Within the course of Monday’s shopping and selling session, the SUI value projected a runt uptick of 1.3% leap to reach a shopping and selling value of $1.36. The bullish turnaround in all probability adopted broader market sentiment because the U.S. Federal Reserve confirmed asserting the federal funds rate at 4.25% to $4.5%. While the crypto market is yet to elongate the bottom formation of basically the most popular correction, belongings esteem SUI stand as major reinforce ranges to passion crypto merchants.

Key Highlights:

- The SUI value wavering above 38.2% and the 50% Fibonacci retracement stage indicates a well being pullback for market merchants..

- An ascending trendline is a day-to-day chart that drives basically the most popular uptrend.

- A 20% in TVL indicates that merchants and liquidity suppliers could well well well very well be exiting the SUI ecosystem.

DeFi Process on SUI Network Declines as TVL Drops

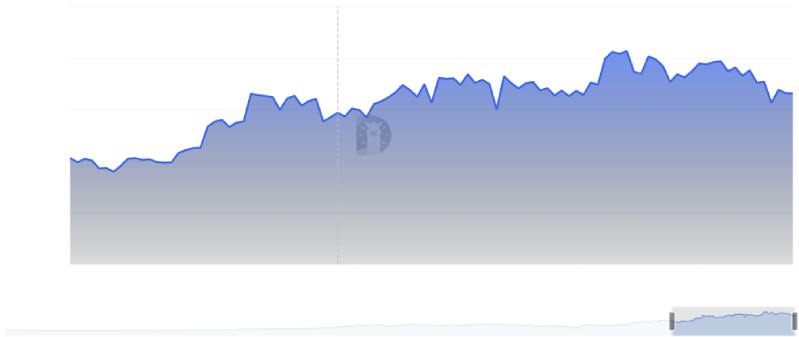

Primarily based on DeFiLlama data, the SUI networks’ total volume locked has considerably dropped from $2.06 to $1.65— a 20% decrease in the closing three weeks. The declining TVL on the entire indicates that merchants and liquidity suppliers are withdrawing funds, potentially signaling waning self belief in the SUI ecosystem.

Decrease TVL suggests a drop in DeFI participation, which could maybe well well notably affect the native cryptocurrency SUI.

SUI Mark Checks Severe Fibonacci Ranges

Amid the broader market uncertainty, the SUI value fashioned a native top at $5.36 stage in early January. The bearish turnaround has plunged the asset over 30% to commerce at $3.7.

The falling value, accompanied by a surge in shopping and selling volume, hints at elevated conviction from sellers to elongate this correction. Presently, the SUI value seeks reinforce at the 38.2% Fibonacci retracement stage, whereas the following major reinforce is at $2.9, coinciding with 50% FIB..

Theoretically, these Fibonacci ranges display shroud healthy retracement ranges for an asset to enhance the exhausted bullish momentum.

The day-to-day chart analysis furthermore displays basically the most popular uptrend trajectory in the SUI value with an ascending trendline performing as a dynamic reinforce. These aforementioned ranges will in all probability be curricula for SUI to again its bullish style.

Thus, a likely breakdown below these will urge the selling stress and drive a long correction below $3.