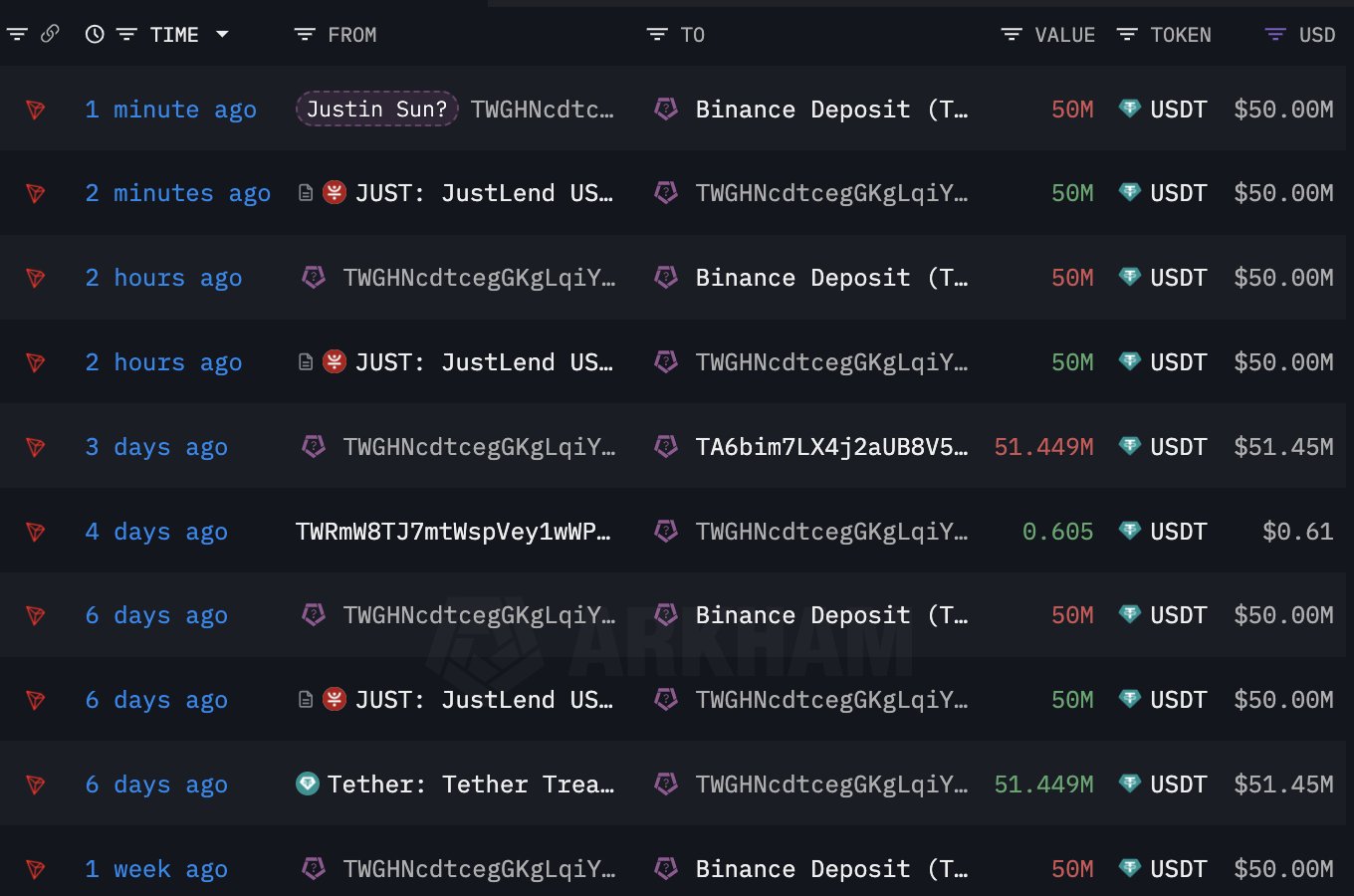

Justin Sun, the co-founder of Tron–a orderly contracting platform for deploying decentralized capabilities (dapps), is over all over again transferring and shuffling millions of bucks. According to Lookonchain details on February 29, Sun reportedly transferred 100 million USDT to Binance, days after transferring gargantuan sums earlier this week.

Justin Sun Holds Hundreds and thousands Of ETH: Will The Co-founder Purchase More?

From February 12 to 24, a pockets linked with Sun received 168,369 ETH for an moderate worth of $2,894. This own, valued at roughly $580.5 million, currently holds an unrealized profit of around $95 million. Profitability also can enlarge brooding about the bright demand for crypto, especially high coins love Bitcoin and Ethereum, in most up-to-the-minute days.

The Ethereum worth chart shows that ETH has been on a transparent uptrend, rising from around $2,200 in early February to over $3,450 when writing. At this tempo, and brooding about the institutional interest in potent crypto assets, collectively with ETH, the chances of the second most treasured coin stretching positive aspects shall be extremely seemingly.

As Bitcoin inches closer to $70,000, the likelihood of Ethereum also monitoring greater toward its all-time high of around $5,000 shall be elevated.

Since ETH already owns a spacious stash of coins, there is hypothesis that the co-founder will double down, purchasing even more coins. The crypto crew will continue staring on the deal with till this occurs and there is stable on-chain details to toughen the acquisition.

Predicament Ethereum ETFs And The Dencun Strengthen Are Key Updates

To this point, optimism is high, especially among the many broader altcoin crew. As Bitcoin races to register unique all-time highs pumped by institutional billions, eyes shall be on the US Securities and Alternate Commission (SEC). There are more than one capabilities for an area Ethereum commerce-traded fund (ETF).

The agency has now not provided a definitive timeline for approving or rejecting the spinoff product. There’s regulatory uncertainty across the popularity of ETH, a large headwind that also can prolong and even quit the timely authorization of this product.

Restful, the crew is calling forward to the next communique in Also can. If the space Ethereum ETF is a hurry, the coin will seemingly rally to unique all-time highs, following Bitcoin.

Nonetheless, sooner than then, eyes are on the expected implementation of Dencun. The upgrade addresses challenges going through Ethereum, collectively with scalability. Via Dencun, Ethereum developers hope to set up the unfriendly for added throughput enhancements within the upcoming years.

With greater throughput, transaction costs tumble, overly bettering user skills. This upgrade also can hurry a long formulation in cementing Ethereum’s aim in crypto, wading off stiff competitors from Solana and others, collectively with the BNB Chain.