Whereas Bitcoin exceeds $ 64,000 with its rally, its earlier ATH is step by step approaching near $ 69,000.

Whereas the FED’s March ardour price resolution is awaited in BTC, knowledge on Deepest Consumption Expenditures (PCE), which is carefully followed by the FED when making ardour price amplify selections and is believed of a main inflation indicator, has been announced.

Accordingly, all knowledge announced referring to non-public consumption expenditures in January are as follows:

Core Deepest Consumption Expenditures Set Index (Annual) Announced 2.8% – Expected 2.8% – Outdated 2.9%

Core Deepest Consumption Expenditures Set List (Month-to-month) Announced 0.4% – Expected 0.4% – Outdated 0.2%

Deepest Consumption Expenditures Set Index (Annual) Announced 2.4%– Expected 2.4%– Outdated 2.6%

Deepest Consumption expenditures Set Index (Month-to-month) Announced 0.3% – Expected 0.3% – Outdated 0.2%

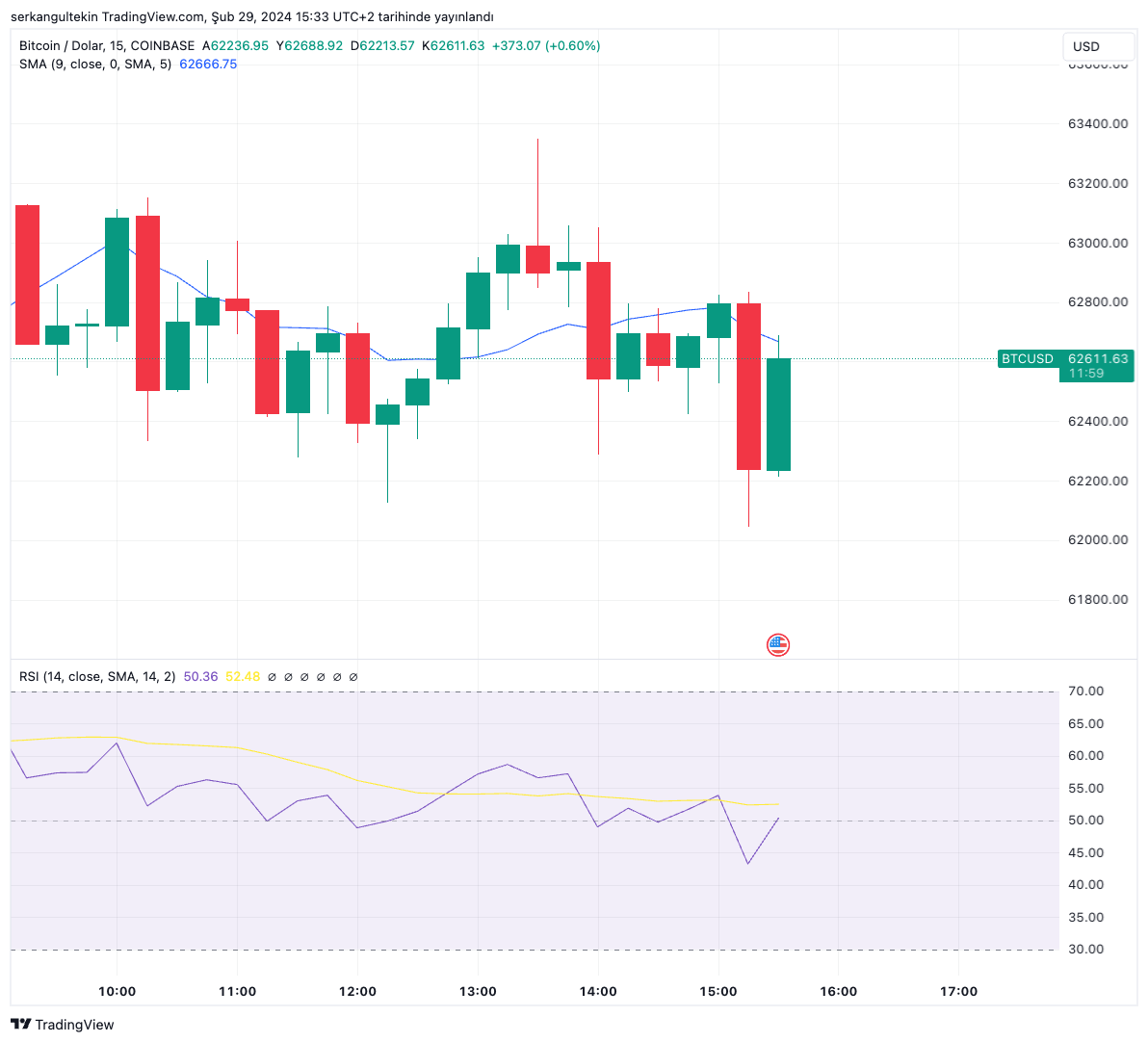

First response of Dollar and Bitcoin:

What is Core Deepest Consumption Expenditures Set Index? What is the Discontinue on Set?

Core Deepest Consumption expenditures (PCE) resolve the price of inflation experienced by patrons when shopping goods and products and companies diversified than Meals and Vitality.

Currency merchants ogle the Core PCE Set List as the Reserve Monetary institution’s most smartly-most popular user inflation indicator.

PCE differs a runt bit of from CPI in that it finest identifies products and companies and goods which would possibly well be consumed and focused individually. The Nutrient and Vitality calculation is roughly 25% of the PCE, but these can vary vastly from month to month and can distort the entire image. Fancy the CPI, it shows set changes in user goods and products and companies. By except for the variable parts, PCE would possibly well be a much bigger indicator under the inflationary slope. (investing.com)

*Right here is now not investment recommendation.