In the crypto ecosystem, pinpointing the staunch moment Bitcoin (BTC) prices bottom out is akin to discovering a needle in a haystack. Most in style data, nonetheless, presents some insights into whether or no longer the Bitcoin tag has bottomed.

Because the digital foreign money touched a one-month low of $58,500, analysts from CryptoQuant and Glassnode published four needed on-chain indicators to position a query to. These indicators will likely be precious for inspecting market behaviors reach the low aspects and determining the stipulations needed for prices to rebound and upward thrust all over again.

1. Monitoring Bitcoin Request of Boost

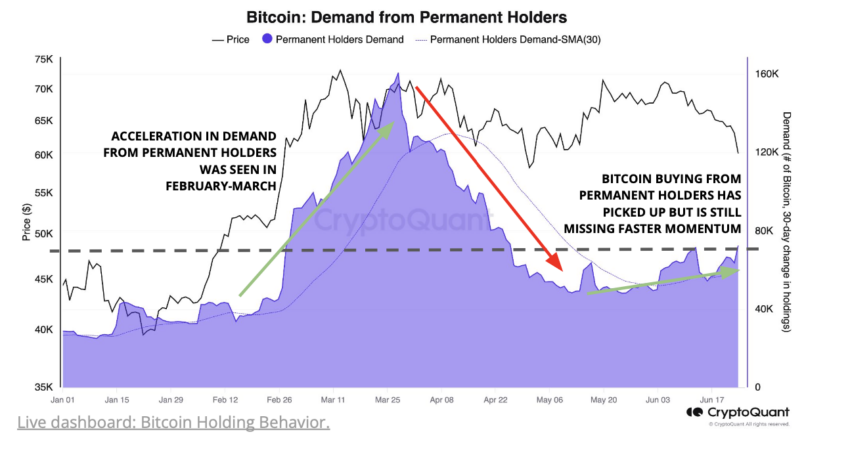

The first quarter of 2024 seen a unparalleled surge in Bitcoin demand coinciding with the originate of US feature ETFs, setting up file highs. On the opposite hand, post-May furthermore, this demand has considered a wide slowdown.

You ought to hasten looking for to rep the demand from permanent holders to uncover whether or no longer Bitcoin has bottomed out. Eternal holders are in fact procuring at a price of 72,000 Bitcoin per month.

On the opposite hand, demand is vastly decrease than in early 2024. A resurgence to those levels is needed for a sustainable tag rally.

Read more: Bitcoin (BTC) Label Prediction 2024/2025/2030

Other than the demand side, Glassnode’s diagnosis unearths considerable insights into the behavior of prolonged-time period holders (LTHs), who play a needed feature in the provision side as properly. LTHs in total distribute coins and hang profits correct thru bull markets, helping to put market cycle tops.

For the time being, the market is witnessing a regime where LTH divestment is moderated. This ability a hasten toward equilibrium rather than euphoria, which is a element when the unrealized profits of LTHs are better than 250%. The excessive profits motivate LTHs to promote BTC aggressively, marking a market top.

The most modern equilibrium fragment suggests that whereas LTHs must no longer but willing to offload their holdings hugely, also they’re no longer collecting at a meander, thus providing a balanced provide dynamic available in the market.

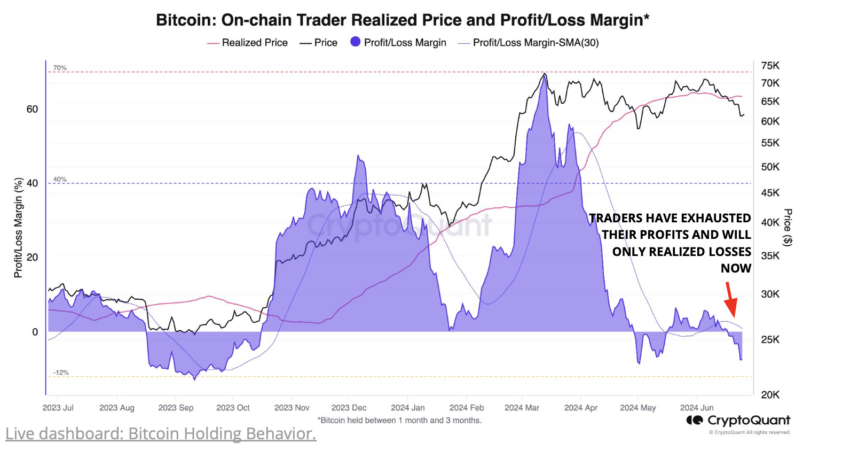

2. Assessing the Profitability of Traders

One other indicator is the profitability of merchants. For the time being, on-chain unrealized margins for merchants are in the harmful, suggesting lowered promoting strain however no longer necessarily a readiness for a tag rebound.

For a bullish signal, these margins must flip optimistic and upward thrust above their 30-day easy though-provoking sensible.

“Since mid-June, the feature tag has plunged below the price basis of every the 1-week to 1-month-mature holders ($68,500) and 1-month to 3-month-mature holders ($66,400). If this construction persists, it has historically resulted in a deterioration of investor self belief and risks this correction being deeper and taking longer to get better from,” Glassnode acknowledged.

Read more: 8 Excellent On-Chain Evaluation Instruments in 2024

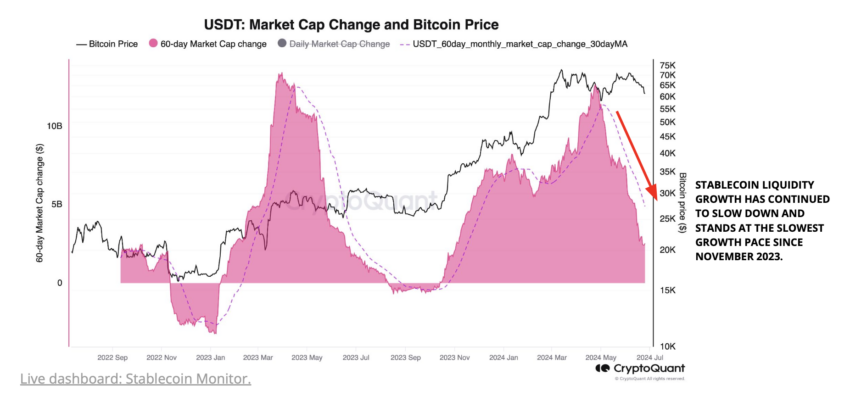

3. Evaluating Stablecoin Liquidity

The growth in Tether’s USDT market capitalization is a proxy for liquidity in the cryptocurrency market. After peaking at $12.6 billion in leisurely April, the enlargement over the previous 60 days has slowed dramatically to correct $2.5 billion, marking the slowest meander since November 2023.

An acceleration in stablecoin liquidity is needed for Bitcoin prices to rally. It might well maybe more than likely maybe maybe provide the market with the foremost capital influx to reinforce increased tag levels.

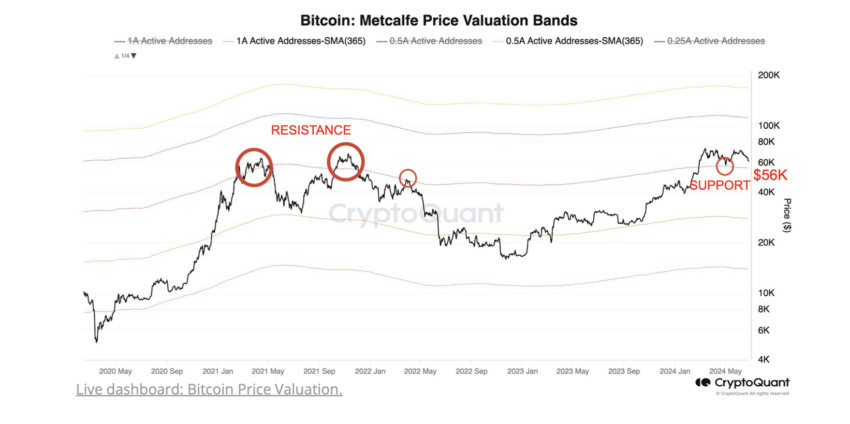

4. Monitoring the Ideal Bitcoin Label Make stronger Level

The closing indicator to position a query to is Bitcoin’s strengthen diploma, at point to pegged at $56,000 essentially based mostly on Metcalfe’s tag valuation bands.

“This valuation is essentially based mostly on the Metcalfe legislation that states the price of a community is proportional to the preference of customers in the community,” CryptoQuant explains.

This diploma has historically acted as every resistance and strengthen in previous cycles. It also equipped strengthen to Bitcoin when its tag dropped to around $56,500 in May furthermore 2024. A drop below this excessive strengthen might well more than likely maybe maybe signal a wide market correction whereas affirming above this diploma might well more than likely maybe maybe suggest the market has bottomed.

Read more: How To Review Cryptocurrencies with On-chain & Classic Evaluation

Amid these technical indicators, social sentiment also reveals signs that the market might well more than likely maybe imagine the underside has been reached. Evaluation from Santiment highlighted a spike in social volume and dominance for the time period “bottom,” suggesting a rising belief amongst merchants and merchants that Bitcoin’s tag might well more than likely maybe no longer tumble further.

On the opposite hand, the market on the total tends to hasten against the retail sentiments. Hence, merchants and merchants might well more than likely maybe composed hang into narrative the nuances fastidiously and stay their very contain be taught sooner than constructing new market positions.