The dot-com express turn into once one huge birthday party.

Notably even as you labored in know-how, that interval from 1995-2000 turn into once a sexy time to be alive. Every person turn into once purchasing for computers, the on-line turn into once taking off, and people bear been turning into in a single day millionaires (at the least on paper).

Then came the dot-com rupture of 2000, and all these paper paychecks went up in smoke. But from the ashes of the dot-com fire arose the next generation of world-changing firms: Amazon, Google, and the full leisure.

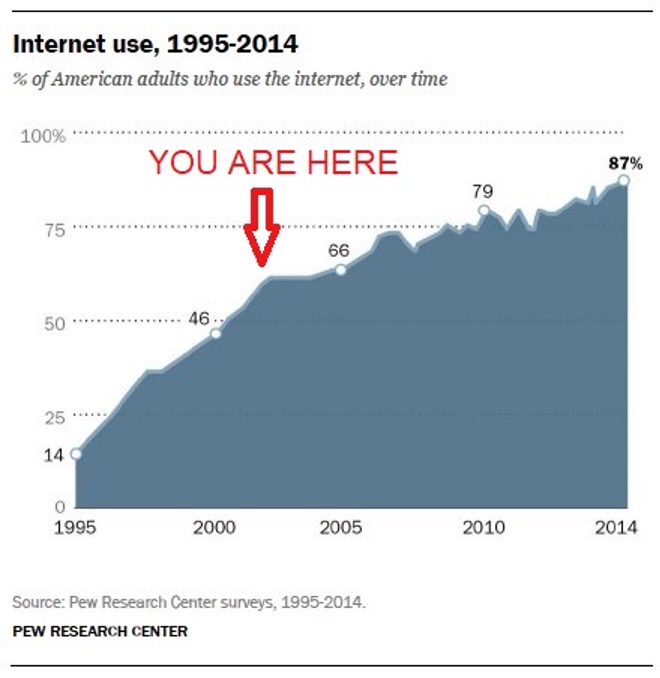

I turn into once lately impressed by an splendid social put up evaluating Net adoption vs. crypto adoption over time. I couldn’t secure sources for his or her numbers, so I spent the morning replicating the chart with respectable files (ogle above). My findings are a shrimp bit completely different, however the takeaway is similar.

In step with this chart, the crypto commercial in 2024 is at a identical stage as the on-line commercial in 2002.

As somebody who’s lived by both, that feels about shapely. Right here’s why.

Users are Increasing

In 2002, the on-line turn into once soundless within the early levels of mass adoption: a entire bunch users, but nowhere conclude to the saturation level. Many other people bear been shapely approaching-line, and broadband turn into once soundless in its infancy (there turn into once quite quite a bit of text, not great video). Memes bear been shapely turning correct into a thing.

In 2024, crypto feels like it’s shapely beginning to enter that segment of hypergrowth. The first crypto ETFs bear launched within the U.S., opening it as a lot as the masses. It’s going from this geeky thing with confusing wallets and passkeys to consumer-pleasant products that someone can entry.

Markets are Maturing

In 2002, the market turn into once soundless reeling from the dot-com rupture, which shut down many early Net companies. The entire firms that survived had to tighten their belts and originate trusty, sustainable companies. This turn into once within the ruin shapely for the commercial: it compelled us to level of curiosity.

In 2024, we’ve been by several crypto booms and busts, but these that bear survived bear also become trusty, sustainable companies: Binance, Coinbase, Circle, Ethereum, Uniswap, and tons others. This, too, has been shapely for the commercial: it compelled us to level of curiosity.

Core Technology is Making improvements to

In 2002, there turn into once so great infrastructure being built: web standards, AJAX, WordPress, e-commerce – and in particular broadband, which would possibly maybe maybe maybe allow video, social media, and all forms of web-essentially based completely applications. All these core technologies bear been the muse of the Net as of late.

In 2024, we’re engaged on core technologies like Layer-2 networks to enhance tempo and more inexpensive mark, DeFi applications that judge our entire financial machine on blockchain rails, and tokenization of trusty-world resources. These are the constructing blocks of the next day’s financial machine.

Rules is Evolving

In 2002, there bear been profound questions about administration the Net, in particular in regard to privacy, security, and mental property. The Telecommunications Act of 1996 turn into once the grand one, adopted by DMCA (1998), E-Authorities Act (2002), and CAN-SPAM (2003).

In 2024, we’re at final seeing some circulate within the U.S., with FIT 21 as a key milestone. The EU has handed the Markets in Crypto-Assets (MiCA) framework, while worldwide locations like Singapore and Switzerland are positioning themselves as crypto-pleasant hubs. (China soundless hates crypto.)

Companies are Increasing Up

In 2002, the successful web firms transitioned from speculative commercial gadgets to trusty earnings generation, pioneering fresh playbooks like e-commerce (Amazon), on-line selling (Google), and digital payments (PayPal).

In 2024, the crypto commercial is evolving from speculative procuring and selling and ICOs into trusty commercial gadgets: digital exchanges (Coinbase, Binance), crypto fund administration (Fidelity, BlackRock), web hosting dapps (Ethereum, Solana), and great more.

The Giants are Emerging

In 2002, it’s laborious to undergo in mind that many shoppers had written off the Net. But that would possibly maybe maybe maybe bear been a large mistake, as a couple of Net firms began to develop into giants that would possibly maybe maybe maybe rapidly dominate the sector (Google, Amazon, eBay).

In 2024, we’re at the identical inflection level, as a brand fresh class of “crypto giants” are beginning to develop in energy. We’ve covered them above, and we duvet them each week in our newsletter. Investing in these crypto firms in 2024, we middle of attention on, is like investing within the Net in 2002.

How Huge Will Crypto Develop?

What’s most intriguing about these chart is how the Net grew after 2002.

If crypto continues to seem at the identical enhance curve as the Net, we’ve bought a “long express” of sustained enhance forward of us, which bodes smartly for our long-term, purchase-and-protect plan.

The Net express turn into once about all people getting on-line. Crypto is ready all people getting on-chain.

The Net associated the sector to a world files machine; crypto is connecting the sector to a world financial machine.

The Net disrupted inclined media; crypto is disrupting inclined finance.

There’s so great noise in crypto markets that it will be worthwhile to each at times design conclude a breath, design conclude a step again, and ogle how far we’ve come.

But how far will we stride? If Net historical previous is any handbook, the birthday party is solely getting started.

* Caveat: Crypto users will be overstated, since it’s genuinely tracking wallets, and a consumer can bear a couple of pockets. As continually, the future would possibly maybe maybe leer completely different than the previous. Make investments carefully.