Hey!

Memorial Day is correct kind across the nook, and I for one am taking a trace forward to chomping on a hot dogs on a rooftop in Brooklyn someplace.

However for now it’s a wet Thursday, and we’re severe just a few future where all the pieces — even in all probability my aforementioned hot dogs — is tokenized on public blockchains. Lets?

Jupiter’s noteworthy thought to unify markets

This week, Jupiter announced its “Mountainous Unified Markets” initiative, which goals to bring “all resources” to Solana and index them on Jupiter.

By an initiative relish GUM, international replace, stocks, accurate-world resources and crypto may perhaps perhaps perhaps moreover take a seat within the same “narrate machine” and transact for fractions of a cent, Jupiter’s pseudonymous founder meow wrote on X just a few minutes back.

Jupiter announced companions for its “GUM Alliance” that encompass market makers and accurate-world resources projects. Within the following few months, Jupiter will be working with these companions to construct liquid markets for more resources on Solana and integrating these markets into Jupiter, in accordance with a post from the protocol on X.

“Someone who’s spent foremost time in DeFi knows that one thing relish GUM is doubtless, and one thing we may perhaps perhaps perhaps moreover aloof aspire for,” one other pseudonymous Jupiter employee wrote on X. “We desire to 10x the scope in crypto.”

Jupiter is a DeFi app that affords issues relish swaps and limit orders. It’s moreover a DEX aggregator that searches across numerous liquidity sources to abet earn the most attention-grabbing doubtless prices on swaps. The app already lists a expansive sequence of crypto tokens, so GUM’s novelty would doubtless be adding issues relish credit, T-funds and accurate estate to the mix.

Tokenizing resources to permit them to efficiently be swapped or moved across the arena is a most fashionable thought in crypto and amongst some in TradFi. BlackRock CEO Larry Fink is a tokenization fan.

Jupiter’s guess is that it may perhaps perhaps perhaps moreover change into the first venue where tokenization involves life at scale. Due to Jupiter collects prices on about a of its products, there’s a industry motive to form this kind of enormous market.

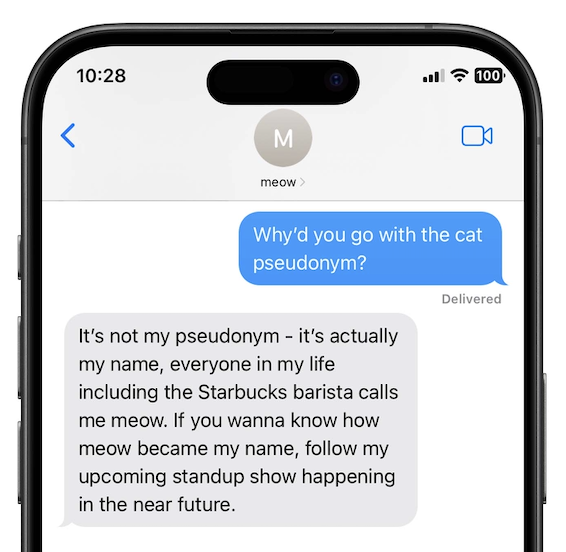

The level of GUM is to construct the “first unified market with [a] ample severe mass of resources, [liquidity] and customers,” meow suggested me in a textual sing material.

In an electronic mail, 21.co’s Tom Wan known as GUM a “excellent” advertising campaign to earn market makers and tokenized asset issuers on the same page.

“Onboarding tokenized resources will continuously have a rooster/egg peril. Issuers are reluctant to tokenize the resources without liquidity, and liquidity wouldn’t ranking until more tokenized resources are launched,” Wan wrote.

— Jack Kubinec

Peculiar

Zeta Markets releases litepaper for its layer-2

You heard it here first, other folks. Zeta Markets has released a litepaper for the “Zeta X” layer-2 it’s hoping to ship to mainnet in early 2025.

Zeta operates a DEX centered on crypto perpetuals trading, leveraging the Solana blockchain’s excessive scalability and low prices to present an improved trading skills. At a trace, constructing an L2 for Solana may perhaps perhaps perhaps moreover seem unorthodox. As a minimum, the network already boasts excessive scalability and low prices — aspects most typically cited by developers when proposing new side chains for legacy networks relish Ethereum.

However Zeta reps order their network goals to push the boundaries extra by offering a extremely personalized trading skills; one which, in accordance with Zeta representative Tristan Frizza, “competes with centralized exchanges.”

This customization will allow Zeta to optimize block rental and transaction processing, turning in low-latency transactions and addressing the elevated prices viewed on other networks. Frizza explained that in space of constructing an isolated rollup, Zeta’s L2 solution will be carefully constructed-in with Solana to tap into its rising total value locked (TVL) and liquidity. On the total, its plot is equal to an appchain where transactions are low ample in latency to compete with CEX speeds. Identical choices may perhaps perhaps perhaps be nigh not doubtless to form on chains relish Ethereum, where transactions are usually too pricey and require bundling to the adverse layer for effectivity.

As Zeta looks to be like to the longer term, it becomes ever more apparent that the evolving DeFi landscape requires fixed innovation to meet the wants of fashionable traders.

— Jeffrey Albus

Zero In

$54 million

That’s the mixed market capitalization of Ondo Finance’s USDY and OUSG tokens on the Solana blockchain, in accordance with recordsdata from Solscan. The 2 tokens are notable accurate-world asset-linked products that present exposure to US Treasurys. Staunch-world asset-linked tokens present a bridge between TradFi and DeFi by enabling patrons to plot exposure to feeble resources relish govt bonds by manner of digital tokens. For context, OUSG and UDSY on Ethereum have a mixed market capitalization of wisely over $250 million, per Etherscan.

A most foremost quantity of the portfolio backing OUSG is held in BUIDL, the tokenized fund launched by the arena’s supreme asset manager, BlackRock, in accordance with Ondo.

— Jack Kubinec

One Appropriate DM

A textual sing material from meow, the founder of Jupiter:

Impress: The day gone by’s edition conflated dropped transactions with failed transactions on the Solana network. We regret the error.