As token buybacks beget reputation in crypto, Amir Hajian, head of examine at market making company Keyrock, warns in a new report that every buck spent repurchasing tokens is a buck diverted from progress and innovation, underscoring the hidden alternative mark leisurely the present of self belief.

Token buybacks relish blockchain projects repurchasing their own tokens from the start market, comparable to stock buybacks. The approach sucks out circulating provide from the market, surroundings up shortage and presumably increasing the token’s rate to model self belief to traders.

The upward thrust of token buybacks marks a turning level in how crypto defines maturity, Hajian argues within the report shared with CoinDesk, writing that what began as an effort to existing that protocols could possibly return rate adore corporations has change into a stress take a look at of their financial realism. The dear level is whether protocols can repurchase with the restraint of a central bank in field of the twitchy reflexes of a bull market.

Noteworthy of this capital for buybacks comes from treasuries in field of habitual earnings, exposing how hasty the pursuit of legitimacy can drain future runway.

With clearer tips forming within the U.S. for crypto and protocols within the waste generating consistent rate profits, token buybacks believe emerged as the most traditional solution to hyperlink earnings to holder rate.

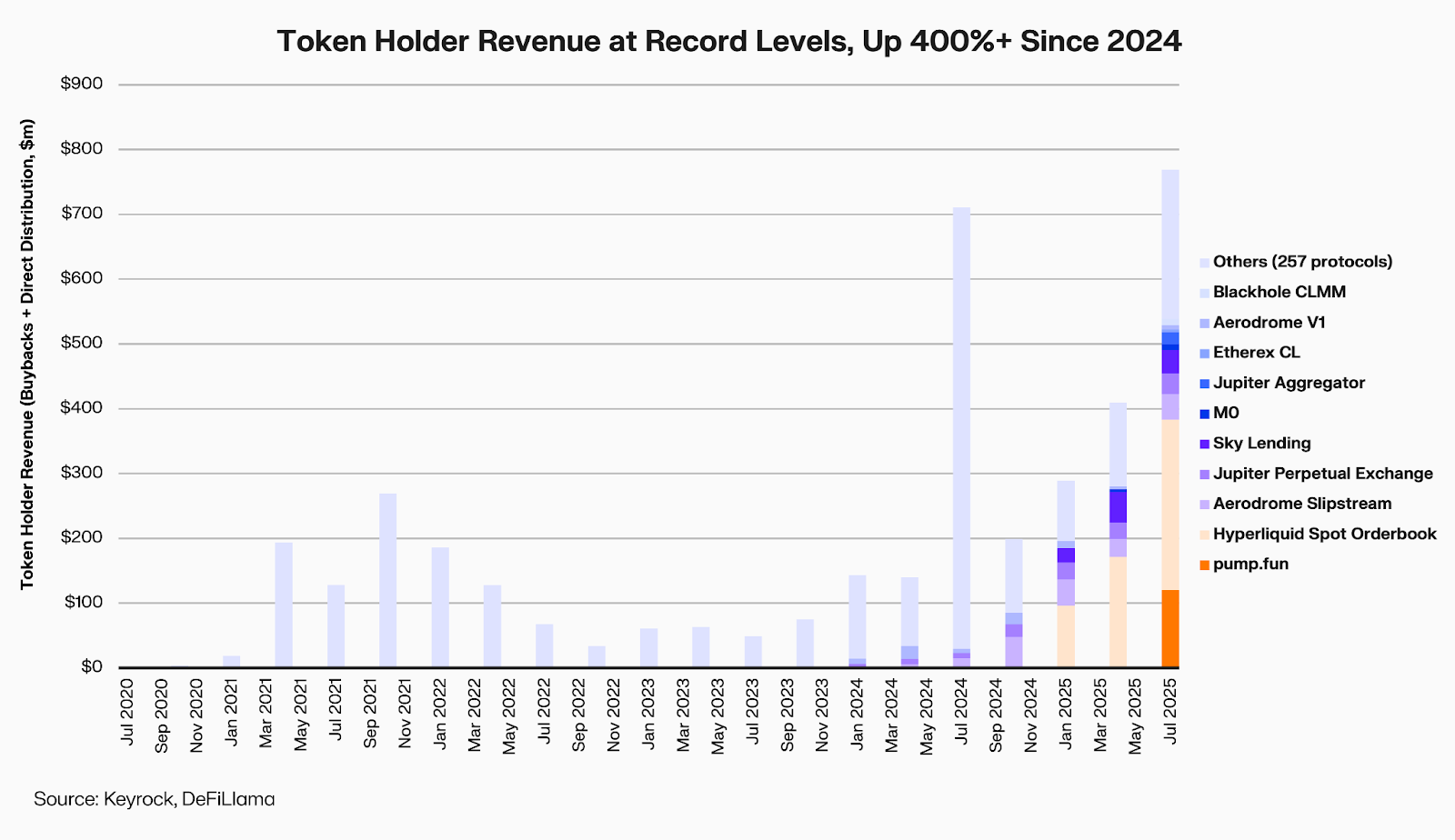

Hajian finds that protocol payouts to token holders believe risen more than 400% since 2024, hitting nearly $800 million within the third quarter of 2025.

All thru 12 earnings-distributing protocols studied, groups returned an moderate of 64% of whole earnings to holders, far bigger than dilapidated DAOs, which reinvest roughly three-quarters of spending into progress and development.

That tilt toward distributions over reinvestment, Hajian writes, has compelled protocols to confront the boundaries of one-time treasury spending. As markets historical and revenues normalize, projects can now not come up with the money for buybacks that treat capital as infinite or timing as irrelevant.

In response, some groups are rethinking how and when rate must quiet return to holders, tying repurchases to valuation metrics, money waft strength, and market conditions in field of fastened percentages.

Hajian aspects to the upward thrust of order off-based and alternatives-based objects as early signs of this shift, designed to originate buybacks counter-cyclical, earnings-sensitive, and sustainable previous the next bull cycle.

Trigger-based methods tie spending to measurable fundamentals, akin to valuation multiples or exclusively diluted rate bands, increasing allocations when tokens see undervalued and scaling them assist when costs bustle hot.

Alternate choices-based constructions drag a step additional, allowing protocols to sell covered locations and bag top class profits whereas committing to future purchase ranges, a beget that generates earnings even when no buyback occurs.

Hajian argues that these objects together replicate a maturing means to tokenomics, writing that they are healthy for treasury management as they align buybacks with accurate market conditions.

The report additionally warns that execution quality remains an below appreciated menace.

Most projects exhaust taker orders that pull liquidity from skinny scream books, exaggerating mark swings once shopping stops. Calibrating buybacks to natural volume and leaning on maker orders, Hajian writes, would allow protocols to add liquidity as opposed to ingesting it.

So, When Ought to quiet Token Buybacks Happen?

A protocol must quiet handiest provoke buybacks once its revenues are habitual, its treasury can shroud on the least two years of operations, and its valuation multiples suggest that the token is shopping and selling below fundamentals, Hajian argues.

Weak projects are inclined to start buybacks when financial strength is clear: Revenues are bag, market liquidity is deep, and the protocol’s valuation has reached ranges the attach capital returns originate financial sense in field of promotional sense.

In disagreement, more contemporary groups step by step deploy buybacks too early to attract users or consideration, mistaking visibility for rate. These premature buybacks drain the reserves wished to fund product, progress, and R&D, Hajian writes.

It’ll also honest be that the actual take a look at is now not the presence of a buyback policy nonetheless the discipline to attend except the fundamentals articulate one. Buybacks aren’t proof of success, nonetheless pretty they’re a measure of whether crypto can evolve from distributing promise to managing earnings.