On-chain analytics point to that insiders are starting to sell YEPE, which licensed trader James Wynn promoted.

- YEPE, memecoin tied to James Wynn, fell 25% after insiders began selling

- At commence, insiders seemingly managed more than 60% of the token, on-chain records exhibits

- To this point, insiders possess made $1,4 million in earnings, and mute be pleased more than 50% of the provision

Memecoin season, significantly on BNB, appears to be coming again. However with it, there’s moreover an explosion of questionable initiatives. On Thursday, October 9, Yellow Pepe, moreover called YEPE, linked to James Wynn, saw a serious correction after apparent insiders began selling.

The BNB-based fully mostly (BNB) memecoin dropped 25%, from 0.4% to 0.3%, after gaining more than 400% in precisely days since its commence. Seemingly the foremost driver of its rally became as soon as the endorsement of a high-profile trader, James Wynn, known for his ultra-leveraged trades, main both to giant beneficial properties and losses.

In an X post, Wynn shared the token’s address, claiming that “YEPE is flying,” and that the “market has spoken”. Predictably, this ended in his followers investing in this current memecoin.

YEPE token exhibits purple flags since commence

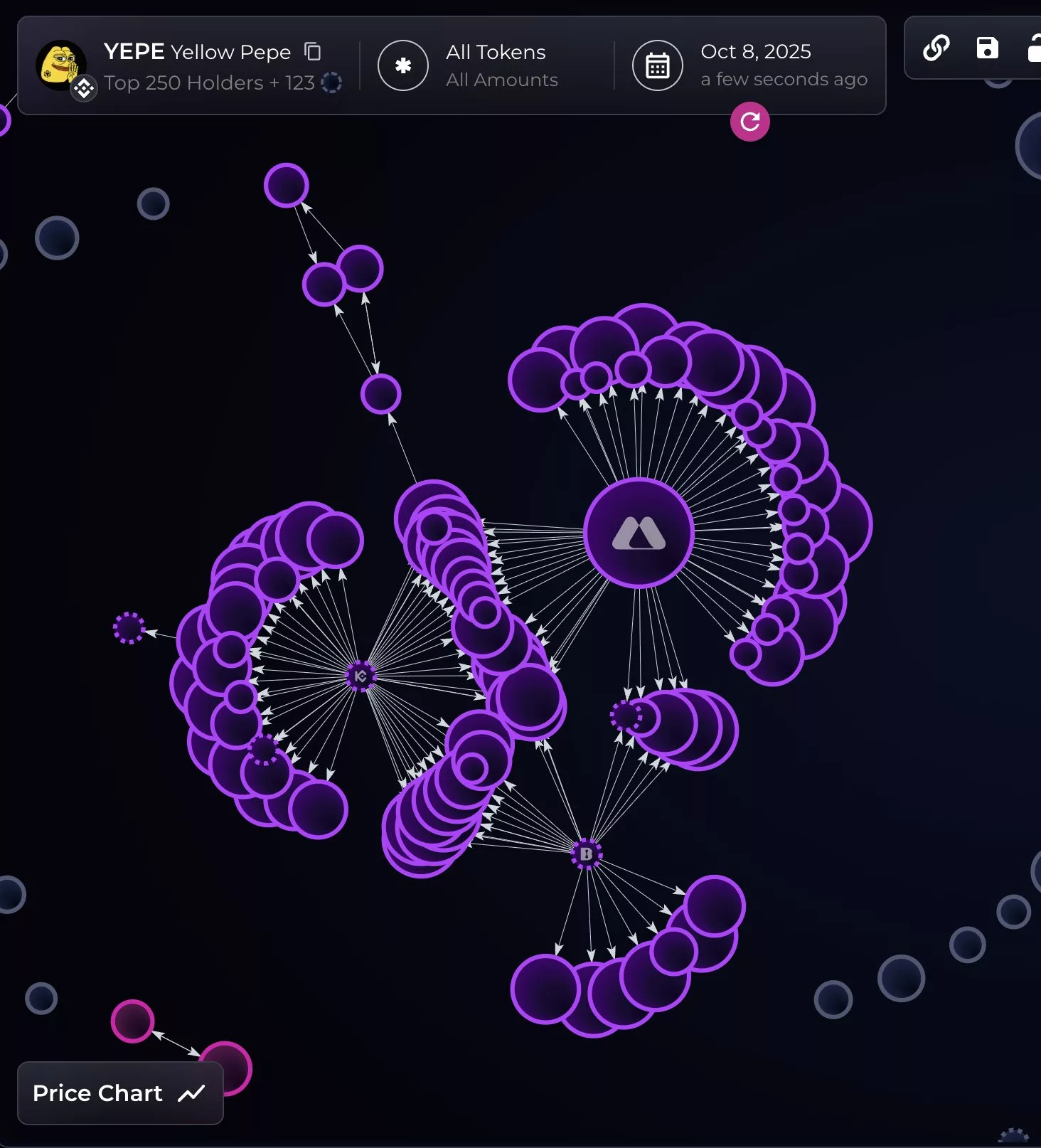

Silent, the token displayed purple flags from its commence. Blockchain analytics platform Bubble Maps published on October 5, the day of its commence, that insiders held 60% of YEPE. One of these high focus could moreover moreover be a purple flag and could moreover result in foremost stress on the price as insiders commence selling.

Predictably, right here’s precisely what came about. On October 8, insiders began dumping their YEPE positions, making $1.4 million in earnings by the subsequent day. What’s more, no topic this selling spree, insiders mute be pleased more than 50% of the token’s provide, in step with Bubble Maps.