further declines.

If it stabilizes or strikes lend a hand above 50, it will signal renewed making an strive to search out ardour and possible stamp restoration.

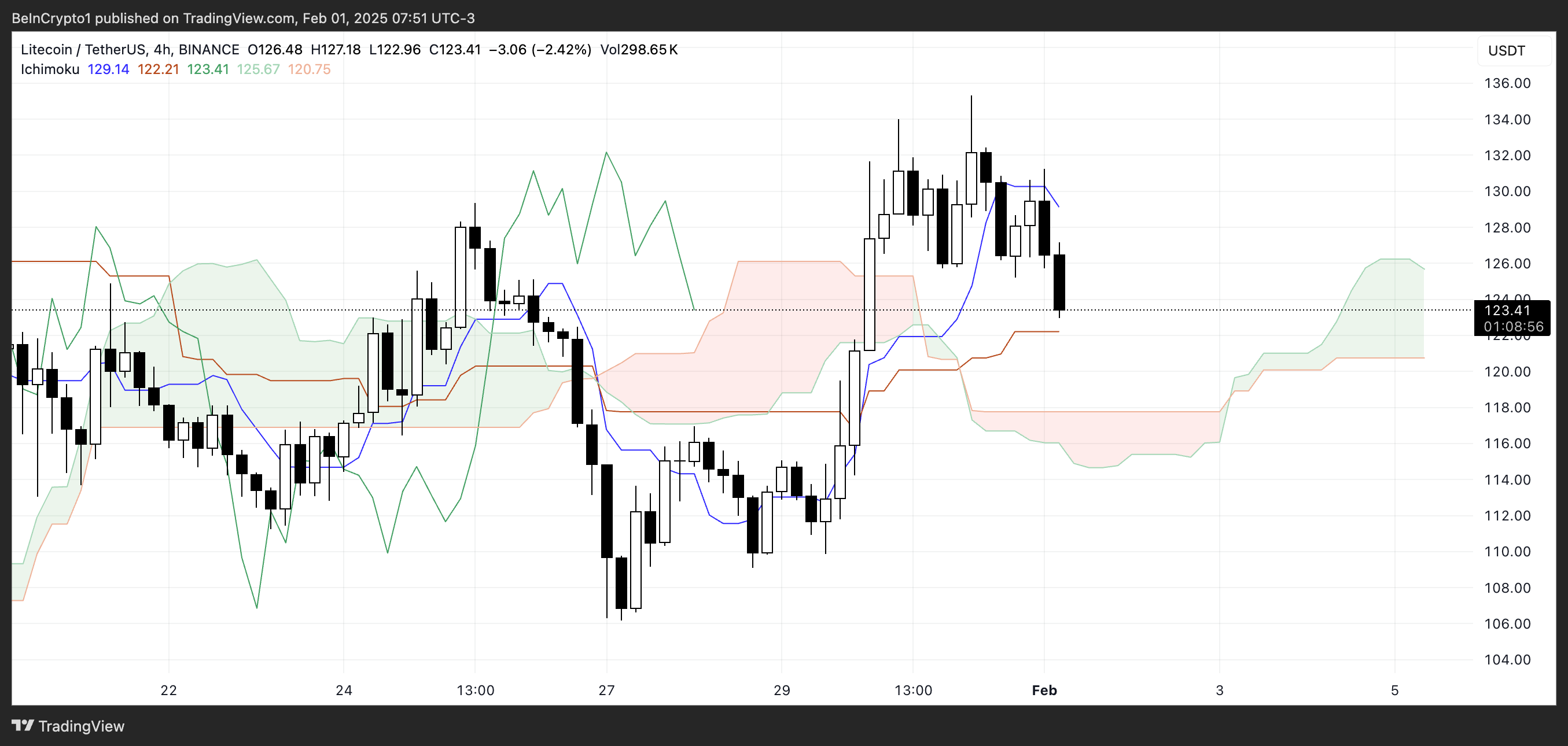

LTC Ichimoku Cloud Presentations Mixed Indicators

LTC stamp is for the time being engaging downward after failing to preserve above the Tenkan-sen (conversion line), which is now sloping downward, indicating a weakening short-timeframe construction. The Kijun-sen (final analysis) is slightly flat, suggesting that stamp equilibrium is being tested, and a stronger directional pass could well manufacture rapidly.

The cost is coming near the Kumo (cloud), which serves as a well-known house for construction confirmation. Staying above it will explain persevered bullish momentum, while breaking below it could maybe maybe presumably signal elevated weakness.

The cloud (Kumo) forward is inexperienced, suggesting that the broader construction stays decided, nonetheless the new stamp movement approach the cloud’s edge alerts uncertainty. If the Litecoin stamp finds improve approach the cloud, which is between $120 and $126, it could maybe maybe presumably stabilize and strive to procure strength.

Alternatively, if it strikes into or below the cloud, it will explain an absence of momentum and possible construction reversal. That happens on story of stamp motion in the course of the Kumo in overall represents consolidation or indecision.

LTC Impress Prediction: A 14% Upside or Downside?

Litecoin’s EMA traces remain bullish, with short-timeframe EMAs light positioned above the lengthy-timeframe ones. Alternatively, the shortest-timeframe EMA is initiating to slope downward, signaling weakening momentum.

If it crosses below the longer-timeframe EMAs, this can construct a loss of life imperfect, a bearish signal that could well presumably lead to further draw back. If so, the LTC stamp could well test improve at $117.

If that degree fails to preserve, the stamp could well presumably extend its decline to $111 or even $106, marking a possible 14% drop from recent levels.

On the diversified hand, RSI and the Ichimoku Cloud explain that the general bullish structure is light intact, meaning Litecoin could well presumably light gain smartly its momentum.

If making an strive to search out stress increases and the EMAs preserve their bullish positioning, LTC could well presumably climb towards the $129 resistance degree. A a hit breakout above that degree could well presumably push the stamp elevated to $141, representing a possible 14% manufacture if momentum strengthens.