Marathon Digital Holdings (NASDAQ: MARA) is the area’s greatest publicly traded Bitcoin (BTC) mining firm. Institutional investors savor step by step increased their positions in Marathon despite the block subsidy halving anticipated in April.

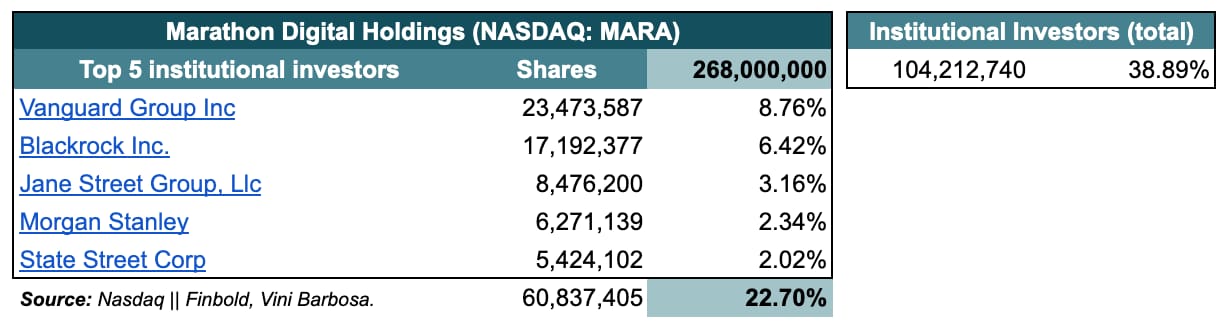

Specifically, institutional investors possess 38.9% of Marathon’s prominent shares, preserving 104,212,740 out of the 268 million. Finbold gathered this data from Nasdaq, which also reveals the tip five institutional shareholders of the Bitcoin mining firm.

First, Vanguard holds 23.47 million shares (8.76%). Subsequent, BlackRock and Jane Avenue savor 17.19 million (6.42%) and eight.47 million (3.16%), respectively. Morgan Stanley has 6.27 million (2.34%) and Tell Avenue is the fifth-greatest with 5.42 million (2.02%).

These five institutional investors sum up to 60,837,405 shares and possess 22.7% of Marathon Digital Holdings.

Marathon stock prognosis

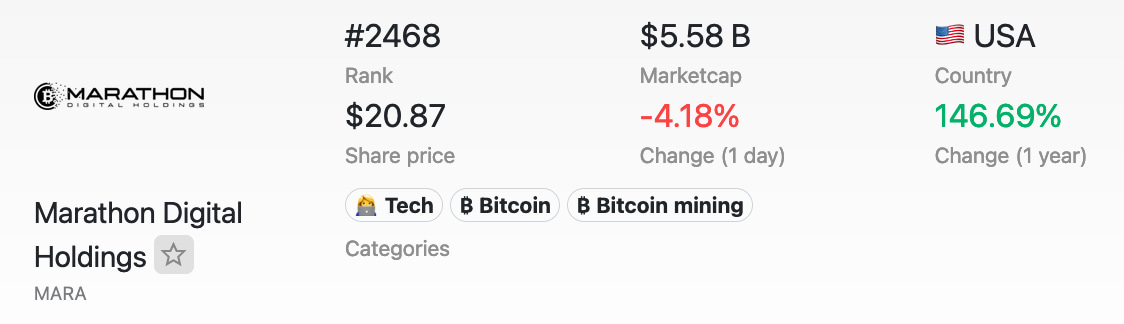

Particularly, MARA is the leading firm in the Bitcoin mining category, in accordance with the CompaniesMarketCap index, with a $5.58 billion capitalization. This makes Marathon the two,468th most respected firm on this planet, also representing the technology and Bitcoin classes.

MARA stock closed March 22 at $20.87 per portion. Thus, losing 4.18% intraday and registering gathered beneficial properties of 146.69% twelve months-over-twelve months.

Bitcoin halving and its results on mining companies and institutional investors results

The core earnings of Bitcoin mining companies comes from mining BTC and accumulating block rewards in costs and block subsidies. Primarily, miners compete with every other to search out the following legitimate block through proof-of-work, measured in hashrate.

Handiest one miner (or mining pool) has the just correct to snort the rewards of every block. In the case of swimming pools, the participants will portion the reward proportionally to their contributed hashrate.

Alternatively, Bitcoin’s block subsidy halves roughly every four years or precisely every 210,000 blocks. At present, over 98% of the block rewards attain from the subsidy, for 900 BTC day to day on reasonable. That is the issuance of contemporary BTC items through a ‘coinbase’ transaction.

All the procedure in which throughout the halving, Bitcoin mining companies will glimpse their earnings carve in in terms of half if BTC’s mark remains the identical. For that just, shares treasure MARA can expose some correlation to Bitcoin, mark-clever, and its earnings can endure from this twelve months’s halving.

In conclusion, institutional investors owning a essential a part of Marathon and other Bitcoin mining companies expose a obvious bias against BTC’s mark in the prolonged scamper. As of writing, these finance giants possess over one-third of the firm’s shares.

This highlights an increased influence from Wall Avenue over Bitcoin’s security and consensus mechanism. Furthermore, the anticipated earnings descend unveils the challenges of the sector.