Lido, a successfully-identified liquid staking protocol, is able to revolutionize the common sense of Ethereum’s Proof-of-Stake by a predominant crypto replace.

The project has just released the Neighborhood Staking Module, which permits anybody to change into a network validator by committing simplest 2.4 ETH.

Unless nowadays, to bustle a validator node on Ethereum, 32 ETH were required.

This acknowledge makes access to consensus more uncomplicated, doubtlessly bringing more decentralization internal the network.

Let’s thought the total facts under.

Abstract

Lido prompts the Neighborhood Staking Module on Ethereum’s crypto ecosystem: validators with 2.4 ETH

Lido, the popular $25.2 billion LSD protocol, has just voted for the free up and activation of a well-known-discussed crypto increase.

Let’s focus on about the “Neighborhood Staking Module” (CSM), whose governance proposal used to be opened on October 22 and concluded just two days later.

Attributable to the certain vote from the community, the replace will soon arrive into produce on Lido and can just unruffled introduce special advantages.

Initially, this can allow particular particular person customers to bustle validator nodes on the Ethereum PoS blockchain with out requiring the brink of 32 ETH.

In its location, the preliminary minimum requirement of two.4 ETH will be introduced, with the significant validator staking simplest 1.3 ETH.

Moreover, those that qualify for the early adoption share will be in a situation to use the feature by locking crypto in stake for 1.5 ETH.

🗳️ Unique on chain vote is live!

Lido contributors are proposing the free up of the Neighborhood Staking Module (CSM), and upgrading the Staking Router to increase compatibility with CSM and future modules.

📅 Main share ends October Twenty fourth at 4PM UTC. https://t.co/q6urmprFww pic.twitter.com/45CCd2roOt

— Lido (@LidoFinance) October 22, 2024

The Neighborhood Staking Module of Lido greatly reduces the boundaries of Ethereum staking, eliminating technical trip and financial boundaries.

The CSM aligns carefully with the vision of Ethereum co-founder Vitalik Buterin of solo stakers having fun with a necessary position in improving the network’s resilience.

With more neutral stakers, the crypto network is certainly more diversified in phrases of operators and succesful of better repelling imaginable censorship attempts.

The testnet share of this increase used to be initiated on July 1st on the Holesky chain, continuing for the following 3 months.

One day of the process, higher than 370 uncommon node operators joined, along with 70 “solo staker” in the significant 10 days.

Now that the CSM has been current by the community, Lido is anticipated to tremendously amplify the selection of node operators the use of the protocol.

The brand new entry barrier for validator nodes at 32 ETH

For the time being, to take part in the execution of a validator node on Ethereum, with out going by the crypto protocol Lido, no decrease than 32 ETH are required.

As share of the Proof-of-Stake consensus mechanism, customers who wish to take part in securing the network, whereas earning a yield on the same time, must stake a minimum amount, enviornment exactly at 32 ETH.

For the time being, the Ethereum network has over 1 million validators, with a total of upper than 34 million ETH staked. The yield is 3.1%.

The belief of the minimum requirement of 32 ETH mainly serves to lend a hand the participation of whale. With a decrease threshold, they’d must interact more particular particular person validators, causing elevated strain on the network for the duration of the entry and exit phases.

On the diversified hand, nevertheless, one of these excessive sum, much like a worth of 82 thousand dollars, represents a well-known entry barrier for minute customers.

A mountainous various of folks in the crypto world attain no longer acquire such an amount in ETH and are forced to realize staking by third-win collectively products and services, equivalent to LSD protocols.

By doing so, the minute fish must necessarily focus round elephantine staking swimming pools to trip the hobby on deposits, centralizing the network.

Rather a lot of times this explain had been discussed in the past amongst the Ethereum community, but a definitive acknowledge had by no scheme been reached.

Now, nevertheless, it appears to acquire reached a turning point.

The brand new CSM increase of Lido interrupts this inefficiency, opening the doorways of the validators’ network even to minute merchants.

This might occasionally just unruffled resolve on the decentralization of the crypto network, this ability that improving its security and resilience.

Furthermore, the brand new module will moreover make stronger the thriving global community of solo stakers by the Neighborhood Lifeguards Initiative, offering an academic contribution.

As confirmed in the click convention by Dmitry Gusakov, collaborator of the Lido protocol and technical supervisor CSM:

“We want to crumple the boundaries, making it imaginable for anybody, no subject financial conditions or technical abilities, to attend provide protection to Ethereum.”

Lido unruffled leads the liquid staking sector whereas the crypto LDO experiences worth undergo

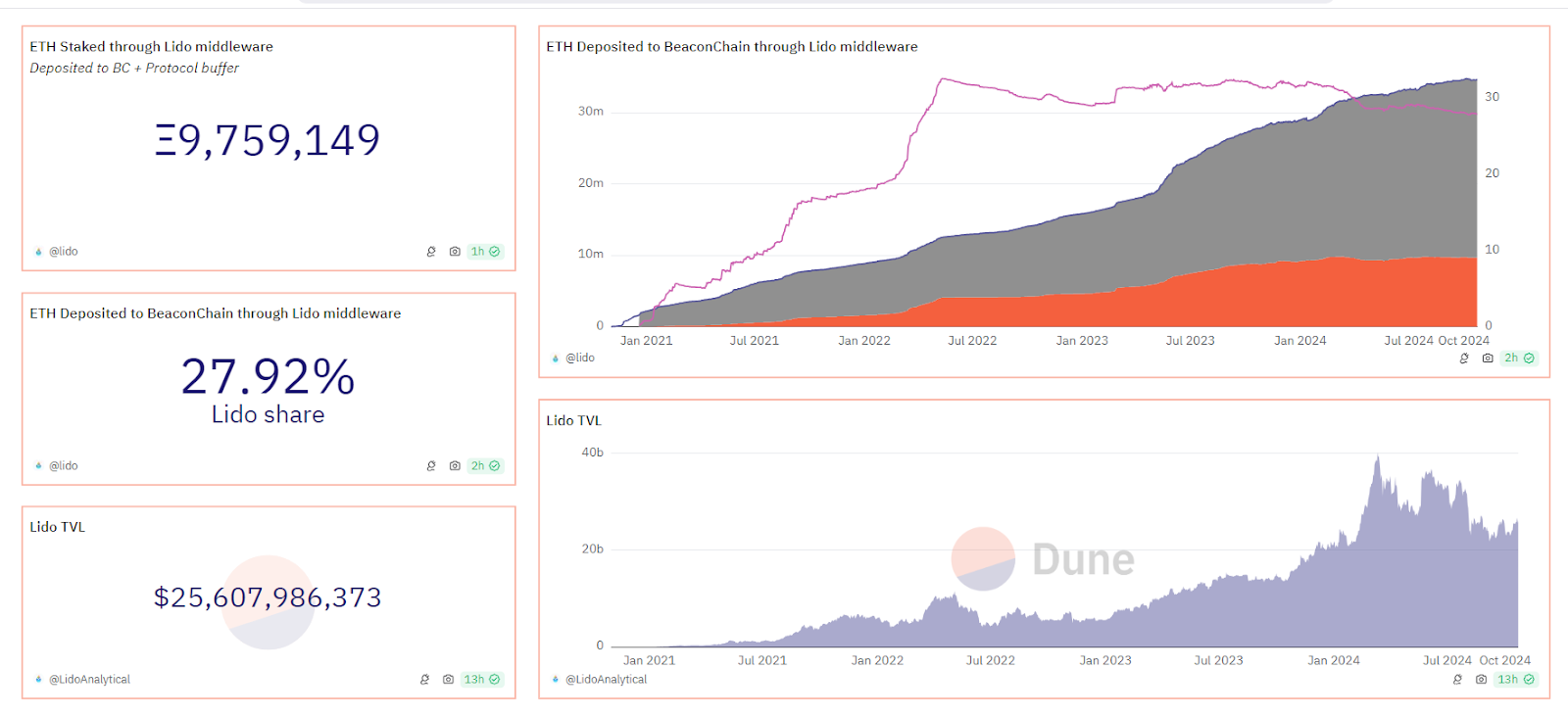

In step with the records from Dune Analytics, Lido unruffled appears to dominate the Ethereum crypto staking market, despite the declining numbers.

The protocol holds a market section of 27.92% with 9.75 million ETH deposited by the same middleware.

This scheme that nearly about 1 out of three validators on the Ethereum network is managed utterly by Lido.

The platform boasts a TVL of 25.6 billion dollars, making it the dapp richest in the DeFi ecosystem.

Finally, it is severe to make clear that from July 2022 onwards, Lido has constantly lost ground, ending up offering opponents 5% of the market section.

This enviornment contributes to the expansion of the restaking sector, which has introduced significant gamers to the market equivalent to Etherfi, Renzo, and EigenLayer.

Correct to give an belief of the pattern that is underway, in the closing 7 days the EigenPods of EigenLayer acquire introduced 62,000 ETH on the Beacon Chain.

In the same length, Lido experienced an outflow of 22,000 ETH, highlighting a elevated allure of the most traditional technology protocols.

In the meantime LDO, crypto of governance of Lido, must face a severe fall in prices.

In the closing year, the currency has lost 38% of its worth, losing from 1.8 to the brand new 1.1 dollars.

After a mercurial upward push on the starting of 2024, with prices reaching even 3.8 dollars, the bears acquire returned to present their presence felt, pushing strongly downward.

From September onwards, the contraction share appears to acquire subsided, giving formulation to a sideways pattern.

It is miles no longer excluded that in the bull market LDO might perhaps presumably just moreover provide nice looking percentage returns, but currently the scenario is the rest but bullish.

Because the significant signal of recovery, we might perhaps presumably just unruffled thought the crypto return no decrease than above 1.6 dollars, and then continue in the bull climb.

The market cap of LDO is 1 billion dollars on the time of writing, 25 times decrease than the TVL of the same Lido protocol.