There are fewer crypto investments for the time being, in step with challenge capitalist Adam Cochran.

VCs assuredly face stress from their restricted companions who’re basically allowing for beating index fund returns.

Cochran — founder of the firm CEHV — explained in a thread on X.com: “VCs accept as true with slowed investing in crypto by lots, and [it’s] a little of a nuanced motive: 1. Most of them accept as true with LPs that factual are desirous to beat index fund returns. 2. Over a medium time period the [risk/return ration] of owning Bitcoin and ETH will without disaster beat index funds, and can handiest be beat by early stage bets.”

Note below.

1/10

VCs accept as true with slowed investing in crypto by lots, and its a little of a nuanced motive:

1. Most of them accept as true with LPs that factual are desirous to beat index fund returns.

2. Over a medium time period the R:R of owning Bitcoin and ETH will without disaster beat index funds, and can handiest be beat by early stage… https://t.co/yOG4TPdkFx

— Adam Cochran (adamscochran.eth) (@adamscochran) August 9, 2024

VCs assuredly target excessive-relate startups and rising technologies that provide colossal upside doable.

For example, the S&P 500 index fund, a protracted-established benchmark for U.S. equities, has delivered a median annual return of roughly 15% real thru the last five years, in step with recordsdata from curvo.eu.

In incompatibility, Bitcoin (BTC) has largely outperformed index funds over the identical period, garnering about Forty five% in common annual returns.

Cochran — a specialist in fintech, man made intelligence and cryptocurrency — highlighted that despite the very fact that crypto investments harbor excessive dangers, they’ve historically outperformed index funds over the medium time period, presenting excessive-reward opportunities. However, he added that VC funds are assuredly skeptical about making such investments at the early stage due to the probability element of digital currencies.

The challenge capitalist explained that many VCs opt to preserve investments in Bitcoin and Ethereum (ETH), alongside with just a few excessive-profile breakout projects, to generate charges and return capital.

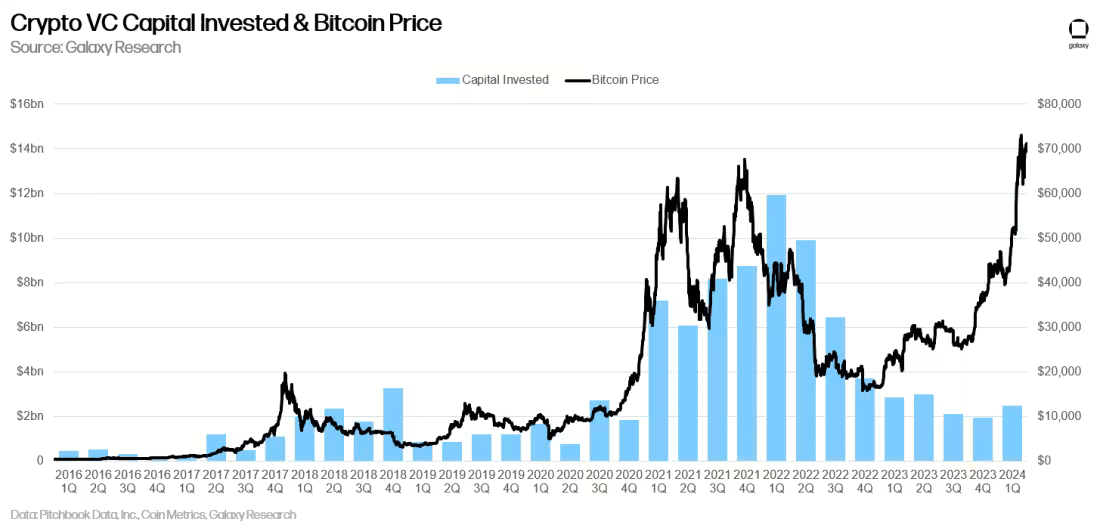

Per a most modern watch from Galaxy Study, within the first quarter of 2024, roughly 80% of challenge capital funding used to be disbursed to early-stage companies, with the final 20% going to later-stage companies.

Despite a decrease in hobby from expansive generalist VC companies, which accept as true with either exited the crypto sector or seriously reduced their investments, crypto-focused early-stage challenge funds accept as true with remained packed with life.

Moderately just a few these funds silent accept as true with capital from their 2021 and 2022 fundraises, allowing promising early-stage crypto startups to stable funding. However, later-stage startups face elevated subject in raising capital due to the reduced involvement of greater VC gamers.

In step with Cochran, one day of the last market cycle, VCs were extra packed with life in investing in applications that had already received traction, such as OpenSea, hoping to capitalize on unhurried-stage user relate.

Moreover, he believes that with hobby in old trends tackle non-fungible tokens, or NFTs, as effectively as AMM forks, DeFi, and layer 2 solutions cooling down and the market awaits the following large innovation, VC companies are in a maintaining pattern.

4/10

Whereas every VC firm manufacturers themselves as pro-innovation and within the trenches with the builders, most of them don’t basically pursue moonshots, they factual throw capital at breakout trends.

On epic of they set up no longer basically accept as true with sufficient substitute insights to steal new probability.

— Adam Cochran (adamscochran.eth) (@adamscochran) August 9, 2024

Cochran popular that whereas some builders proceed to make new tips without exterior capital, discovering the following major pattern is stalled.

This plight is exacerbated because VCs imagine sluggish capital can homicide colossal returns in cash markets, discouraging early-stage investments.

He added that this period of boom of no process serves as a litmus test for VC companies’ accurate commitment to the crypto substitute.

These with a deep knowing of the home can silent blueprint impactful early-stage investments. In incompatibility, others would possibly handiest make investments in later-stage opportunities, revealing a lack of factual alignment with the sphere.