Recently, Joe Coin has been gaining loads of attention this implies that of its rising model. Many investors and crypto followers are new about what’s causing this surge and what the future holds for this digital currency. On this article, we’ll steal a nearer leer at why Joe Coin is on a bullish pattern, what components are driving the expansion, and what to hunt files from next.

How has the JOE Coin Mark Moved Recently?

The sizzling model of JOE is $0.367958, with a 24-hour trading volume of $21.37 million. It has a market cap of $132.35 million and holds a market dominance of 0.01%. Over the final 24 hours, JOE’s model has increased by 3.84%.

JOE hit its all-time high of $4.98 on November 21, 2021. Its lowest recorded model modified into $0.026588 on August 11, 2021. Since that peak, JOE reached a cycle low of $0.132031, with a rebound to a cycle high of $1.23537. The sizzling market sentiment for JOE is bullish, whereas the Agonize & Greed Index sits at 50, indicating a just sentiment.

There are 359.69 million JOE tokens in circulation, out of a most provide of 500 million. JOE’s annual provide inflation rate is 6.91%, meaning 23.26 million unusual tokens had been created over the final yr.

Why JOE (JOE) Coin Mark is UP?

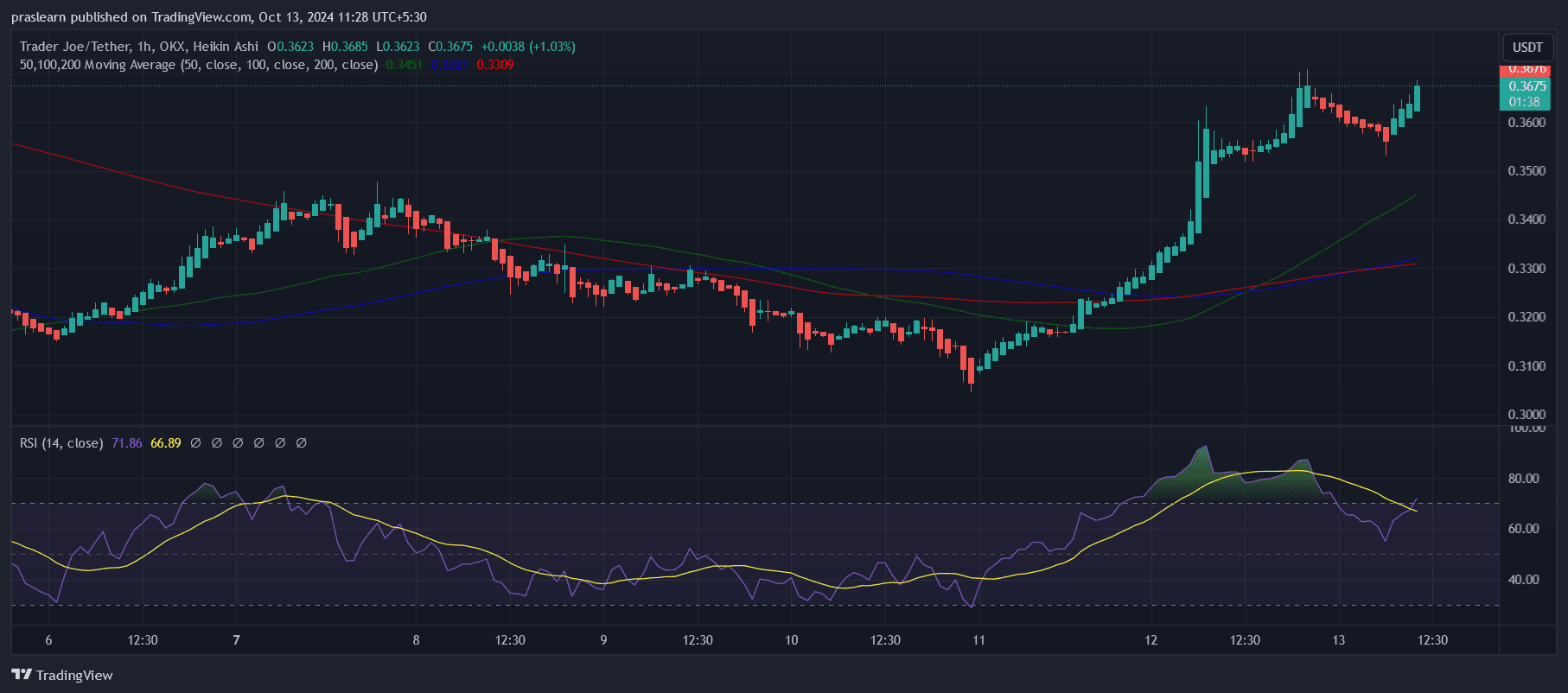

The latest surge in JOE Coin’s model will be attributed to a combination of tough technical and main components. From a technical standpoint, the JOE/USDT trading pair has shown sturdy bullish momentum, particularly after a consolidation section from September 21 to October 1.

This consolidation, marked by sideways model motion, helped set a sturdy toughen depraved across the $0.012 vary, which has since propelled the model upwards. This pattern suggests a healthy model buildup, where investors obtained confidence, main to increased making an strive for stress and a subsequent breakout.

Basically, JOE Coin’s model is being boosted by its strange imaginative and prescient and choices, similar to the Liquidity E-book (DLMM), Token Mill (BCAMM), and an upcoming Central Restrict Enlighten E-book (CLOB). These innovations are making a extra atmosphere friendly, low-model, and accessible on-chain substitute, which appeals to each merchants and investors.

The strategic integration of JOE’s ecosystem with prominent blockchains like Avalanche (AVAX), Arbitrum, and Monad extra enhances its model proposition by leveraging these tough platforms for instantaneous and scalable transactions.

Furthermore, the earnings-sharing mannequin, where stakers of JOE compose a portion of the platform’s earnings, is driving seek files from as extra investors are drawn to the token’s passive profits attainable.

This mannequin aligns with the broader market pattern where tokens that supply utility and rewards are at possibility of compare increased ardour. All these components combined make contributions to the sizzling upward model pattern for JOE Coin, with sturdy indications that it also can proceed its bullish trajectory as adoption grows and the platform’s ecosystem expands.

How high can the JOE (JOE) Mark race?

The price of JOE (JOE) has shown sturdy enhance, growing by 62% over the final yr, supported by its sturdy technical indicators and extraordinary platform choices. Shopping and selling above the 200-day simple appealing common is a key bullish signal, suggesting that the coin is in an upward pattern and gaining momentum.

Furthermore, JOE has posted 15 green days in the previous 30 days, representing a 50% success rate in sure day after day performance, extra reinforcing the sizzling bullish outlook. With high liquidity relative to its market cap, JOE enjoys soft trading and reduced model volatility, which is known as a signal of confidence amongst merchants and investors.

On the other hand, despite these strengths, JOE has been outperformed by 51% of the high 100 crypto resources over the final yr and severely by Bitcoin, which indicates that whereas JOE is experiencing enhance, it is potentially not as aggressive as another predominant cryptocurrencies. It’s miles additionally smooth down 93% from its all-time high of $4.98, which serves as a reminder that whereas JOE is on a definite trajectory, it has a prolonged restoration direction ahead to gather its earlier highs.

Searching ahead, the model attainable of JOE will depend upon a combination of things, along with its means to defend the sizzling momentum and proceed delivering model to its ecosystem.

With innovations just like the Liquidity E-book and Token Mill improving the platform’s utility, coupled with the earnings-sharing mannequin that incentivizes staking, there’s a sturdy foundation for future enhance. On the other hand, the yearly inflation rate of 6.91% also can exert downward stress on the model if the unusual token issuance outpaces seek files from.

By formulation of future model predictions, if JOE can retain its bullish pattern and proceed attracting merchants and investors to its ecosystem, it also can blueprint for fundamental milestones, with attainable resistance spherical $1.23 (its final cycle high).

Over the longer duration of time, with persevered adoption and favorable market conditions, it would possibly well maybe presumably bother its all-time high, however this would possibly well require a predominant shift in market sentiment and broader crypto market performance. Therefore, whereas the shut to-duration of time outlook remains sure, it also can steal time earlier than JOE approaches its earlier peak.