KuCoin Token has emerged as the pinnacle performer in the cryptocurrency market, with a 3% surge over the previous 24 hours. This designate hike has brought on immense profits for a segment of its transient holders (STHs).

Alternatively, the very nature of these traders, who customarily honest to capitalize on rapid designate movements, poses a doable risk to the sustainability of KCS’s contemporary positive aspects. This analysis information why.

Immediate-Term Holders Put KuCoin Token at Possibility

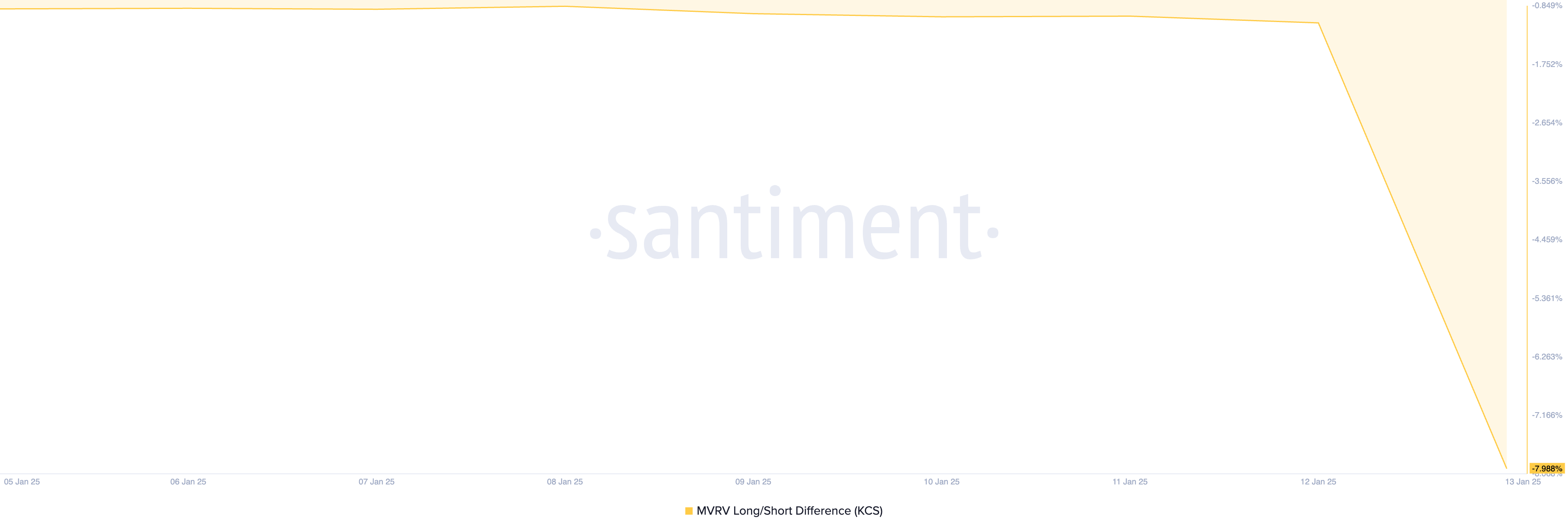

KCS has notorious a 376% uptick in its trading quantity over the previous 24 hours, pushing its designate up 3% during that interval. Attributable to this hike, many KCS STHs are of course in profit, reflected by the readings from its MVRV Long/Immediate Distinction. As of this writing, this sits at a 30-day low of -7.98%.

An asset’s MVRV Long/Immediate Distinction measures the relative profitability between its long-time interval and transient holders. When the metric’s designate is optimistic, it suggests that its long-time interval holders are extra winning, indicating bullish sentiment and doable for extra designate appreciation.

Alternatively, as with KCS, a negative distinction suggests that Immediate-Term Holders (STHs) are extra winning, signaling bearish sentiment and the aptitude for a designate fall. These traders, who customarily withhold property for shorter classes, are extra inclined to promote their tokens during transient designate fluctuations to stable profits.

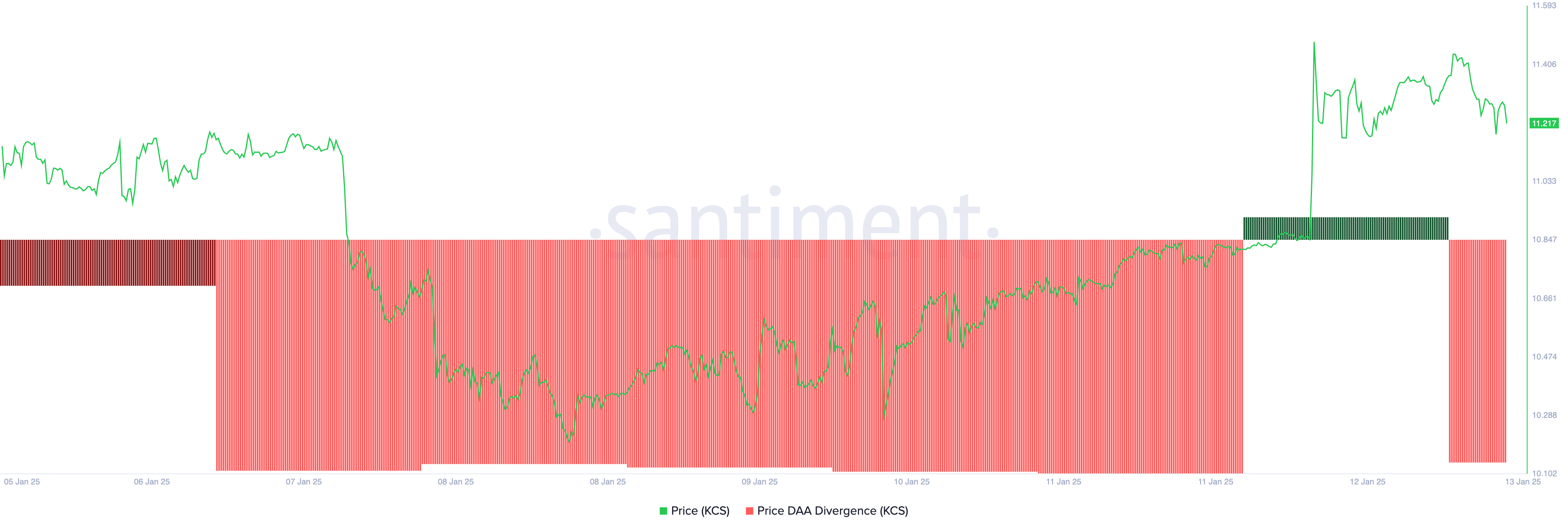

Furthermore, despite KCS’s designate hike, its Tag DAA (Day-to-day Crammed with life Addresses) Divergence indicator has very best flashed promote signals as of late.

This suggests that whereas the designate is climbing, community assignment does now no longer give a snatch to the rally, hinting at underlying weakness. If this model persists as speculative traders rob profits, a KCS designate reversal is drawing near near.

KCS Tag Prediction: Bearish Divergence Capabilities to Skill Reversal

An analysis of the KCS/USD one-day chart presentations the aptitude formation of a bearish divergence between the altcoin’s designate and its Chaikin Money Float (CMF). At press time, this indicator is in a downward model at 0.01 and is poised to plunge beneath the zero line.

An asset’s CMF measures cash stir along with the stagger into and out of its market. When it declines during a designate rally love this, a bearish divergence is fashioned. This divergence signals that selling strain is increasing, doubtlessly undermining the sustainability of the upward momentum.

If KCS’ CMF slips beneath zero, confirming the strengthening selloffs, its designate will reverse its contemporary model and plunge to $10.15.

Alternatively, if procuring for strain increases, this bearish outlook would be invalidated. In that scenario, KCS’ designate may perchance perchance breach resistance at $11.42 and climb toward $13.82.