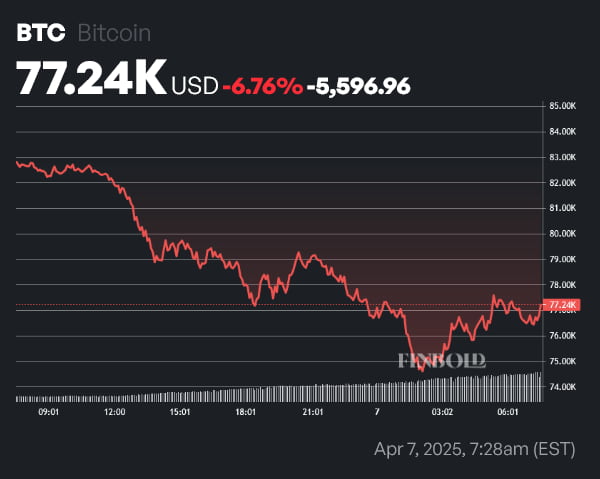

Within the previous 24 hours, Bitcoin (BTC) has considered a significant label pullback in tandem with the broader cryptocurrency market, which marked a $300 billion loss over the weekend.

To be accurate, BTC has misplaced 6.76% in label on the everyday chart.

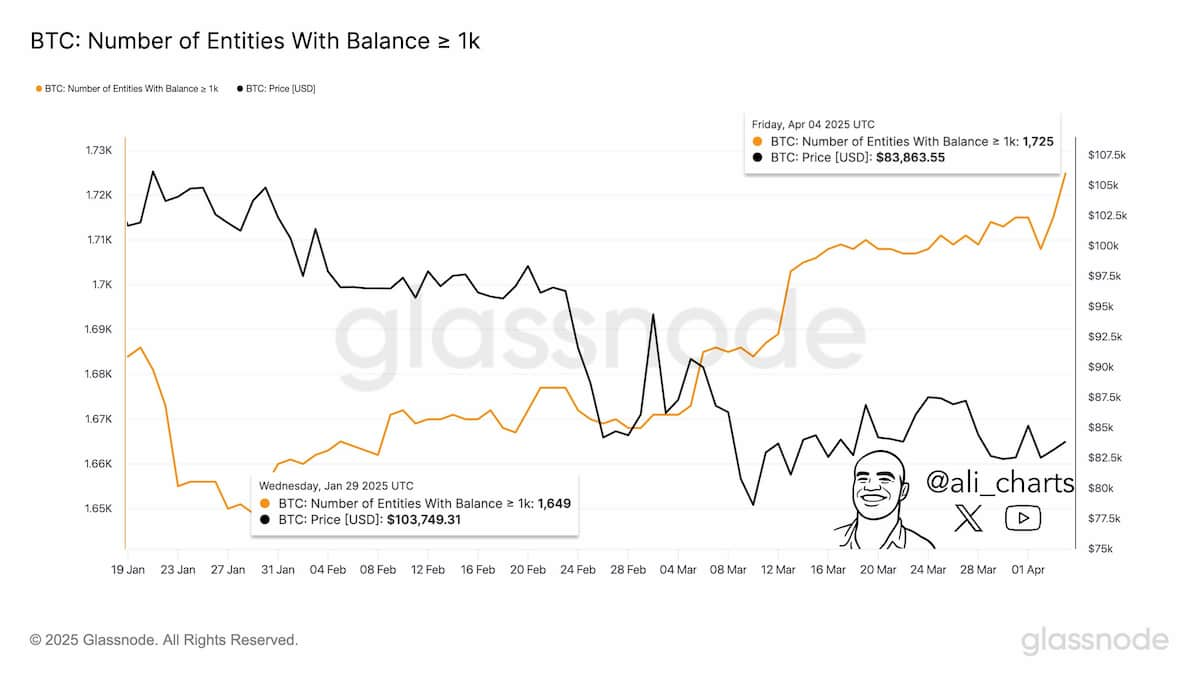

In distinction to the fresh rupture, institutional investors appear to absorb retained a bullish outlook.

Within the previous two months, 76 new entities that aid greater than 1,000 BTC absorb joined the community, per an April 7 X submit from eminent cryptocurrency technical analyst Ali Martinez.

This represents a 4.6% magnify within the assortment of accounts keeping greater than 1,000 Bitcoins. Despite the main digital asset crashing below $80,000, institutional investors are no longer promoting their holdings — so in any case one component of Bitcoin quiz stays salvage.

Institutional Bitcoin quiz is a lengthy-term bullish ticket — nonetheless can absorb shrimp finally ends up within the end to term

Bitcoin’s technical outlook stays dire, as a death immoral chart sample became as soon as unbiased no longer too lengthy ago seen — and the continuing decline in costs is occurring on solid quantity, indicating that the asset would possibly per chance silent be far from reaching a bottom.

In a roundabout way, end to-term label action will rely on wider macro factors. The executive driver within the inspire of the present decline is President Trump’s budding replace conflict. Unless the U.S. administration’s draw to tariffs modifications substantially within the coming weeks, the broader crypto market, as well to BTC, will likely proceed to see costs journey downward as investors shift their center of attention to safer, low-risk resources.

Featured image by capacity of Shutterstock