In accordance with contemporary recordsdata, the 12 U.S. location bitcoin trade-traded funds (ETFs) collectively prepare over 1.2 million BTC. But, two in suppose—Blackrock’s IBIT and Constancy’s FBTC—train a inserting majority, accounting for more than 71% of that combination.

Wall Facet road’s Bitcoin Giants: IBIT, FBTC, MSTR Tighten Grip on Bitcoin’s Scarce Provide

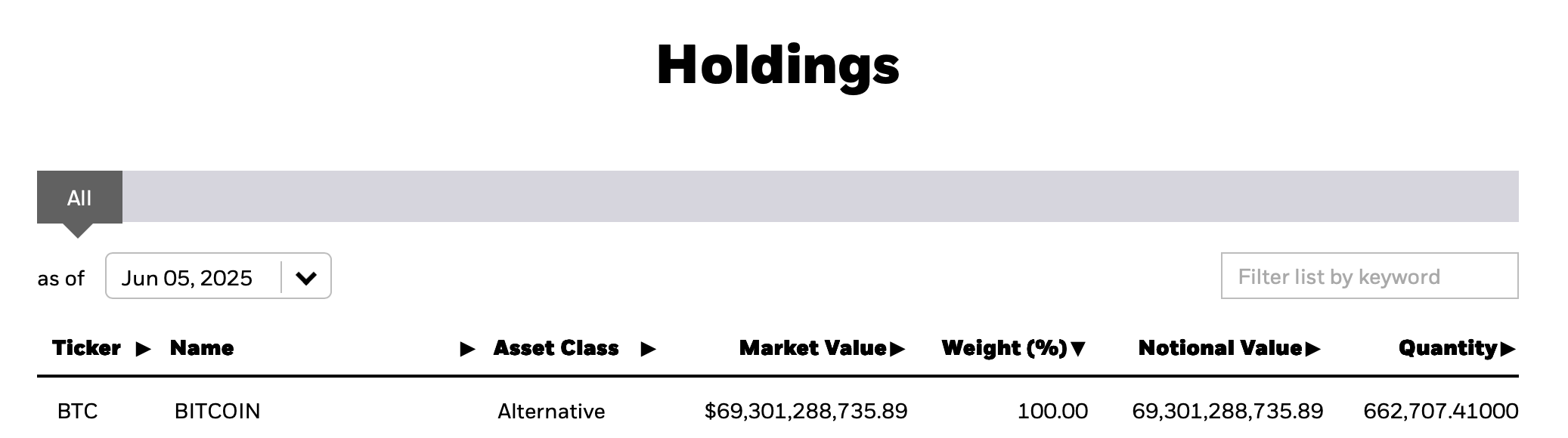

Blackrock’s IBIT debuted on Wall Facet road on Jan. 11, 2024—exactly 1 one year, 4 months, and 26 days within the past. As of recordsdata nonetheless on June 5, 2025, the agency’s Ishares Bitcoin Trust ETF controls roughly 662,707.41 BTC, translating to $69.2 billion in payment. This single ETF on my own accounts for 55.23% of the 1.2 million BTC managed by the 12 publicly traded bitcoin funds.

IBIT’s holdings comprise 3.16% of bitcoin’s 21 million mounted provide and 3.34% of the 19,875,085.22 BTC in circulation at the time of publication. No other crypto trade-traded product (ETP) has accomplished this scale of accumulation this snappy. Although IBIT and its peers trade 5 days a week, watching holidays and pauses, if IBIT had been acquiring BTC every calendar day since Jan. 11, 2024, its each day haul would be roughly 1,296.88 BTC over that stretch.

If this cadence continues, Blackrock’s ETF is projected to attain 1 million BTC by Feb. 21, 2026—fair 260 days from now—representing 4.76% of bitcoin’s onerous cap. Constancy’s FBTC, by distinction, has taken a more tempered route. Over the identical 1 one year, 4 months, and 26 days, it has gathered 196,264.34 BTC, for the time being fee fair over $20 billion at prevailing rates. Applying a similar calculations, FBTC has averaged 389.34 BTC per day since Jan. 11, 2024.

Whereas FBTC holds the honor of being the 2d-greatest U.S. bitcoin ETF, its trajectory has been contrivance more measured than IBIT’s accumulation. Could fair aloof it withhold this contemporary rhythm, FBTC would hit the 500,000 BTC milestone by spherical July 18, 2027. Possess in solutions Approach (beforehand Microstrategy), which initiated its bitcoin (BTC) acquisitions on Aug. 11, 2020. Averaged out, this translates to a each day accumulation fee of 330.09 BTC. If that identical trajectory holds real, Approach is no longer going to depraved the 1 million BTC threshold except Oct. 27, 2028.

The accelerating competitors amongst predominant financial institutions for bitcoin dominance hints at a deeper strategic shift unfolding under the ground. With accumulation timelines now plotted years into the lengthy run, these ETFs are no longer merely chasing assets—they’re staking claims in a digital monetary train. What started as a run for returns may perchance effectively evolve accurate into a contest over monetary impact itself.