Market observers mediate several altcoins, at the side of Lido DAO ($LDO), Nexo ($NEXO), Sui ($SUI), Jupiter ($JUP), and Ondo ($ONDO), could maybe well perhaps very neatly be buying and selling under their moral value.

Most modern label action has been mixed, with some tokens displaying bullish momentum while others face bearish stress. Inspecting key label developments, toughen, and resistance ranges on each of them can present insights into the capability future actions of these resources.

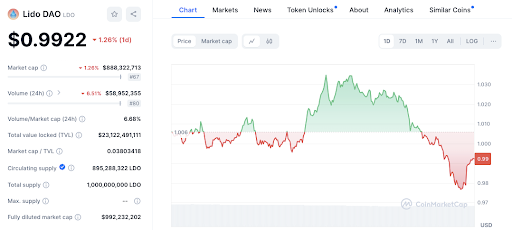

Lido DAO (LDO): Navigating a Downtrend

Lido DAO (LDO) has viewed a valuable decline currently, with its present label at $0.9862, down 2.00% in the future of the final 24 hours. At first opening at $1.006, LDO experienced a peak at $1.02 but did now not defend this degree. The token is now buying and selling under the essential $1.00 label, suggesting weakening bullish momentum.

Immediate toughen for LDO is found around $0.98. If this degree holds, it could well probably well perhaps stabilize the present downtrend. Nonetheless, a damage under could maybe well perhaps lead to additional downward movement in opposition to $0.97. Resistance is viewed at $1.00 and $1.02. To build up bullish momentum, LDO wants to rupture through these key ranges.

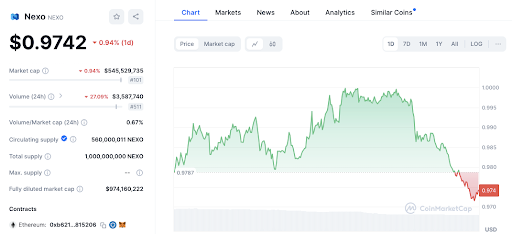

Nexo (NEXO): Struggling to Lend a hand Ground

Nexo (NEXO) is currently priced at $0.9733, reflecting a 0.66% decline within the day. The token started at $0.9787 and reached an intraday excessive of $1.00 earlier than chickening out. The present label under key toughen ranges signifies a bearish style.

Immediate toughen for NEXO is at $0.97, with the capability for additional decline to $0.96 if this degree doesn’t defend. Resistance lies at $0.98 and the psychological barrier of $1.00. A reversal of the bearish sentiment for NEXO hinges on overcoming these resistance aspects.

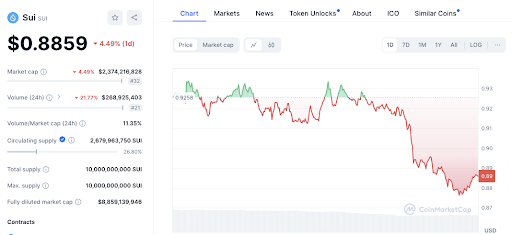

Sui (SUI): Going through Bearish Force

Sui (SUI) has faced fundamental downward stress, currently buying and selling at $0.8851, down 4.36% for the day. The token opened at $0.9258 and hit an intraday excessive of $0.93 earlier than descending. The present label suggests a solid bearish style.

Immediate toughen for SUI lies around $0.88. An additional decline could maybe well perhaps push the label the whole components down to $0.87. Resistance ranges are at $0.90 and $0.93. Breaking through these ranges is fundamental for any doable style reversal.

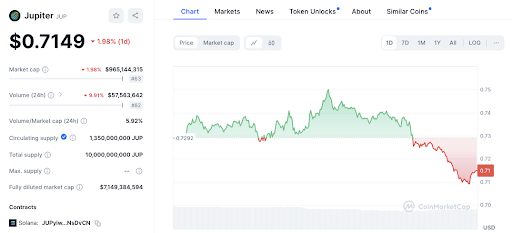

Jupiter (JUP): Assessing Downward Momentum

Jupiter (JUP) has experienced a downtrend, starting from $0.75 and transferring to $0.71. This decline is accompanied by increased selling stress and a 2.52% decrease in market cap. Lend a hand is evident around $0.71, the build apart the label has confirmed some stabilization.

Learn moreover: High 10 Below-$1 Cryptocurrencies to Utter in July 2024

Resistance is at $0.75. If JUP breaks under $0.71, it could well probably well perhaps face additional design back. Conversely, a rebound above this degree could maybe well perhaps allow it to enlighten the resistance at $0.75.

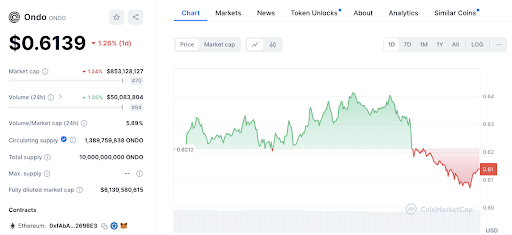

Ondo (ONDO): Oscillating with Seemingly

Ondo (ONDO) is buying and selling at $0.6116, following a peak of $0.64 earlier than getting into a downtrend. The label is drawing shut the toughen degree of $0.61, which could maybe well perhaps finish additional declines.

Resistance is illustrious at $0.64. If ONDO fails to defend toughen at $0.61, additional drops are that you just’re going to imagine. Nonetheless, a winning rebound from this degree could maybe well perhaps glimpse it enlighten the resistance and doubtlessly acquire better.

Disclaimer: The figuring out provided on this article is for informational and academic functions finest. The article would now not constitute financial advice or advice of any model. Coin Edition is now not in label for any losses incurred due to the the utilization of content, merchandise, or products and companies talked about. Readers are told to exercise caution earlier than taking any action linked to the corporate.