The JUP token designate persevered its parabolic circulation this week as Jupiter’s market fragment in the decentralised alternate (DEX) alternate rose. The token soared to a excessive of $0.6388, its most life like doubtless point since February 2nd. It has jumped by extra than 46% from its lowest point this one year.

Jupiter market fragment good points

Jupiter, a brand new decentralised alternate (DEX) in Solana’s ecosystem, has emerged as one amongst the fastest-rising players in the alternate.

Files reveals that it has added hundreds of customers and is now processing tokens rate billions per week amid the continuing crypto bull bustle.

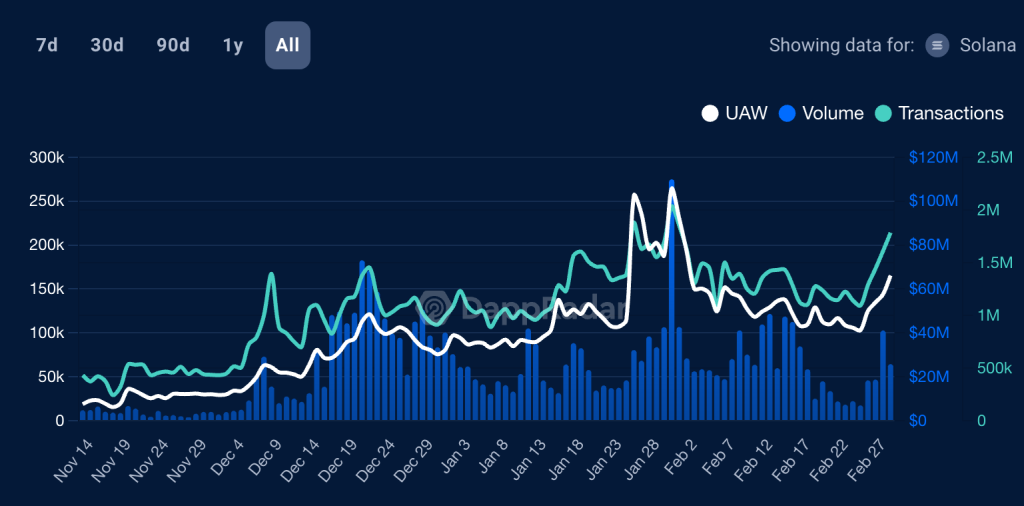

Based fully mostly on DappRadar. The platform has had over 1.32 million Uncommon Lively Wallets (UAW) in the previous 30 days, a 33% lengthen. It has also had over 41 million in transactions in this period, making it one amongst the head players in the alternate. The chart under reveals this fashion since November.

Jupiter DEX transaction fashion

The diverse crucial data from CoinGecko reveals that the day-to-day quantity of all tokens traded in the alternate has jumped sharply lately. It jumped to over $1.4 billion in the previous 24 hours, making it the 2d-ideal player in the alternate after Uniswap.

Uniswap’s V3 on Ethereum dealt with over $1.57 billion, that methodology that Jupiter is narrowing the hole. And it’s a ways never any longer alone as Orca dealt with over $931 million in the identical length. Most critically, the total fee locked (TVL) in the Jupiter ecosystem has soared to a legend excessive of $216 million.

Jupiter’s market fragment has jumped as a result of sturdy performance of Solana and its ecosystem. As I wrote on Thursday, Solana pricemade a sturdy bullish breakout, because it moved above its most life like doubtless point in December. As it jumped, it invalidated the double-high pattern that has been forming.

Also, diverse players in the Solana ecosystem luxuriate in Bonk, dogwifhat, and Jito dangle all made a sturdy bullish breakout. Essentially the most energetic pairs in Jupiter were USDC/SOL, USDC/USDT, MSOL/SOL, and USDT/SOL.

Jupiter designate forecast

JUP chart by TradingView

On the 4H chart, we search that the JUP token designate bottomed at round $0.4550, its lowest swing on February Twenty fourth.

It has now bounced again and moved above the crucial resistance point at $0.5620, its most life like doubtless diploma on February 15th. The token has also risen above the 50-length involving common and the 38.2% retracement point.

Also, the Relative Energy Index (RSI) and the MACD indicators dangle pointed upwards. Consequently of this truth, the outlook for the JUP designate is bullish, with the next thunder drag wanting being at $0.6673, the 50% retracement point.

The post JUP token designate spikes as Jupiter good points market fragment in DEX seemed first on Invezz