The Net Computer (ICP) mark has recently drawn consideration, reflecting a stable, realistic sure user passion shown by the OI-Weighted Funding Charge. Despite a constant decline in the RSI 7D over three weeks—suggesting a vivid buying ecosystem but a potential tumble in passion.

Alternatively, this bullish pattern could well soon shift. Remarkably, ICP has surged 38.68% all the scheme in which thru the final month, with an astonishing forty five.60% ranking larger in correct two days. Alternatively, EMA lines could well soon shift mark sentiment.

RSI Has Been Declining

ICP mark grew from $10.Seventy nine on March 20 to $20.59 on March 27, a 90.82% sing. It’s attention-grabbing to enlighten that RSI 7D was around 73 and 74 right thru that identical duration.

The Relative Strength Index (RSI) is a momentum oscillator that measures the velocity and alternate of mark movements, starting from 0 to 100. On the overall, an RSI above 70 indicates an asset is overbought and will seemingly be primed for a mark correction, whereas an RSI below 30 suggests it’s a ways oversold and doubtlessly undervalued.

For Net Computer (ICP), the RSI 7D stood around 86 in the first half of of March, signaling great purchaser passion and a that it’s essential well seemingly also deem of overbought situation. It then declined to 73 and is currently at 71, reflecting a constant decrease.

This downward pattern in RSI means that keenness in ICP could well be cooling off, seemingly leading to a consolidation piece. A consolidation piece, characterised by lowered mark volatility and tighter trading ranges, could well masks that the market is balancing out quiz and provide after the fresh surge, environment a potential groundwork for the following mark motion direction.

Read More: Net Computer (ICP) Coin Explainer for Inexperienced persons

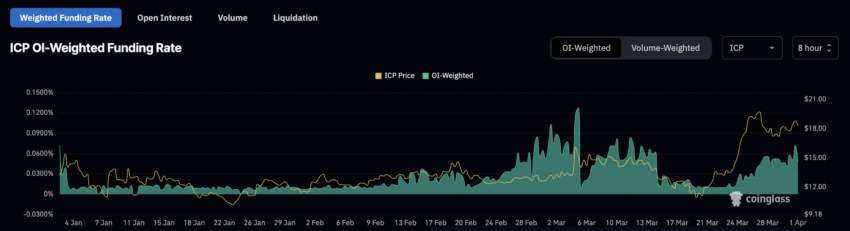

Start Curiosity Weighted Funding Charge Indicates Stable Curiosity

The ICP OI-Weighted Funding Charge has considered a well-known shift from 0.003% one week ago to its fresh standing at 0.0483%. This metric, most foremost for thought market dynamics, represents the everyday rate paid by traders to withhold futures positions, adjusted in accordance with the overall originate passion across assorted exchanges.

Indubitably, it reflects the market’s leverage sentiment; a bigger rate indicates a bullish outlook with long positions dominating, suggesting traders are willing to pay extra to withhold their bets on rising prices.

Historically, correct earlier than the closing mark surge, the OI-Weighted Funding Charge for ICP was around 0.01%, a stage that preceded valuable mark appreciation.

The fresh ranking larger to 0.0483% mirrors this pattern, suggesting an intensified bullish sentiment. Alternatively, this gargantuan ranking larger moreover brings the chance of market saturation; as the rate to withhold long positions becomes larger, the incentive for taking fresh long positions diminishes, doubtlessly leading to a stabilization or consolidation of mark.

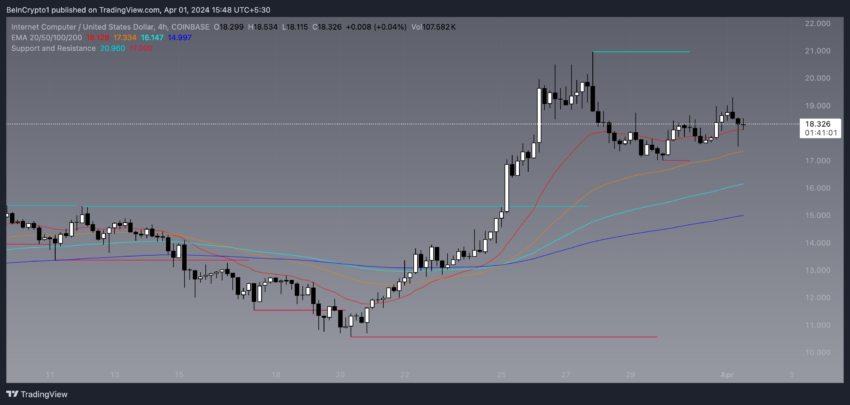

ICP Imprint Prediction: Consolidation Earlier than Novel Push?

Analyzing the ICP 4H mark chart, a well-known pattern emerges with the EMA (Exponential Transferring Moderate) lines executing a ‘golden inappropriate’ on March 23. A golden inappropriate happens when a shorter-time duration transferring moderate crosses above a longer-time duration transferring moderate. That indicates a potential bullish momentum forward. After this inappropriate, the ICP mark certainly witnessed a spirited upward push from $13.2 to $19.8 by March 27.

EMA lines are long-established to tender out mark info to title the market pattern extra clearly. They provide extra weight to fresh prices, making them extra responsive to fresh info. Even supposing the golden inappropriate suggested an upward pattern, the converging distance between the EMA lines in the closing few days could well point in direction of mark consolidation.

Right here’s when an asset’s mark trades within a confined differ as the market decides its subsequent switch, regularly characterised by traders taking earnings and fresh traders coming into the market at the fresh mark ranges. Hence, it means that the ICP mark could well stabilize non permanent between $16 and $18.

Read More: High 9 Man made Intelligence (AI) Cryptocurrencies in 2024

Taking a belief forward, if the buying stress is great ample and the bullish sentiment persists, ICP could well push to test the resistance at $20.Ninety nine. Conversely, if the market experiences a shift in sentiment leading to a downtrend, ICP could well tumble to pork up ranges of $11.5 and even extra correct down to $10.5.