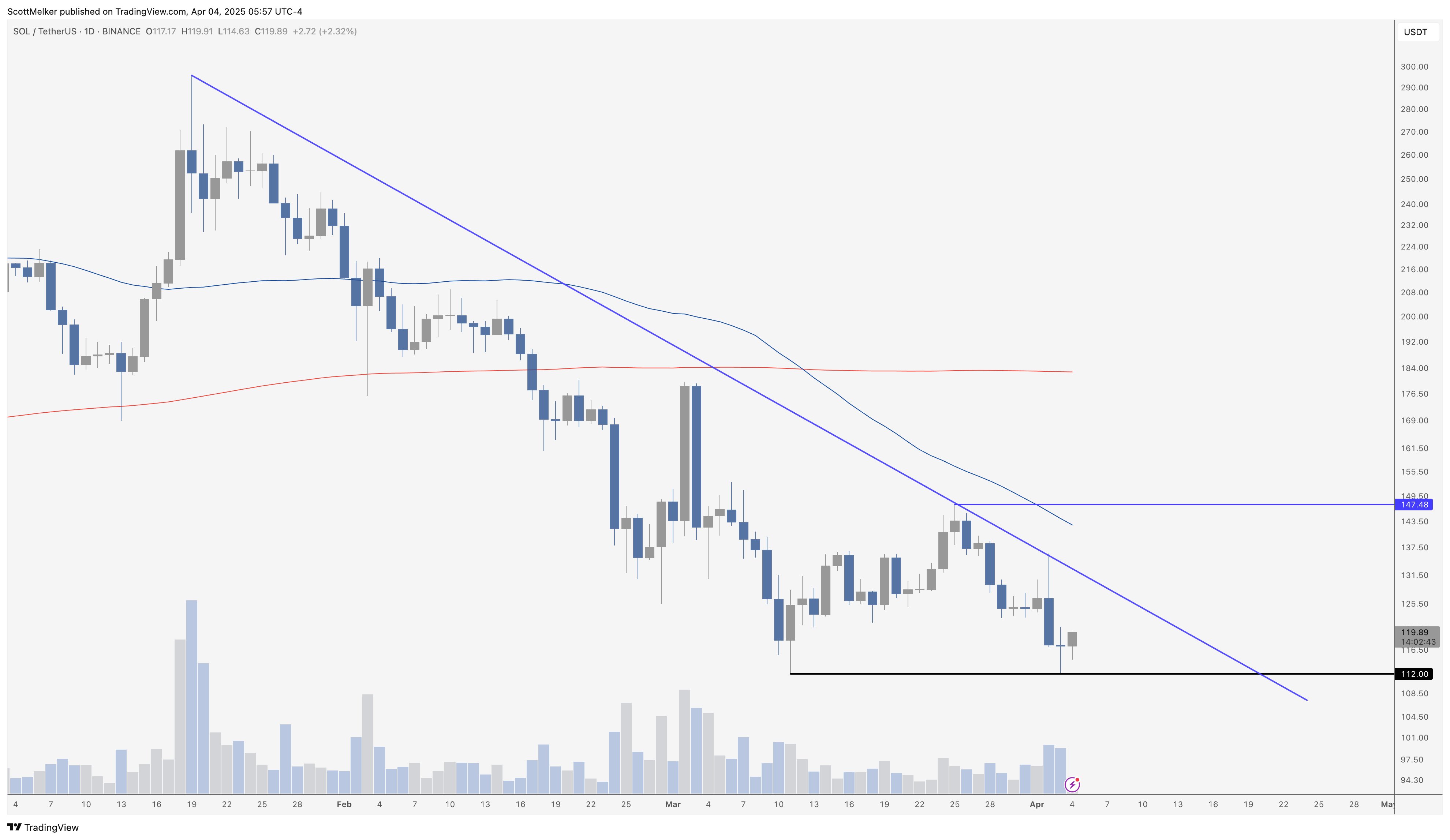

In a recent technical diagnosis shared by job of X, crypto analyst Scott Melker aka The Wolf Of All Streets (@scottmelker) highlighted a critical toughen-resistance setup for Solana (SOL), emphasizing what he views as a textbook jump off of a key technical stage. “Picture wonderful jump off of $112 toughen. Double bottom would verify with a atomize above $147, the swing high between the 2 bottoms. Don’t let someone call it a double bottom till that occurs. Regardless, nice jump off of toughen with defined resistance to stumble on,” Melker mentioned.

The analyst’s chart presentations SOL rebounding from near $112, reinforcing that zone as vital quick-term toughen. For a bullish double-bottom pattern to validate, Melker sides to a breakout above the downtrend line (for the time being around $130). If SOL breaks this resistance, $147 would possibly be the critical stage that can per chance well must be breached. Except then, he advises warning about prematurely labeling the formation as a confirmed double bottom.

Solana Bottom In?

Critically, these remarks attain on the heels of unlocks. In step with a put up by on-chain intelligence company Arkham on Thursday, “$200M OF SOL UNLOCKING TOMORROW. Day after these days to come (4th April) marks the largest single-day free up of staked SOL till 2028. These 4 accounts staked a complete of $37.7M of SOL in April 2021, and are up 5.5x at contemporary costs.” The scale of these unlocks has generated substantial discussion on social media.

One other trader, NooNe0x, took a extra optimistic stance, remarking, “SOL unlocks. Taking a see at the grand facet, at the contemporary time’s free up used to be the final mountainous block. At the contemporary time on my own is as grand as 40% of the total lot that’s level-headed left. It’s 78% done, Could well, June and

Historically, predominant token free up occasions—whether or now no longer for Solana or diverse initiatives—occupy on the total been anticipated successfully prematurely by traders and investors. Markets “label in” that mountainous holders sell their outmoded tokens, normally utilizing costs lower before the specific free up. As soon as the free up date arrives, if the anticipated sell-off does now no longer materialize as severely as feared (or if grand of the unlocked stake remains off the market), costs occupy tended to stabilize and on the total acquire successfully within the days or weeks that observe.

This pattern emerges as a result of many holders, especially elevated or early investors, might per chance well decide to restake or withhold onto their tokens within the event that they withhold a solid traditional outlook. Meanwhile, quick-term traders who had been making a guess on free up-linked volatility might per chance well shut positions as soon as the match passes. This “aquire the rumor, sell the news” (or vice versa) dynamic can result in label whipsaws around free up periods, but no single result is assured; grand relies upon on how grand genuine selling power surfaces and broader market sentiment at the time.

Meanwhile, Awawat, a trader and angel investor at APG Capital, cautioned that Solana would possibly be in a precarious dwelling despite protecting above $100. “SOL entirely shrekt – broke 170 vary low, bounced at 120 as soon as or twice – now protecting above 100 however the ice is skinny – final colossal free up the following day – will dispute sub-100 if given but this appears to be like to be like rough given the affirm of the trenches,” he wrote.

At press time, SOL traded at $115.