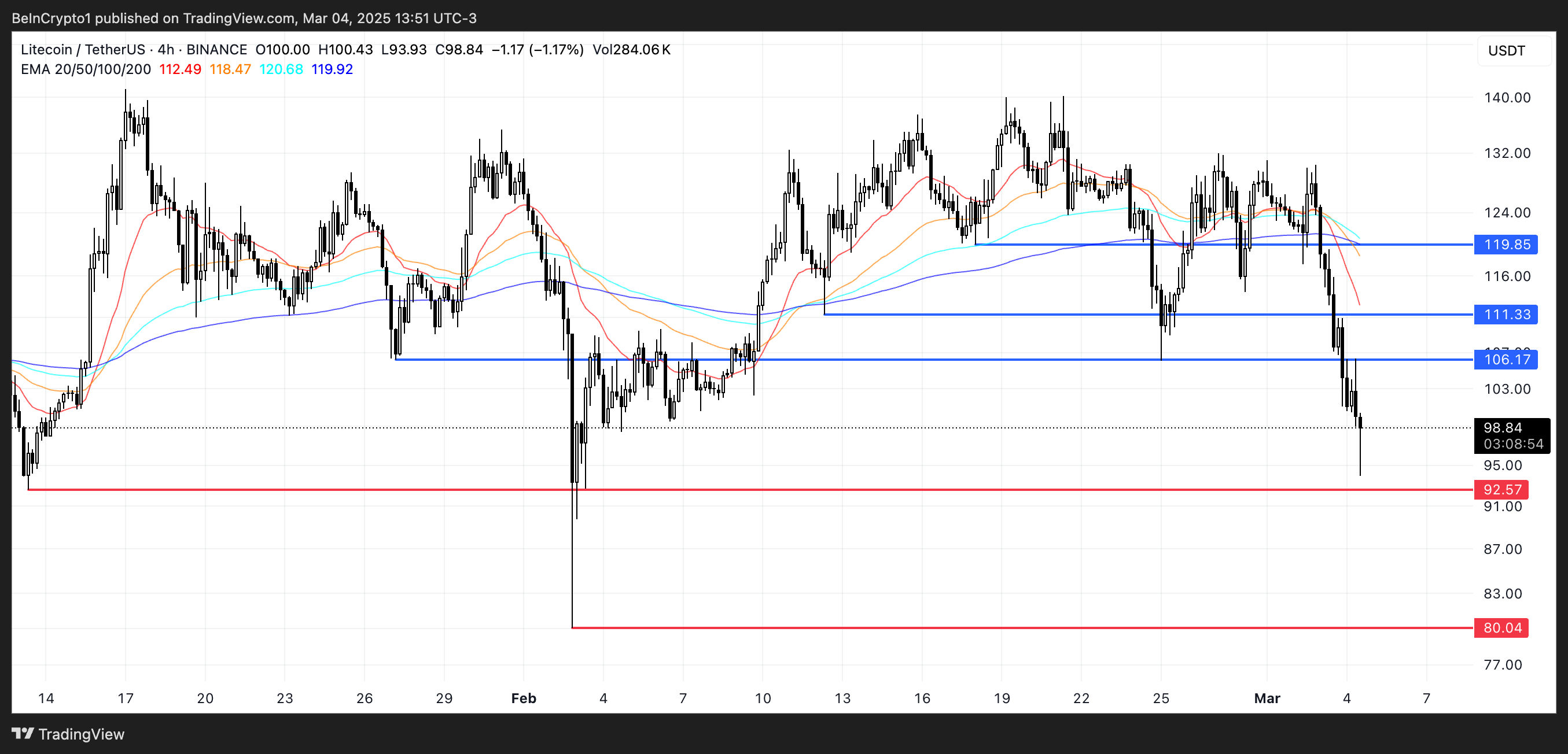

Litecoin (LTC) is down larger than 12% within the final 24 hours, with its label shopping and selling round $100 and its market cap losing to $7.5 billion. The intelligent decline comes as selling stress intensifies, pushing LTC’s RSI into oversold territory and Chaikin Cash Drift (CMF) deeper into unfavorable phases.

If the downtrend continues, LTC can also take a look at $92.5 enhance and doubtlessly descend to $80, its lowest label since November 2024. However, if momentum shifts, LTC can also strive a restoration, breaking support above $100 and concentrated on resistance phases at $106, $111, and presumably $119.

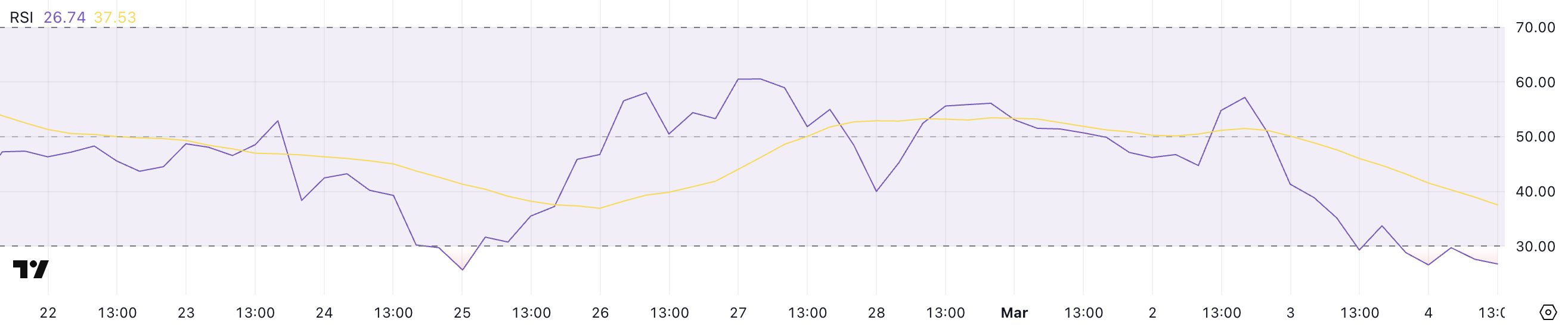

LTC RSI Is For the time being At Oversold Ranges

Litecoin Relative Energy Index (RSI) has dropped to 26.7, a intelligent decline from 57.1 simply two days ago. This steep fall means that LTC has entered oversold territory, suggesting intense selling stress.

This form of hasty descend veritably displays dread selling or a solid bearish pattern, leaving LTC at concern of further downside except patrons step in.

However, an RSI this low also alerts that the asset can also simply be nearing a doable short reversal, as oversold conditions veritably consequence in relief bounces.

RSI is a momentum indicator that ranges from 0 to 100, measuring the energy of recent label movements. Readings above 70 indicate overbought conditions, the place sources tend to face selling stress, whereas readings beneath 30 indicate oversold conditions, the place shopping alternatives can also simply emerge.

With LTC’s RSI now at 26.7, it’s deep in oversold territory, rising the potentialities of a short jump.

However, if bearish momentum persists and RSI continues falling, Litecoin can also fight to acquire enhance and prolong its losses earlier than any restoration strive.

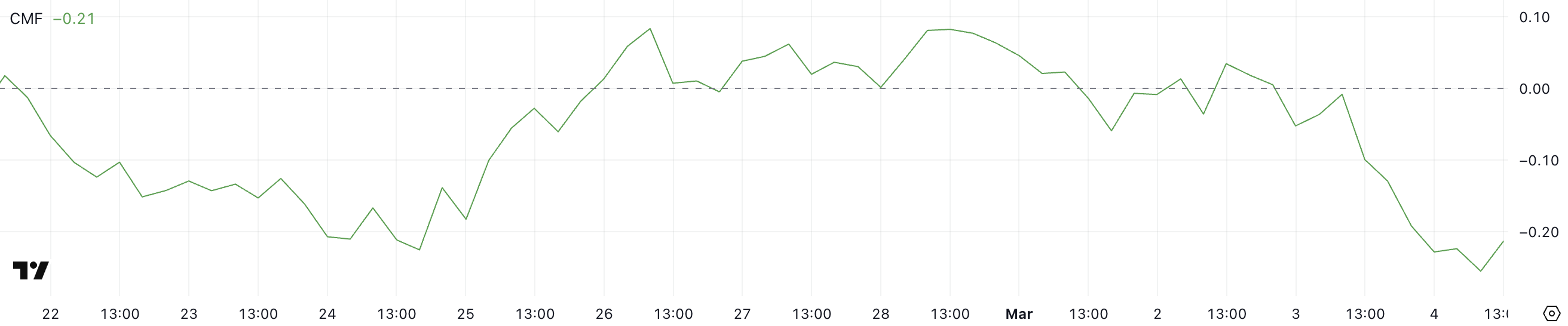

Litecoin CMF Fell Below -0.20

Litecoin’s Chaikin Cash Drift (CMF) is for the time being at -0.21, down from 0.03 simply two days ago, indicating a valuable shift in capital waft. Earlier, CMF hasty dropped to -0.26, its lowest level since mid-February, reinforcing bearish sentiment.

A declining CMF suggests that selling stress is rising, with extra capital flowing out of LTC than into it.

This pattern alerts that merchants are pulling liquidity from Litecoin, making it advanced for the charge to withhold any short rebounds.

CMF measures shopping and selling stress by examining quantity and label movements starting from -1 to 1. Obvious values indicate accumulation, that stretch extra money is flowing into an asset, whereas unfavorable values indicate distribution and increased selling stress.

With LTC’s CMF now at -0.21, sellers remain in retain watch over, and except shopping quantity returns, LTC can also fight to acquire enhance.

The recent descend to -0.26 presentations that capital outflows are reaching outrageous phases, rising the priority of further downside except sentiment shifts.

Will Litecoin Descend Below $90 Soon?

If Litecoin’s downtrend continues, the charge can also take a look at the $92.5 enhance level, a key zone that has beforehand held patrons. If this level is misplaced, LTC can also descend as limited as $80, marking its lowest label since November 2024.

With momentum indicators love RSI and CMF showing bearish stress, further declines remain a chance except patrons step in to protect enhance.

However, if LTC reverses its pattern, it’s going to also acquire momentum and push above $100, with $106 because the first major resistance level.

A breakout above this is in a position to also consequence in a take a look at of $111, and if bullish momentum strengthens, LTC can also rally in direction of $119.